There are more and more payment providers popping up, fueled by FinTech momentum, yet a nearly $155 trillion Payments ' market is still largely underserved, according to Covercy, a currency exchange payments startup that just raised a $1.5 million funding round earlier this year – as it aims to provide value in what otherwise could seem as a saturated space. Yet, this space is apparently still filled with huge opportunities.

There are many sides to the payment space, especially as ongoing FinTech developments unlock new approaches, and as banks have not yet fully jumped on the bandwagon to lower fees for the same services offered as alternatives elsewhere, even though they may have lowered fees for other products in recent years. For example, sending an international wire is still expensive no matter where you are, with very few exceptions.

This could be driven partly because of banks' stronghold in that space – why would they drop prices if they didn’t have to? (i.e. no competition and high existing demand.)

"...there is no centralized clearing system, outside of SWIFT for example which is costly and used by banks, so only the private sector can take care of this and is what Covercy provides..."

Not So Niche Market

The currency conversion fee gap between banks and alternative payment providers creates a market opportunity known in finance as arbitrage and is literally one core part of what Covercy is doing as part of its product value-offering by arbing fees. The other core part is its ability to lock in FX rates for conversions - so that the sender of the transaction can know in advance the effective exchange rates and all-in costs, as traditionally banks provide such conversion information after the transaction has already happened, informing the customer on a post-trade basis.

Doron Cohen,

co-founder, Covercy

Source: LinkedIn

For example, a customer needing to buy euros might know the dollar amount they plan to convert but won't yet know the final amount converted in euros until after the transaction is done at the effective exchange rate, as in the case of most bank-wires done within a branch. Whereas even though some banks may offer the effective rate during the completion of an online wire form, the fee still remains expensive, even if the effective exchange rate is known beforehand.

Covering Currency

Changes are ongoing as banks create ways to compete with the alternative payment providers, in addition to partnering with them, and as some standalone providers compete in the payments space back against banks.

This latter segment is where Covercy comes in as an alternative provider and as its name implies the company offers a way for users to "cover" their "currency" needs, with both lower costs and locking in FX rates - when compared to traditional channels. In addition, the company has partnered with a few companies already that require the Covercy service for their clients and have a defined target audience in focus, in addition to existing client bases.

Arbitrage on Fees

Covercy aims for an edge in the payment space by providing a service that a bank would otherwise charge more for. Yet for clients “more” has been considered normal, as not many alternatives are well known yet, so an opportunity was identified for the business model to emerge.

That is where Covercy aims to position itself and the firm is already regulated in multiple jurisdictions, including the UK and Israel, and is backed by venture capital firm SGVC, and leverages an online offering in connection with its service where nearly everything is done electronically.

Using a proprietary Risk Management strategy Covercy locks in foreign exchange rates, in advance, for individuals and corporates looking to send funds cross-border - yet charges as if the transaction was under domestic pricing, thanks to its organizational structure which holds very little risk in its regulated business. That is, it waits for funds to hit its account from the sender before sending the equivalent based on the pre-agreed exchange rate for the target currency to the recipient, similar to a cleared-funds model.

Target Client = Corporates

International wires can cost anywhere from 50% to 400% higher (or even more) than transferring the same amount domestically, thus, Covercy saw an opportunity to arbitrage that difference and return value to clients while providing the same outcome.

The way the company achieves this value capture is by maintaining accounts denominated in various currencies, and while providing deliverability in those same currencies, so that when a client wants to remit from a specific amount cross-border, Covercy facilitates the payment using its domestically held accounts, thus circumventing the international wire charges.

The savings are passed on to the clients, where customers are able to pay local domestic wire fees, for international wires that would otherwise cost considerably more than local transfers. Nearly any business that has any type of cross-border payment needs and that has used banks traditionally to handle related wires could stand to benefit from such a service, both on the cost side as well as the specificity of the effective exchange rate on a pre-trade basis. The product is also available to individuals, although retail is not Covercy's main focus currently.

Covercy's co-founder Doron Cohen told Finance Magnates during an interview: "Almost every country today has a payment solution for local clearing such as through the central bank of that country (i.e, ACH in the US, and SEPA in Europe). However, central banks don't provide such a solution for cross-border payments because there is no centralized clearing system, outside of SWIFT for example which is costly and used by banks, so only the private sector can take care of this and is what Covercy provides for a fraction of the cost when compared to international wires."

Regulation in Europe and Israel

The company has initially set its focus within European and Israel (as source countries) yet can remit to accounts in different countries where its clients need funds sent (i.e to the US) but not vice versa (i.e. client cannot send from US to Europe). So the service is available throughout Europe and Israel, with plans for greater expansion as the firm is re-investing in its own growth.

While the firm may occasionally cater to the needs of a retail trader, that is not its focus. It instead is looking at the needs of corporates and wholesale providers in the B2B space, as B2C payments are already covered by retail-focused payment providers (i.e. MasterCard, PayPal, Visa, UnionPay, etc…) including those that cater to the FX online brokerage space.

The brand's UK entity Covercy Europe Limited is FCA-regulated as an Authorised Payments Institution, in addition to other distinctions in the UK, and the brand's Israeli entity is Covercy Technological Trading Ltd also authorised as a Currency Services Provider in Israel.

Growth Plans

Covercy is targeting suppliers and importers of goods, as well as exporters, travel agencies, real estate transactions, lawyers and accountants, and any corporates that have cross-border payment needs, including payroll related. Such customers, even with the best pricing from their banks, will often not know what rate they will get on the FX side, or if they know one side of the transaction, for example they are sending X amount of US dollars, they won’t know the amount that will be received on the other side in the local currency until after the transaction is done, and as reiterated throughout this post.

Covercy aims not only to save money on the cost of the transfer, using its multi-currency denominated account, but also leveraging its risk-management approach to lock in the forex rates beforehand so that clients know exactly what rate they are paying and the resulting foreign currency amount that will be received on the other side. These two areas are the crux of the Covercy offering.

FinTech Funding

US-based venture capital firm SGVC - which led the last round for Covercy - invests in FinTech and looks for established revenue models, a strong ecosystem of investors, a defensible product, and the ability to scale, according to a description on its website. These attributes must have been attractive in Covercy's business model as part of SGVC's due diligence before the $1.5m round was invested. Therefore, Covercy could be well positioned to grow into this space with the right strategy and marketing plan and execution.

Mr. Cohen explained to Finance Magnates that Covercy's current Chief Marketing Officer Boaz Zaionce had previously led marketing and sales efforts for the popular website creation services offered by Wix.com, and thus brought complementary talents to balance between his own FX expertise. Covercy's management include board members, and senior management in Europe and Israel, who are driving the focus to scale the firm's business model across target customers who stand to potentially save on cross-border transfers.

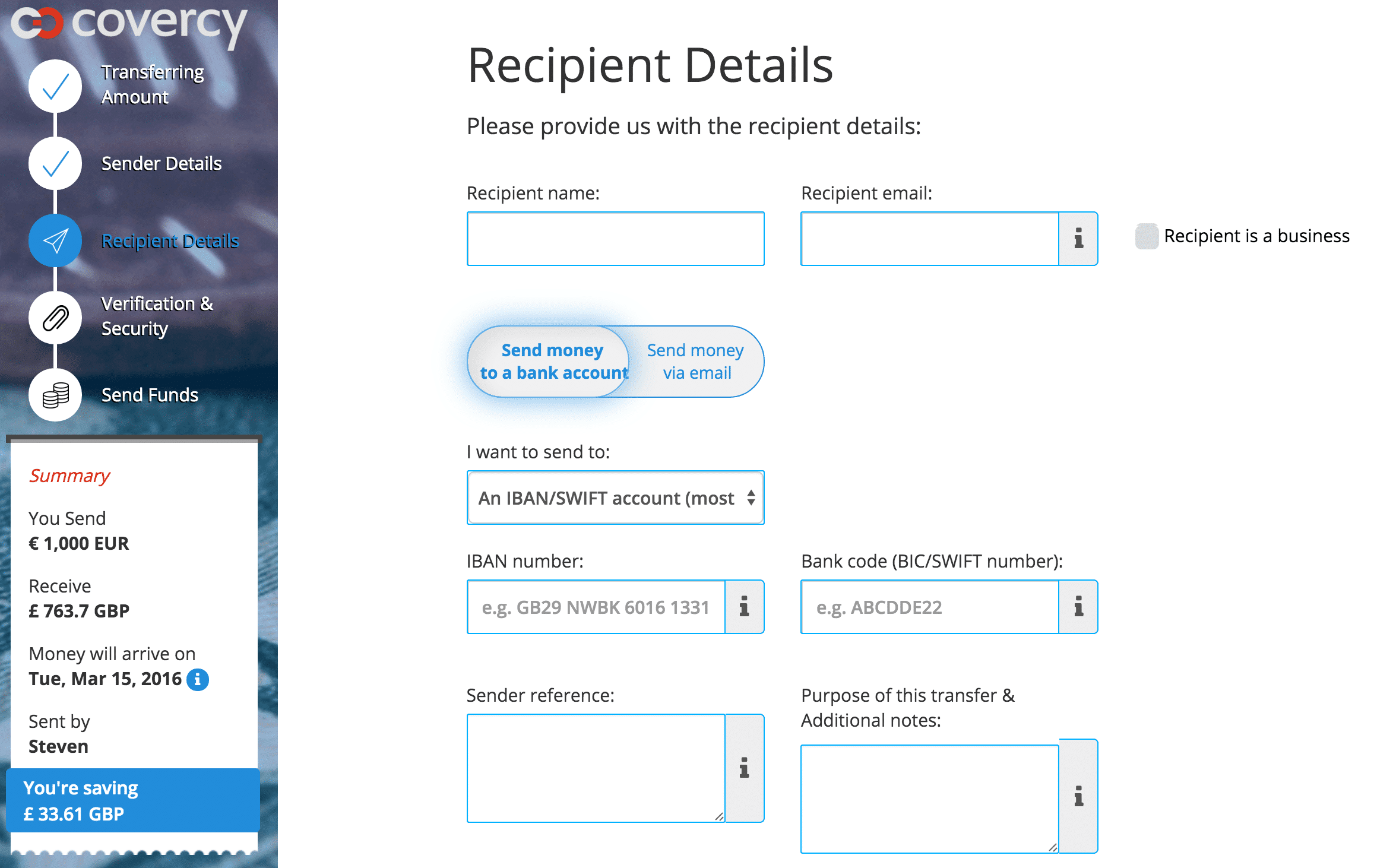

In reviewing the Covercy website as part of this analysis update, the signup and navigation were easy and the interface intuitive, and it will be interesting to see to what degree the company will evolve from here in terms of its product, website and overall growth targets. The payments space continues to see new market entrants driven by new FinTech ideas that are aimed to solve existing challenges and/or discover new opportunities.