Anticipation is approaching an all-time high as iFX EXPO International begins. Taking place at Limassol’s City of Dreams Mediterranean Integrated Resort, between 18 - 20 June, the exhibition offers the perfect opportunity to network with global B2B and B2C financial and fintech industry professionals.

Leading technology provider Solitics will be one of the prominent exhibitors at the online trading expo of the year. The team will be at booth no. 13, a strategic location that places Solitics in the spotlight.

Forex brokers, prop trading firms, banks, loan companies, and other financial institutions looking for a customer engagement and personalisation solution will benefit from attending iFX EXPO and meeting Solitics.

5 challenges that Solitics can help overcome

With so many financial firms including brokers competing for the same target market it has become increasingly difficult to stand out from the crowd. The marketing landscape has also changed drastically in the past two decades, making it more challenging for FX brokers and prop firms to acquire and keep clients engaged at every stage of their journey. So, how can financial market players stand out, enhance the trading experience, and increase customer loyalty? This is where Solitics comes in.

Developed by technology and data experts and customised to the needs of the financial sector, Solitics’ customer engagement solution is a perfect fit for brokers and prop firms in a variety of use cases:

Native multiple account management for increased personalisation

While modern trading platforms inherently support multiple trading accounts per user, customer relationship management and marketing automation solutions are still lagging behind, especially when it comes to synchronising user-centric data across all the accounts registered under a single user profile.

Unlike traditional marketing automation platforms, Solitics is built on a data-driven infrastructure that natively supports user-specific, real-time responsiveness across multiple accounts. This helps financial firms tremendously, unifying risk management for multi-account/portfolio users, empowering them to tailor offers based on client-specific parameters built around each client’s trading preferences and behaviours rather than their single-account activity.

By partnering with Solitics financial organisations increase operational efficiency and gain the ability to orchestrate dynamic user journeys with automated, tailored, real-time messaging.

Real-time responsiveness for seamless and efficient trading

The ability to respond quickly to market events and dynamics, changes in margin and portfolio risk level is paramount. By enabling brokers to connect all data sources, ranging from price feeds, third-party content providers such as TipRanks, Trading Central, news portals, platform and account-related data, Solitics increases their ability to adapt and respond to market shifts as they occur.

Whenever there is a change in volume, margin or portfolio risk level, or a relevant market event, including asset price changes, analyst perspectives, or a scheduled event, such as macroeconomic data releases (GDP, NFP, monetary policy decisions, etc.), Solitics enables brokers to set personalised, automatic triggers and send traders instant alerts, signalling the change.

These alerts can be triggered across multiple channels (e.g., trading platform, website pop-up, mobile push notification, SMS, etc.). Through hyperpersonalised communication that leverages real-time market data, brokers can deliver the much-added value to their clients much quicker. This not only fuels traders’ decision-making, but also helps brokers boost trust in their financial services and build deeper, more meaningful connections with their clients.

Gamification for increased trader engagement

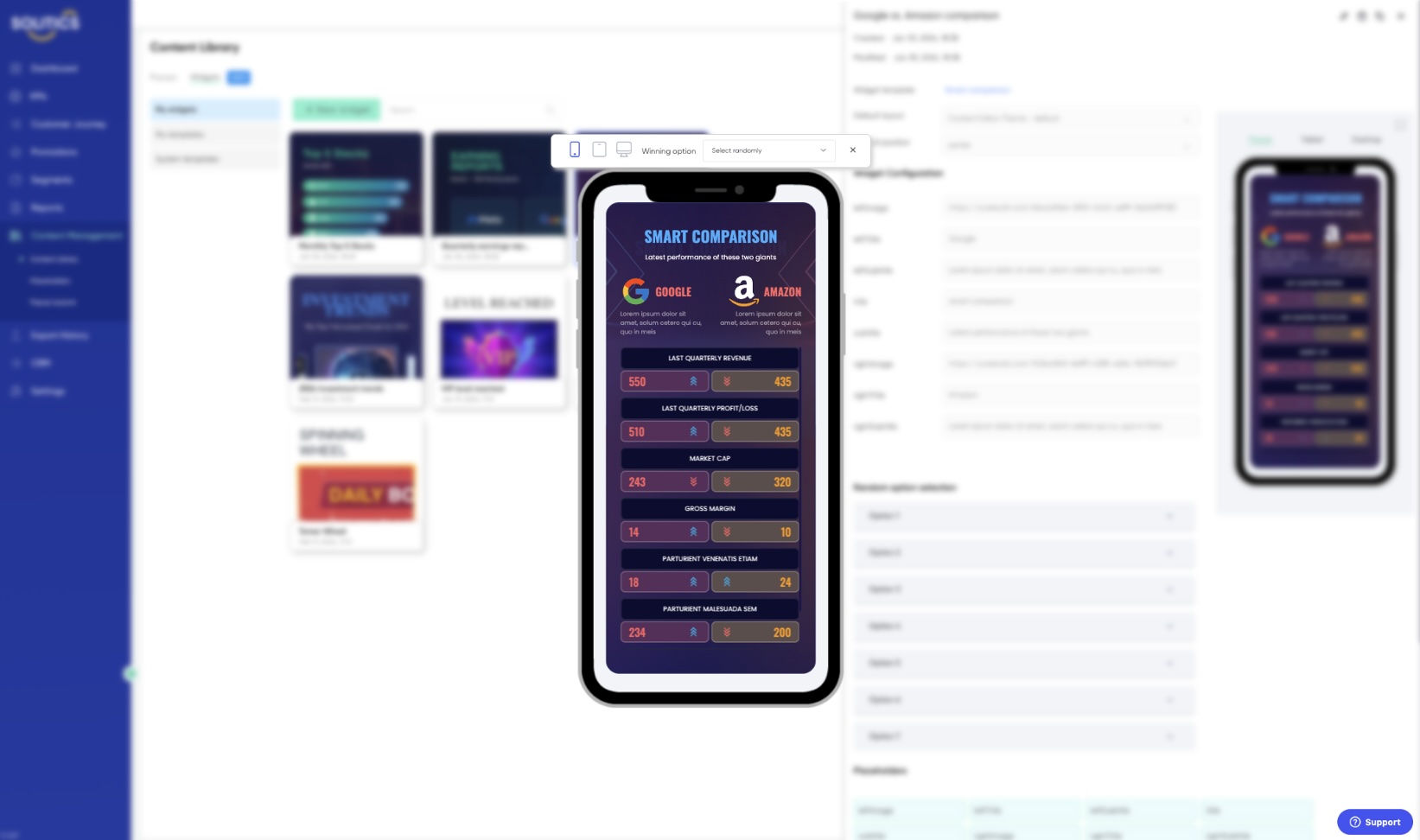

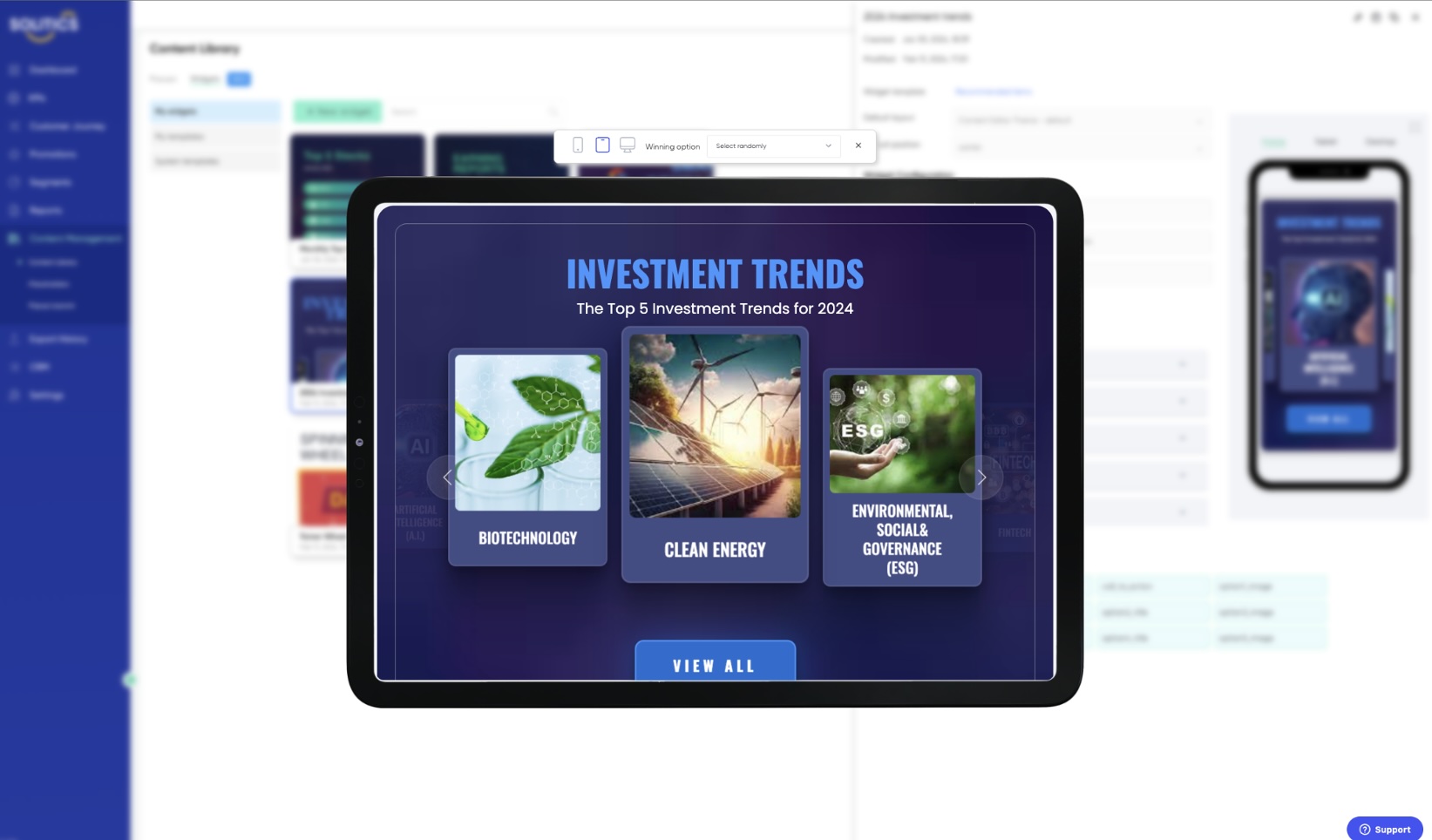

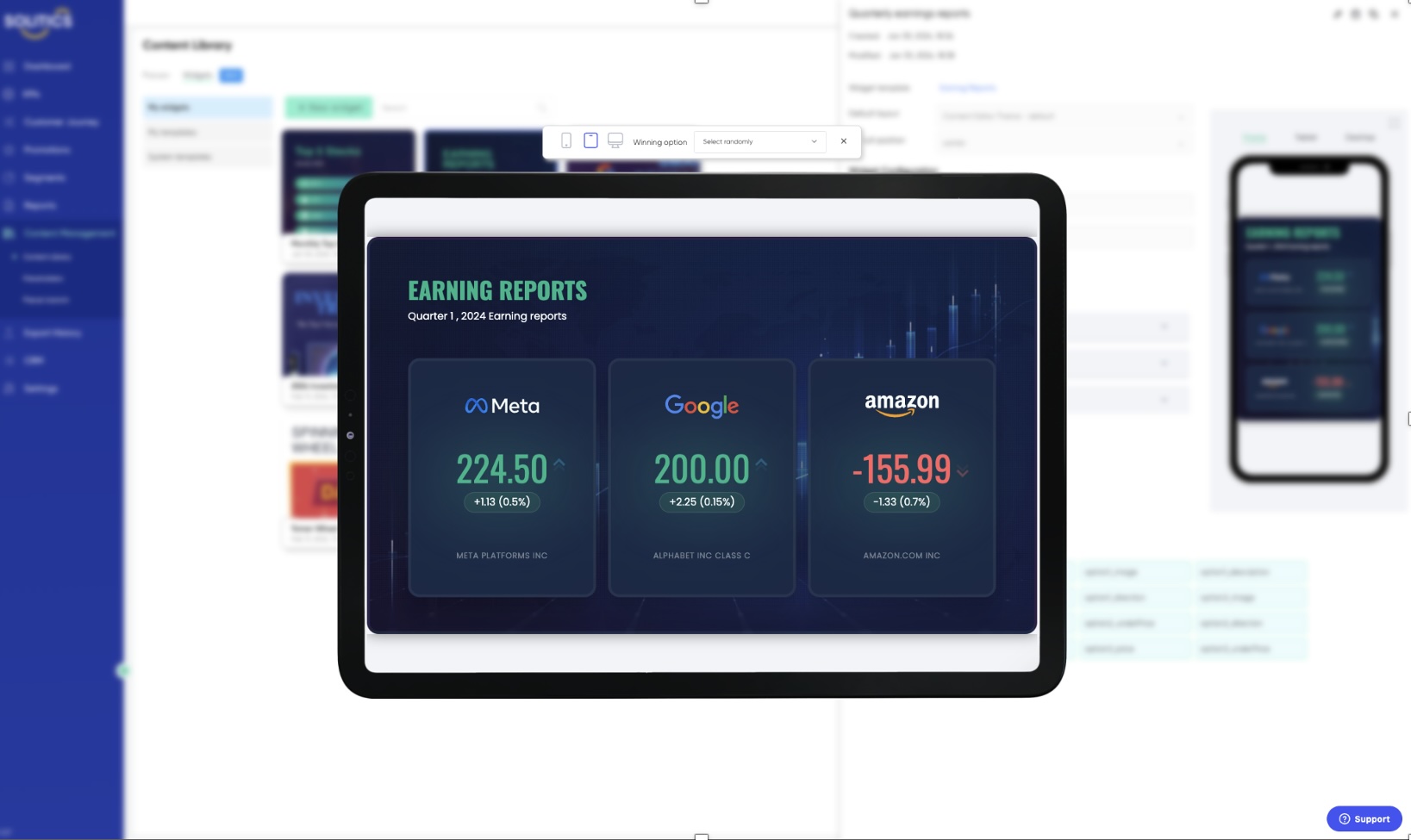

Flexible and versatile as it is, the platform allows for quick and easy customisation, enabling brokers to capitalise on user interaction with gamified widgets. One of Solitics’ hallmark features, these widgets are a form of motivational design that uses trader-specific data to generate an immersive yet gamified visualisation of top traded assets, up-to-date price changes, financial reports, and more.

These gamification widgets introduce an element of excitement and engagement that transcends traditional means of displaying technical and fundamental factors impacting an asset’s performance, but rather incorporating storytelling elements into the user journey. Doing so, Solitics aids brokers in creating an enhanced and interactive trading experience for their clients.

Boost visitor-to-lead conversion rates

Most FX brokers seek to engage users from the very beginning, on the first page. This is, however, not always the case, leaving room for interpretation and doubt. While website design, copy and navigation play an important part in piquing traders’ interest, it takes more than that to convert them into loyal customers. Intriguing? Yes. Possible? Solitics makes it possible.

Mustering advanced customer data and behaviour analytics, Solitics allows brokers to craft onsite, real-time user journeys for their ‘anonymous’ website visitors and push them further down the funnel with personalised messaging, gamification and tailored offerings, boosting their marketing efforts significantly.