In an outcome that comes as no surprise to observers, Sam Bankman-Fried, the Founder and former CEO of the now-defunct crypto exchange FTX, has been found guilty on all seven charges that he faced during his trial. As a result, he now potentially faces a maximum prison sentence of 110 years.

Those charges include wire fraud, conspiracy to commit fraud, and conspiracy to commit money laundering. Bankman-Fried will be sentenced on March 28 next year, although he faces a second trial on March 11 for five additional charges.

With the trial concluded, there is a prevailing sense that a chapter has closed, and it prompts reflection on how this impacts the entire cryptocurrency industry. To fully grasp the significance of the past few tumultuous years, it’s essential to delve into the context and surrounding events that led to Bankman-Fried’s downfall.

BREAKING: A jury has found Sam Bankman-Fried guilty of all 7 criminal counts against him. @Kr00ney reports. https://t.co/NML57SVCdL pic.twitter.com/PccrhR0Eac

— CNBC (@CNBC) November 2, 2023

2020 to 2021: A Crypto Carnival

Bankman-Fried launched FTX in 2019, and the exchange peaked in mid-2021. By then, it had become the third-largest crypto exchange in the world. It had over a million users, while its upper executives were, as is now widely documented, living in otherworldly opulence, and eccentricity, in the Bahamas.

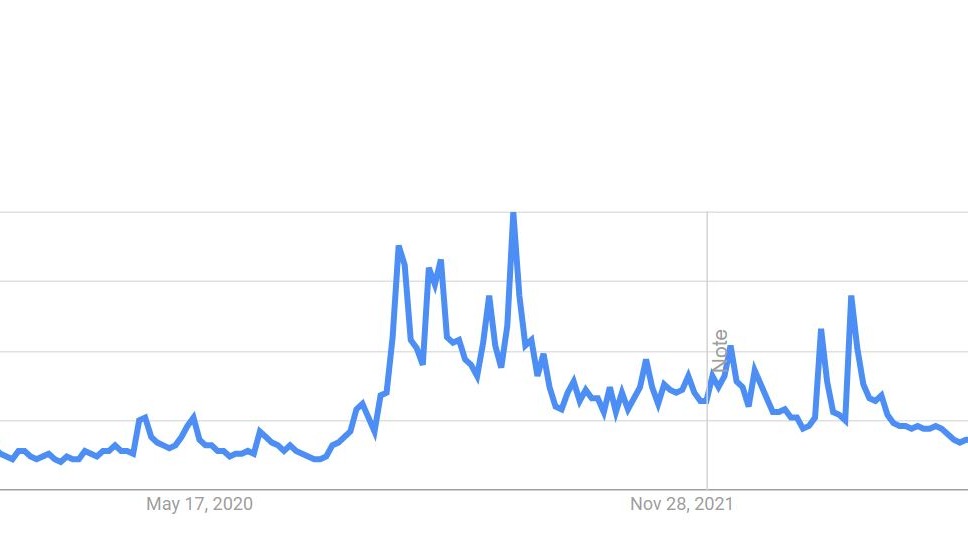

Part of the reason this rapid growth was possible was that as FTX launched, crypto itself was heading towards a manically bullish period, having recovered from the crash of 2018, which happened after the hugely euphoric run-up in prices at the end of 2017.

As unprecedented pandemic measures went into force in 2020, entire populations worldwide found themselves at home, always online, and often with stimulus payments incoming from the government. This occurred in sync with 2020’s Bitcoin halving (a four-year event widely believed to move the BTC price upwards) and suddenly there was a perfect recipe for a surging crypto bull market, with FTX and other platforms reaping substantial returns.

What’s more, there was a public desire for a respectable exchange that retail investors, often inexperienced with crypto, could place their trust in. Bankman-fried stepped up to ensure that FTX played that role, putting in place celebrity endorsements, acquiring naming rights at what would briefly become the FTX Arena, and running a Super Bowl halftime commercial.

And, as for Bankman-Fried himself, he projected the role of disarmingly casual tech altruist: safely nerdish but visionary, or depicted as a genius who simply wanted to make society better, and make FTX’s users wealthier in the process. His hair was messy, he wore shorts, he claimed to drive a Toyota Corolla despite his riches, and he even advocated a supposedly world-changing brand of practical philosophy called Effective Altruism.

In addition, he generously contributed a significant portion of the funds he had available through FTX to politicians from both sides of the American political spectrum, thereby gaining influence and once more enhancing his political credibility.

SBF, Sam Bankman-Fried has been found guilty.

— unusual_whales (@unusual_whales) November 3, 2023

However around 40% of CONGRESS(!!!) received donations from SBF and FTX that were mixed user funds!

Only a few politicians returned or donated the funds.

Here is the full list of everyone who has received funds from FTX and Sam. pic.twitter.com/2KWysjLEdP

The Crashes and Crises of 2022

In 2022, the exuberance around crypto that had propelled Bitcoin and other protocols to new all-time highs by late 2021 rapidly gave way to an industry-wide collapse, partly as a result of rising interest rates but fueled in a destructive feedback loop by the failure of Terra/Luna, and the collapse of crypto hedge fund Three Arrows Capital and lending protocol Celsius. Perhaps the most devastating blow occurred when FTX, a prominent player in the crypto space, filed for bankruptcy that November.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

Remarkably, these shocks to the crypto system have resulted in four highly prominent individuals being arrested: not only Bankman-Fried but also Alex Mashinsky of Celsius on various counts of fraud and conspiracy; Do Kwon, the Co-Founder of Terra/Luna and creator Terraform Labs, now jailed in Montenegro for document forgery; and Su Zhu of Three Arrows Capital for failing to cooperate with bankruptcy proceedings in Singapore.

The End of an Era in Crypto?

The end of the SBF trial looks as though it may also mark the end of an era in crypto, indicating that the industry can never return to its wildest pioneer phase, or the attendant eccentricities and risks. That the jury verdict coincides with functioning regulatory frameworks being worked out worldwide, and even beginning to be put in place, only emphasizes the shift taking place.

Moreover, Bankman-Fried’s sentencing date, next March, looks like it might roughly coincide with the arrival of spot BTC ETFs, should they be approved. While we shouldn’t look for symbolism too much, one can’t help but detect that these changes in the landscape are happening all around the same time.

JUST IN: 🇺🇸 US Attorney says Sam Bankman-Fried perpetrated one of the biggest financial crimes in US history. pic.twitter.com/CLzVhiALUg

— Watcher.Guru (@WatcherGuru) November 3, 2023

Crypto has been dominated in public, throughout its short history, by a series of flamboyant characters who sometimes push eccentricity to the extremes, or in Bankman-Fried’s case, into the realms of serious criminality. While we shouldn’t expect such participants to disappear entirely, on a stage to which sober corporate entities such as BlackRock are now entering, there will likely be fewer opportunities for another Bankman-Fried-like character to wrest temporary control of the story.

If the institutions are coming, then the game will change, and if you were on the front lines of crypto between 2019 and 2023, you got a close-up view of a clattering, one-of-a-kind spectacle that was truly of its moment.

The verdict may come to mark a change in crypto, as the industry shifts into greater maturity.