One of the latest fintech startups that leverages Blockchain technology and that has received funding is US-based Fluent – which today announced a seed round of $1.65 million – led by New York firm ff Venture Capital (ffVC) and joined by Digital Currency Group, Crosscut Ventures, Draper Associates, Fenbushi Capital, Lindbergh Tech Fund, and the St. Louis Arch Angels, according to a company press release.

Fluent has emerged from stealth mode with a distributed ledger solution aimed at helping corporations - including banks, lenders and other enterprises - enhance their approach to trade finance in their supply chain via use of the Fluent network.

Their solution makes supply chain finance impressively simple and intuitive for banks and companies alike.

As part of the seed funding, there are also new members joining Fluent’s board, according to people familiar with the deal, as the company gets more than just a vote of confidence from prominent blockchain venture capital companies. In addition, the company's website fluent.network lists a number of advisors including from Google and major banks.

“We are excited to see Fluent adopting the core technology underlying the bitcoin blockchain to build a financial network that enables real-time, peer-to-peer financial transactions within a trusted network of stakeholders in a value chain," said Barry Silbert, founder and CEO of Digital Currency Group. "Their solution makes supply chain finance impressively simple and intuitive for banks and companies alike."

Barry Silbert

Source: Bloomberg

Bank pilot and partner

As part of the announcement Fluent also unveiled its banking partner and pilot participant, Commerce Bancshares - a Missouri-based US bank - which is listed on the NASDAQ under ticker CBSH, according to the company’s official press release about the round.

In addition to the pilot program with the bank, Fluent has gained interest from a number of businesses that want to have access to its financial marketplace, among other potential target audiences that could benefit using such a solution.

We look forward to working with additional banking and corporate partners to help create a new paradigm in trade and supply chain finance.

Finance Magnates recently wrote about Fluent after it was chosen to act as the Entrepreneur in Residence (EIR) for Startupbootcamp’s current New York accelerator program. With regard to that news, the company’s Chief Marketing Officer and co-founder, Casey Lawlor commented: “We have been in fintech and the blockchain industry for a long time and look forward to supporting early companies as they enter the space."

Mr. Lawlor added regarding today's news: "This funding round grew organically out of interest gained through conference and media exposure. We had a very targeted approach to utilizing blockchain technology and that resonated with people."

Pre-seed to seed funding

In its early stages of starting up, Fluent had received a pre-seed round for nearly $875,000, as an emerging company in the SixThirty accelerator program and with help from UMB and other investors. It currently has offices in San Mateo, Lexington, St. Louis, and in New York City.

The new seed funding of $1.65 million announced today brings its total capital raised to $2.5 million, and the new capital will be used by Fluent to support its current burn rate as a blockchain-focused fintech company in the Payments and trade finance space and for it to hire new developers and salespeople as the firm aims to expand and commercialize its product.

In response to questions about the seed round, Mr. Lawlor explained: "We have already hired another blockchain architect from the industry and plan to hire 2 more developers. We will also bolster our sales and business development forces with 2 additional hires.”

Fluent is harnessing the underlying technology in cryptocurrency to enable pain-free supply chain financing.

Harnessing crypto-technology

John Frankel, partner at ff Venture Capital (ffVC), commented in the company’s press release regarding the deal: "Fluent is offering a robust solution—backed by an exceptional team—to help businesses better manage credit in their supply chain."

"Fluent is harnessing the underlying technology in cryptocurrency to enable pain-free supply chain financing. This is a space we have been interested in for some time and excited to see such a talented team take a novel approach to reducing friction in global supply chain commerce," he concluded.

“With this Seed financing round, we’ll continue to execute on our vision of rewiring the world’s financial circuits to power long overdue improvements in trade finance and global commerce at-large,” said Lamar Wilson, CEO of Fluent, commenting in the company’s press release.

Mr. Wilson added: “We look forward to working with additional banking and corporate partners to help create a new paradigm in trade and supply chain finance.”

Source: Fluent.network

The aim to be frictionless

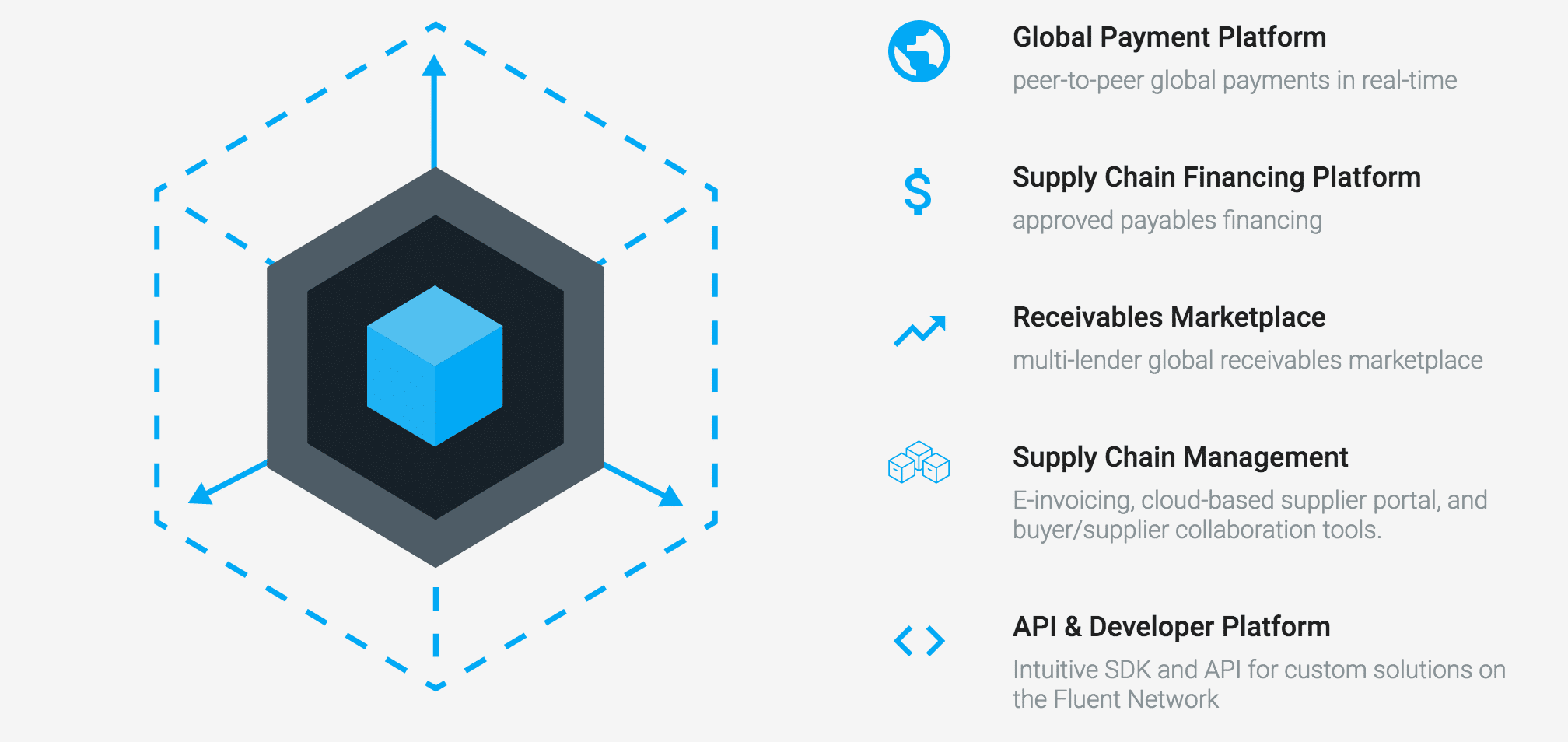

Fluent’s platform allows large enterprises to offer a supplier platform to their end clients with regard to trade finance, where they can tokenize their invoices and send them via blockchain to a marketplace filled with various related parties, where the financing of deals are programmatically attached to the network in a secure manner.

Just like in traditional supply chain trade finance (whether electronically or offline), when goods are exchanged or received and are in good order, the value of the invoice is made available for payment by the responsible parties to the transaction as per the payment terms and related timetables. On Fluent network, this is aimed to be frictionless while increasing the data security and compliance aspects via the use of blockchain technology. There can be literally millions of uses for blockchain style distributed ledgers for validating data in a world that is increasingly producing vast amounts of information, yet it's important to distinguish between related blockchain startups.

Fluent network

The company’s website Fluent.network represents its branding as it aims to be a provider of supply chain solutions that participants can use for their related trade finance needs. While the offering is available to corporate clients and financial companies, Fluent is not looking to necessarily compete with companies that offer trade settlement or related transaction services that financial services companies need on either the pre-trade or post-trade execution side, but to the needs that such companies may have in other parts of their business.

Once a firm is enabled to be on the network it can begin transacting, where the deposits it takes are collateralized at a banking institution and can be used on Fluent's blockchain-driven platform.

The company's platform aims to be a frictionless payment rail that uses a closed loop platform and acts as trustless peer-to-peer system, while discretion is applied to determine the level of good standing a firm has before being able to transact.

Distributed ledger appeal

This funding round grew organically out of interest gained through conference and media exposure.

A nearly-constant array of news has been emerging at an increasingly fast rate with regard to the use of distributed ledger solutions that use blockchain and related approaches, across the whole spectrum of the financial services world, including at exchanges, clearing and settlement, and for use by brokerages and even regulators and governmental bodies, as well as other areas of capital markets and even other unrelated industries.

A distributed ledger related conference is set to be held in mid-June in St. Louis where Fluent has an office and will sponsor the event. Mr. Lawlor explained about the need to differentiate between blockchain firms - in response to questions posed by Finance Magnates, he said: "We believe that this kind of focus on individual use cases will be essential to progressing the industry from POC to production. The level of discourse needs to be higher and will improve by addressing industry use cases separately. We don't include all industries with an online presence to be related, yet we lump all "blockchain" companies together-- capital markets, supply chain, insurance, health care, bitcoin, etc."

The key point is that with a distributed ledger system the history of transactions remain immutable thus making it a lot harder for perpetrators to commit fraud in such an environment while at the same time making it a lot easier for firms to detect any such wrongdoing.