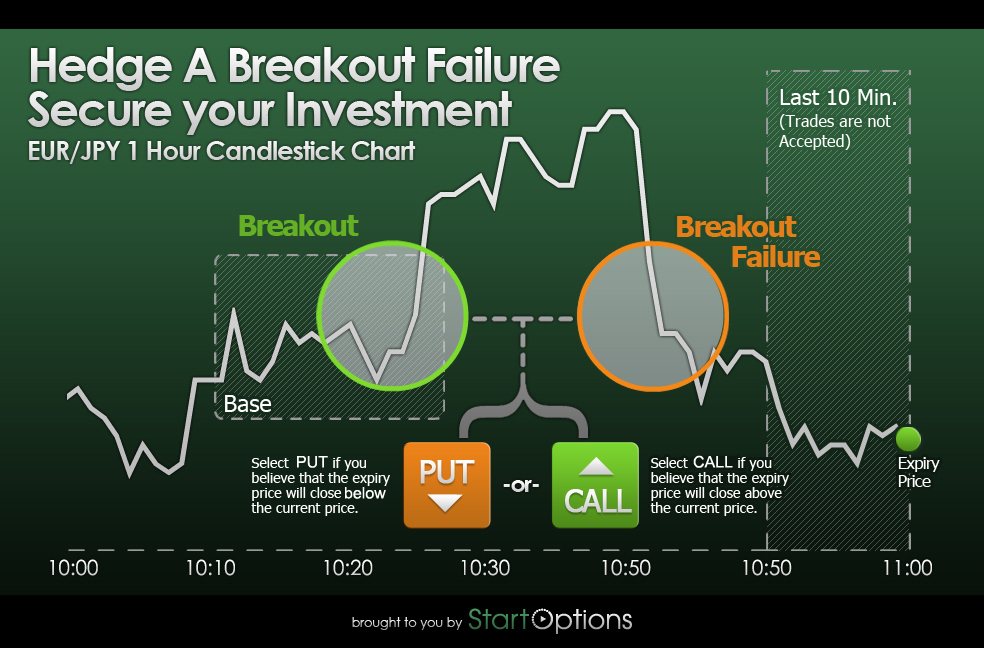

Although Binary Options trading by nature is already risk controlled because you as a trader never lose more than your initial investment amount, there is an easy way to minimize your loss in the event you chose the wrong direction: it is called hedging breakout failures.

The strategy is simple:

It is 30 minutes into the hour trading window. You have 20 minutes left to execute a trade (remember, the last 10 minutes are closed to trading). You want to choose your position, for example, a CALL or a PUT at the current strike price $100. You recognize a breakout and you want to speculate that the instrument's price will continue in that direction by placing a Binary Option CALL or PUT trade, depending on the direction of the breakout. If the instrument continues to move in the direction you speculated at the moment you placed your trade, should the hour close you would have a successful trade. However, the hour is not yet closed and suddenly you see that the instrument's price begins to change direction. The moment it reaches back to $100 (your strike position when you made your trade) is the moment when you need to act to hedge your breakout failure. You know that if the instrument's price continues past $100, you will have lost your trade, and thus your full investment amount. There is still 5 minutes left to execute your trade, and so you place a trade in the opposite direction (if you had placed a CALL then now you place a PUT) when the instrument's price is at $100. Note that you must execute the trade as close to the price that the breakout occurs. In this case you have hedged your trade and “insured” your position. If you had hedged your bet as close as possible to when the breakout fails, you will see the benefits of hedging to minimize your loss.

To put the same example into dollar terms, let's say you placed your trade at the instrument price of $100 for an invested amount of $100. You would have lost your full invested amount of $100 had you not decided to hedge your trade. Since you acted proactively, you then placed your opposite trade (hedge), also for $100, at the breakout failure point. You invested overall $200, but you got $185 back instead of $100 had you not placed your hedge. Your total loss then, instead of $100, is only $15. Using this hedging strategy, if you are right only 50% of the time then you will make a steady 70$ per game on average (85$ when you are right, - $15 when you are wrong).

And that's it. Simple, straightforward, and smart to do define what encompasses hedging breakout failures in Binary Options trading.

Open an account with StartOptions and receive: welcome bonus, Daily Hot Picks and Ebooks. Sign up today and receive a $750 bonus on deposits of $2,000!

Learn more at www.startoptions.com/learn