One of the biggest benefactors of the smartphone revolution and tablet evolution has been digital game maker King Digital Entertainment plc (KING:NYSE). The company is a prominent developer and publisher of mobile games, boasting a global reach and considered to be amongst the biggest game developers for Facebook and application stores. The diversified approach of the company since its inception 13-months ago, after releasing multiple hit titles, makes this company valuable despite reservations from investors skittish about owning shares that are very volatile amid a constantly evolving technology landscape.

The Fundamental View

Earnings for King Digital Entertainment released on May 14th showed the company managed to beat estimates on both the top and bottom line, an increasingly rare trait amongst publicly traded companies in the current buyback fueled stock frenzy. Earnings per share were recorded at $0.61, beating expectations by $0.08 with revenue also managing to top estimates, even though revenues have declined -6.2% versus a year earlier. What really caused the massive Volatility that has kept investor interest subdued at best is the revenue guidance which emphasized the cyclical weakness to be delivered in the second quarter owing to game releases later in the year. Revenue is expected to fall approximately 14% quarter over quarter which is likely to induce panic amongst traders.

From a user point of view, the company has continued to make positive strides with a growing user base and growing player value. For the first time in several quarters the company managed to grow the user base while usage numbers reached record highs. Active monthly users rose to 550,000,000 while daily users grew 10% to 158,000,000 individuals. Helping matters is the announced strategic partnership with Microsoft which will open up the company’s assets to a whole new user base. From a financial point of view the company has managed to build a strong model that emphasizes cash flow. Unlike many technology businesses, especially publicly listed social media names, King Digital Entertainment actually manages to make money and not lose it. This makes a price-to-earnings multiple of 8.24 very attractive from an investor’s point of view, especially if they are seeking upside in mobile technology.

Adding to shareholder value has been buybacks which are extremely rare for a company that is so young, coming in at just over a year-old trading on the public markets. The company has already managed to hand back cash to shareholders in the form of two special dividends, with the latest occurrence in March, seeing shareholders rewarded with $298 million. King remains disciplined however, maintaining large amounts of cash on the balance sheet, reporting over $650 million at the end of the first quarter. If King can continue to maintain margins and competitive advantage, there is no reason why shares should not become an investor favorite based on the growing popularity of mobile gaming. The strong value offered in both active user growth, player value, and possible income growth for investors makes this company an attractive long-term play.

The Technical Take

From a technical point of view, the track record for King Digital Entertainment is rather sparse owing to its more recent entrance to capital markets. The latest look at the 52-week range of 10.04-21.32 shows that the company is trading towards the lower end of the range after listing at an IPO price of $22.50 in 2014. The company’s shares have proven very volatile, falling over 15% in after-hours trading last week, following the release of first quarter earnings before recovering the losses in the following trading session. Much of the volatility can be attributed to the high levels of short interest, with nearly 22% of outstanding shares held short.

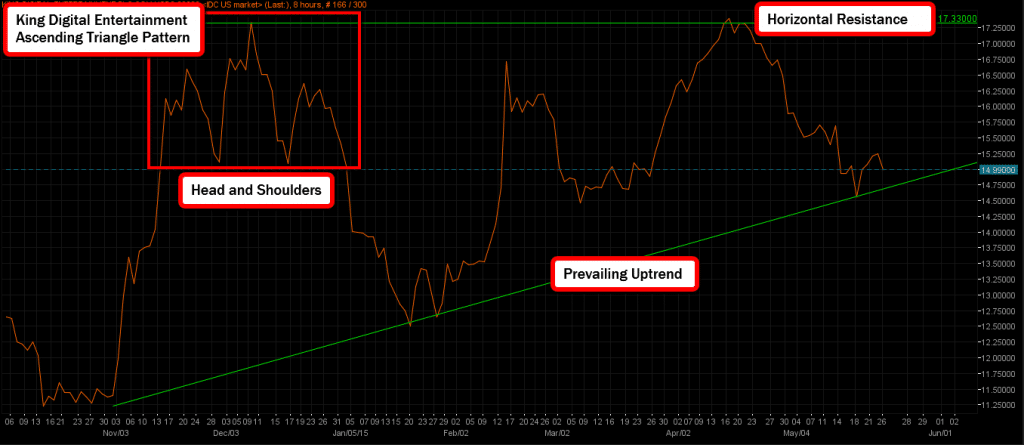

A look back in time shows that KING shares were setup in a head and shoulders bearish pattern back in November which was completed in January and subsequently saw shares fall steeply. However, the prevailing uptrend intact from the beginning of November remains strong, providing the lower bound for the recent consolidation in prices. Very important resistance sitting at $17.33 gives the impression that the shares are preparing for a potential ascending triangle breakout to the upside over the coming months if user and financial results continue to improve on a sequential basis despite guidance warning of lower revenues in the second quarter. The key targets in the short-term are resistance at $15.70 and $16.23 on the upside. Any move below the uptrend line could be indicative of a downside reversal that will test support at $14.46 and $13.59.

Conclusion

On the whole, King Digital Entertainment provides great value for investors at a time when technology valuations are at epic proportions not seen since the last technology bubble. Unlike many of its upstart peers, especially in social media, King makes money, setting it apart from the crowd. With the valuation multiples so low amid strong earnings, cash flows, and new releases in the pipeline, present levels could provide a tremendous opportunity for short-to-medium-term investors looking for appreciation owing to the ascending triangle pattern. For longer-term investors, this might mark a great potential entry point especially considering the company’s outlook as it continues to develop and distribute award winning mobile games that consistently receive among the highest ratings from application stores. The key for management is now generating excitement amongst potential investors to build confidence in the company’s outlook.