Although not capturing the same brand recognition as peers such as Goldman Sachs, Morgan Stanley (MS: NYSE) has proven itself to be a more than capable banking institution. The firm focuses on three main segments including brokerage services, wealth management, and investment banking. Broadly speaking, the firm has benefited like many American peers from record low interest rates and the implicit subsidy provided under the Federal Reserve’s quantitative easing program. Near record low rates make both borrowing and Leverage very attractive and cheap however, much of the gains felt by the firm have been the result of a renewed focus on building the wealth management unit and reducing reliance on brokerage services for income.

The Fundamental View

Valued at approximately $75 billion, Morgan Stanley may be dwarfed in size by many other American bank holding companies by size, but not necessarily earnings potential. The vast margin expansion experienced by the firm comes at a time when the company is trying to increase its focus on the wealth management business, taking advantage of secular demographic trends, especially in the United States. Aside from the company’s strong balance sheet position, the stock is attractive from an investor standpoint due to the potential for further appreciation after strong top-line and bottom-line growth witnessed in the latest earnings announcement. Adding to the optimism is the dividend which is value for income investors looking for a combination of payouts and appreciation in the underlying.

Earnings reported on April 20th saw the company beat analyst estimates of $0.78 per share after earning $1.18 per share and adjusted earnings of $0.85. The company has managed to show strong earnings at a time when many companies are still focusing on cost cutting and buybacks to support valuations. Morgan Stanley managed to grow both revenues and profits, highlighting the strong future for the company if they can maintain the present growth momentum with the latest reporting period seeing the company grow at the fastest rate in years. Much of the earnings gains came from strong trading revenues in both Equities and fixed-income. Wealth management was the real winner, responsible for 39% of the firm’s total revenues. After buying out the remainder of the joint wealth management venture with Citigroup, the group has seen revenues soar, climbing 6.20% in the first quarter.

Morgan Stanley dividends fell substantially post-crisis after averaging $0.27 for over four years before the crisis. The latest dividend announced showed 50% growth over the prior period as Morgan Stanley emphasizes shareholder value and returning cash. From a valuation perspective, the company has a weaker price-to-earnings ratio relative to broader equity benchmarks despite being double most banking peers. The company’s current P/E ratio stands at 18.97, well above industry peers owing to its increased focus on wealth management relative to competitors. The company’s 1-year return has only been beaten by Goldman Sachs. Fundamentally, Morgan Stanley is a sound institution and the pivot towards wealth management is paying off in spades as other industry giants struggle to contain weaker earnings growth from brokerage and advisory services.

The Technical Take

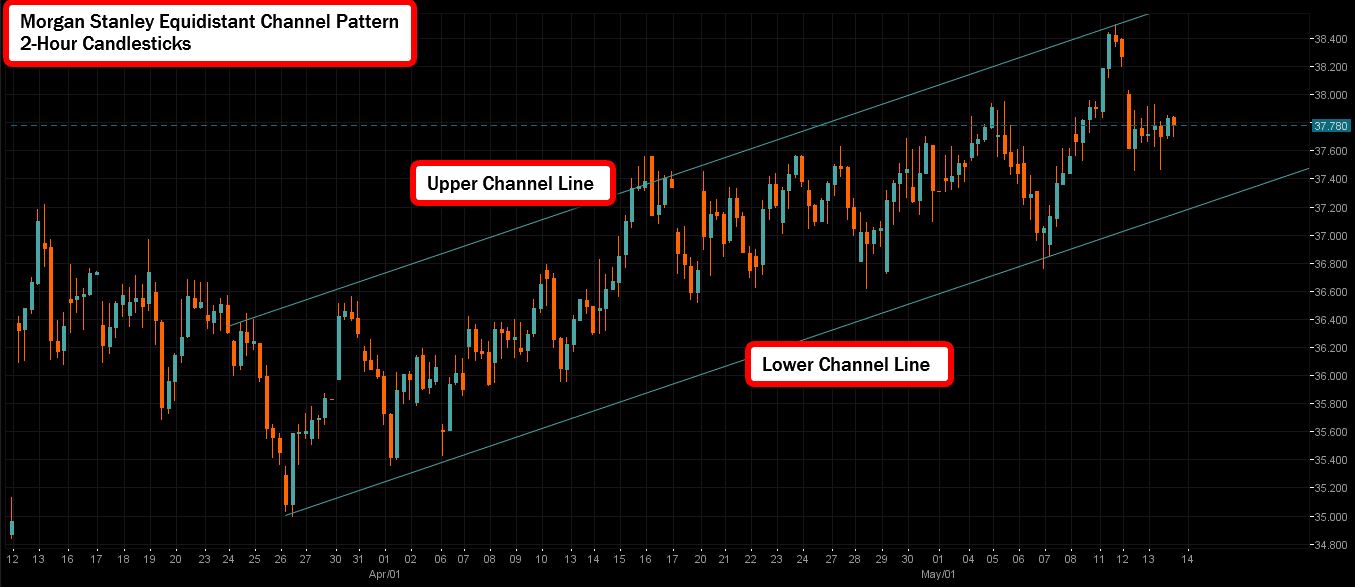

With the stock trading marginally off 52-week highs, the bullish case for share prices is strong considering the confluence of fundamental and technical factors. With the 50-day moving average crossing the 200-day moving average to the upside back in March, the stage is set for the golden cross technical pattern which is typically accompanied by upward momentum. On a near-term basis, Morgan Stanley shares are trending within an equidistant channel pattern. The technical pattern exhibits a strongly bullish bias after holding in a multi-month uptrend bound by the upper and lower channel lines. The general strategy for trading such a formation is initiation of long positions at the lower channel line to be closed at the upper channel line. In this specific case, trend following is key because shorting into an uptrend even from the upper line of the equidistant channel sees potential reward shrink while risk increases.

Source: https://www.netdania.com/

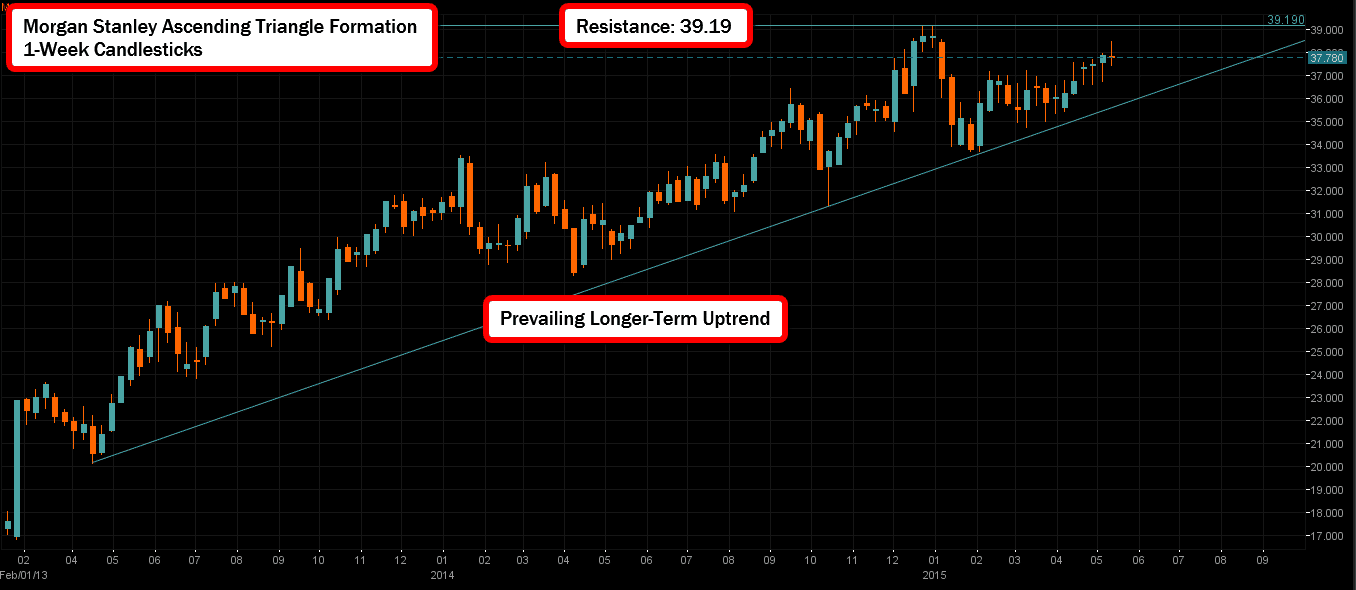

From a longer-term perspective, Morgan Stanley has largely benefited from the rising trend of American equity markets. As was once famously noted, “a rising tide lifts all boats.” In that respect, Morgan Stanley is no different, with the firm’s shares advancing due to a confluence of zero interest rate policies and corporate reorganization. The two-year ascending triangle technical formation in play has a predominantly bullish bias, similar to the equidistant channel pattern listed above. The consolidation between the prevailing uptrend and resistance sitting firmly at $39.19 currently bounds the price action. Any move above the resistance level (52-week highs) will likely result in an upside breakout that will be accompanied by additional volume and upward momentum in share prices. Should prices move below the prevailing uptrend line, this could very well signal a longer-term reversal in prices and potential pullback before the resumption of momentum higher.

Source: https://www.netdania.com/

Conclusion

On the technical basis, once 52-week highs have been overcome, the stage is set for share prices to make a run at $40 per share which is about 6% higher from present levels. While analysts have targets in the high $30s, if the company can achieve its ambitious growth targets in the key wealth management sector, beating expectations should be no problem for Morgan Stanley’s management. However, should the broader financial markets experience a downturn, Morgan Stanley will not be immune despite the renewed focus on wealth management. Its broad underperformance of other sector peers makes it an attractive play on the upside, but substantially riskier in the event of any correction. While no major changes to monetary policy or the outlook are imminent for traders focusing on the short-term picture, longer-term factors could easily see a deep correction in share prices to the low-to-mid $30s.