Anyone who has followed the financial press in Israel in recent months will have realized that the Israel Securities Authority (ISA) is on the warpath against the binary options industry in Israel, and has every intention of closing it down.

According to the Chairman of the ISA, Prof. Shmuel Hauser, binary options are very similar to gambling, and often involve fraudulent business practices intended to deceive the investing public. Admittedly, the binary options industry has its problems, but portraying the entire industry in a negative way is a gross generalization.

That being said, the entire binary options industry in Israel is feeling the impact and has been forced to take defensive measures.

The proposed bill

In recent months, on a number of occasions Prof. Hauser revealed his intention to introduce a legislative amendment that will ban binary options offered to non-Israeli traders and grant the ISA the power and authority to enforce such a ban. On February 22, 2017, Prof. Hauser made good on his promise and published a proposed bill that, among other things, will prohibit the management and operation (in the broadest sense) of binary options trading platforms out of Israel, even if regulated elsewhere.

In addition, the proposed bill prohibits the management and operation of non-regulated and certain cases regulated trading platforms, even if the financial instruments offered by them to their non-Israeli clients do not include binary options. Furthermore, the proposed legislative amendment will only recognize regulatory licenses or permits granted pursuant to EU regulation or US federal regulation, as long as they do not offer binary options. All other regulatory regimes are presumed inadequate unless confirmed by the Minister of Finance or proven otherwise to the satisfaction of the ISA.

the ISA cannot and should not see itself as the protector of any investor living anywhere in the world

If adopted, this proposed legislative amendment will create a new reality that requires some reflection about the industry, the reasons that led the ISA to take such aggressive stance, and perhaps the steps that companies in this industry should explore in order to adapt to this dramatic change in the regulatory landscape in Israel.

In the explanatory text that accompanied the proposed bill, the ISA states that it had received complaints from foreign regulators and enforcement agencies regarding losses caused to clients residing in their respective countries due to corrupt and often fraudulent business practices employed by companies based in Israel and servicing such foreign clients.

Obviously, we do not condone, let alone protect, such business practices. However, there are numerous companies operating out of Israel that have been conducting their business differently, and one must wonder whether the drastic measures proposed by the ISA and the heavy price they entail are indeed justifiable.

In this context, I would like to raise one concern regarding the proposed bill, which I believe should be considered by the ISA and by the Israeli legislature – the international ramifications of the suggested legislative amendment.

What is the ISA looking to achieve?

In order to understand the ISA and its motivation with regard to the binary option industry, it is imperative to look at its actions and statements in light of the regulatory developments that had taken place in recent years.

Even though binary options have been around for more than a decade, the ISA did not publically address this financial product until November of 2014, when a major legislative amendment relating to the regulation of electronic trading platforms came into effect. While this legislative amendment did not mention binary options explicitly, it was the trigger for the ISA to begin developing its approach towards this industry.

The reason for this had nothing to do with the specific financial instrument, but rather with the way it was made available to the public. The November 2014 legislative amendment – that was aimed solely at companies offering trading services to the Israeli public - regulates trading platforms that act as the counterparty of their clients, by trading to their own account, or by acting as intermediaries to one identifiable entity that acts as the counterparty to client trading activity.

the ISA is on the warpath against the binary options industry in Israel

Even though binary options can be found and traded on major exchanges, an alternative market developed making binary options available for trading by the general public. This simple-to-use and apparently thrilling financial instrument became increasingly popular all over the world, creating a lucrative industry with an impressive presence based in Israel.

The trouble is that the combination of this financial instrument and the fact that the Trading Platform – that controls every step of the trading process – is the counterparty to each transaction entered into by a client – has the potential to create a dangerous temptation to defraud clients. Unfortunately, some companies in the binary option industry couldn't resist that temptation, acted the way they did, and gave an entire industry a bad reputation.

The first milestone

Pursuant to the November 2014 legislative amendment, 21 companies submitted license applications, some of which were binary options trading platforms. Because this was a new regulatory regime, the ISA explicitly clarified that such new legislation impacted only companies seeking to provide services to Israelis, and that it did not prohibit the management and operation of companies that block Israeli clients and operate globally. The ISA took approximately six months to evaluate these license applications before it decided to categorically disqualify binary options in connection with Israeli traders.

In retrospect, this was the first milestone in the development of the ISA's approach towards binary options. The most recent milestone is the proposed bill banning the operation of binary options trading platforms out of Israel also for foreign traders, regardless of whether the platform is regulated or non-regulated. As mentioned above, I would like to raise two issues that require additional consideration in connection with this most recent milestone.

The international relations challenge

Under Section 2 of the Israeli Securities Law, the purpose of the ISA is to protect the interests of the investing public.

The ISA has expressed its opinion in numerous formal publications that this fundamental principle applies to the investing public in Israel. This is also the only reasonable and sensible way to interpret Section 2, because the ISA cannot and should not see itself as the protector of any investor living anywhere in the world.

Citizens of foreign countries are protected by their governments and their respective financial regulators. In this respect, each sovereign state decides if and how it will protect its citizens in connection to specific financial-related services and activities. This is their prerogative as well as their responsibility. Therefore, the State of Israel, through its financial regulator and its legislation, is certainly authorized to decide that binary options’ trading platforms may not solicit and interact with Israeli residents.

However, it is not at all clear that the ISA – that is charged with the protection of Israeli investors – should be granted with the power to ban binary options trading platforms that do not deal with Israeli investors. It is one thing, when the ISA grants assistance to foreign regulators looking into possible violations of the laws in their respective jurisdiction; it is an entirely different thing when the ISA undertakes the responsibility to protect all investors on the planet, regardless of where they are and the type of protection their respective governments decided to grant them. In the former, protection of foreign citizens and residents is granted due to an important principle in international law – reciprocity. In simple words it means 'you are in need of help today so I will help you today, and you will help me tomorrow, when I am the one in need of help', and it is justifiable because at the end of the day it increases the ISA's ability to protect the Israeli investing public.

But why is it justifiable to protect foreign investors as proposed in the bill promoted by the ISA?

In fact, the proposed legislative amendment that the ISA seeks to implement hurts the principle of reciprocity. As mentioned above, this principle provides that regulators and enforcement agencies in different countries and jurisdictions will help each other out in their efforts to accomplish their purposes and goals. In addition, this principle dictates that regulators respect each other's authority and sovereignty.

won't this have a negative impact on the reciprocity between the two regulatory agencies?

By way of illustration, if the United States Securities and Exchange Commission seeks the assistance of the ISA with regard to an investigation into insider trading, the ISA will not decline the SEC's request just because it is based on a legal theory of insider trading that is not recognized in Israel. The ISA will assist because it respects the US regulator and its authority and power to conduct the investigation that it is conducting. Similarly, the US will not refuse to assist the ISA just because the ISA is conducting a criminal investigation into a matter that the SEC may feel would be more appropriately addressed through administrative or civil proceedings.

The problem with the proposed bill in connection with binary options is that it bans also trading platforms operating under a license or permit granted by an authorized foreign regulator. For example, a binary options trading platform operating under a CySEC license, passported into all other European Union member states, will not be allowed to continue operating out of Israel, if the current language of the bill remains as is when the legislative process is completed.

Not good enough for us

In effect, the ISA is telling the Cypriot regulator – and indirectly all of the other regulators in Europe – that their respective regulatory regimes are not good enough and that they are not doing a good job protecting the investing public they are responsible for. Ironically, according to the ISA, one of the main drivers for this proposed bill is the reputational damage caused to Israel by fraudulent binary option trading platforms operating out of Israel.

Is there no reputational price for legislation that implicitly disrespects sovereign foreign regulators and their respective regulatory regimes?

The proposed bill may be perceived as problematic in connection with the principle of reciprocity and mutual recognition in another way as well. According to the proposed legislative amendment, FX and CFD trading platforms that provide services to non-Israeli clients under a foreign regulatory regime other than European Union or US federal law, must convince the ISA that its license is comparable to the licenses granted by the ISA in order to operate out of Israel. By way of illustration, a FX trading platform that provides services to Australian clients under a license granted by the Australian regulator, is now required to prove to the ISA that its license is comparable to the Israeli one in order to continue servicing Australian clients.

the ISA cannot and should not see itself as the protector of any investor living anywhere in the world

In other words, under the proposed legislative amendment, the ISA will be authorized to evaluate the appropriateness and comprehensiveness of the Australian regulatory regime. Now, imagine that the ISA determines that the Australian license is not good enough. The meaning of such a determination is that the ISA feels that the Australian license does not grant sufficient protection to the Australian investing public. Won't this determination have a negative impact on the way the ISA is perceived by the Australian regulator? And if it does – won't this have a negative impact on the reciprocity between the two regulatory agencies?

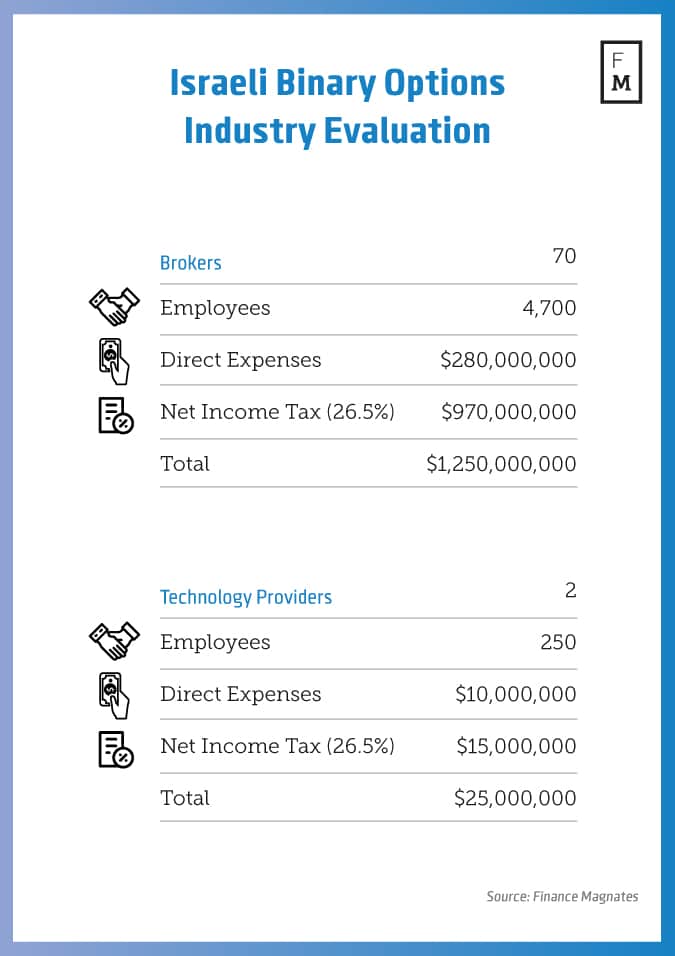

It should be noted that the proposed bill presents a number of other challenges, such as the violation of the fundamental right of occupation in order to achieve a goal that is outside the scope of the ISA's role and purpose, the unemployment of thousands of employees working in this industry in Israel and the loss of the taxes that are now paid to the State of Israel and will cease once these businesses are shut down. However, in addition to these considerations, this proposed bill may inadvertently have a negative impact on the international relations of Israel and the ISA with other sovereigns and other regulators.

These concerns alone are a sufficient enough reason to reconsider the way this proposed bill was drafted.

This article was written by Dr. Zvi Gabbay, Head of the Financial Regulation and Securities Department at Barnea & Co. and former Head of Enforcement at the Israel Securities Authority.