Otto Fassheber Jorand

This article is written by Otto Fassheber Jorand, Financial Advisor at Golder Broker S.A.

A week away from the Fed’s most anticipated policy meeting of the last decade, investors are hesitant as to whether the Federal Reserve will begin exiting the zero interest rates policy era.

Deepening the conundrum over whether to raise rates or not, we can find strong arguments from both the hawkish and the dovish sides of the table.

Taking a look at the domestic U.S. economic indicators, in the second quarter of the year the economy grew 3.7 percent and the labor market is still strengthening with the unemployment rate reaching 5.1 percent, which is close to a full employment scenario. At the same time, wages are growing at 2.2 percent which is seen as eventually pushing inflation pressure higher. Some policy makers, such as St Louis Federal Reserve President James Bullard, see all the necessary conditions for a rate rise in early September.

But the numbers well tortured may always confess… for Donald Kohn, Vice-Chairman of the FED’s Board of Governors forecasts an average rate of annual growth of 2.2 percent for the next six years, which is seen as a disappointing recovery.

Even Ms. Yellen has not given a clue as to when the FED is going to make a move, given those three timings in her news conference in June:

“The importance of the timing of a first decision to raise rates is something that should not be overblown, whether it’s September or December or March — what matters is the entire path of rates. And, as I’ve said, the Committee anticipates economic conditions that would call for a gradual evolution of the fed funds rate toward normalization.”

Perhaps the domestic economic indicators are not enough to achieve a consensus. But if we look around it just gets worse - a large number of the economists and even Fed officials agreed to an interest rate lift-off starting this month, but that was before China's stock market crash and currency devaluation.

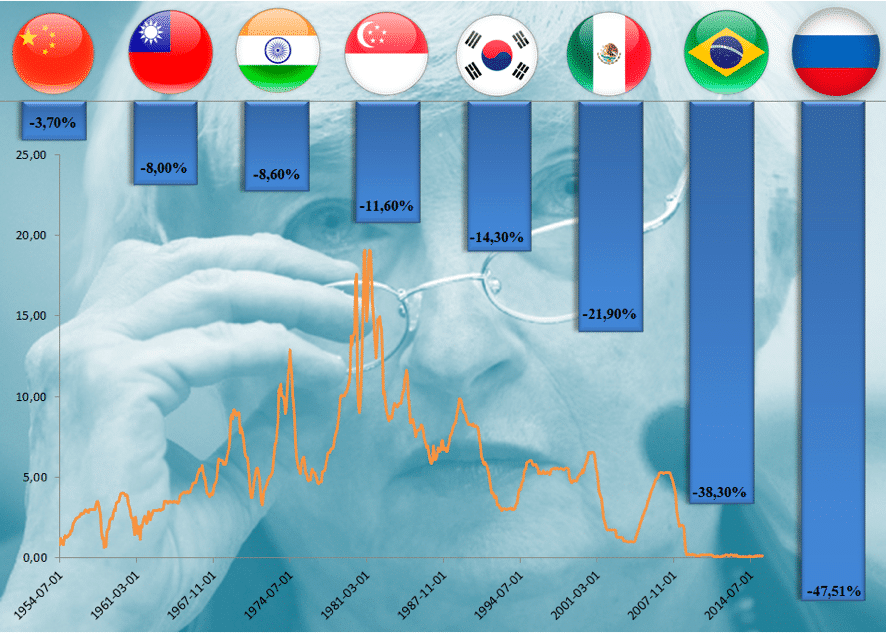

The Fed’s interest rates moves and the path of the U.S. dollar have always been important for EM economies, and the scenario is playing out again. The devaluation of the renminbi by the People’s Bank of China on the so called “Black Monday” was only the wake-up call for investors about what is going on in EM economies. After seven years of easy money, the monetary policies in the U.S., Japan and the Eurozone are causing EM currencies to dip from overvalued into undervalued territory.

How an EM Currency Crunch Can Affect FED’s Rates Rise?

There is a global perception of how dangerous a Fed rate rise could be for EM economies. The chief economist of the World Bank, Kaushik Basu, warned about triggering “panic and turmoil” in EM economies in an interview with the Financial Times this week.

"The world economy is looking so troubled that if the U.S. goes in for a very quick move in the middle of this, I feel it is going to affect countries quite badly," he said. The comments follow warnings from the IMF about the potential repercussions of an immediate rate hike.

The Fed is facing an intense and hard debate at its September policy meeting, regarding domestic economic growth, labor market resilience and potential inflation pressure, among other zero interest rates policy effects. A dramatic global crisis leading to a slowdown in China and EM currencies' crunch and a deep recession are after effects, which we can already see in the Brazilian economy.

“There is a concern in emerging market economies all over the place in case China takes a hit,” Mr. Basu said. “This is the problem right now in the world . . . Overall we are going to get into a slower global growth phase.”

Putting all of this together and what happened over the past two weeks with the Chinese markets, Leads one to believe that a rate hike scenario is looking less likely than it did even in June.

Article written by Otto Fasseheber