Last week the U.S Securities and Exchange Commission (SEC) filled fraud charges against several alleged perpetrators of a $78 million scheme involving the stock of Jammin Java (OTCQB:JAMN), an artisan coffee company that operates under the ‘Marley Coffee’ brand, leveraging the fame of reggae star Bob Marley.

The SEC claims that the company's former CEO Shane Whittle orchestrated the scheme with the help of a number of accomplices from around the world. He utilized a reverse merger to secretly gain control of millions of the company’s shares, and spread them to offshore entities. To conceal his control of the stock, Whittle made misstatements and misleading omissions in beneficial ownership reports.

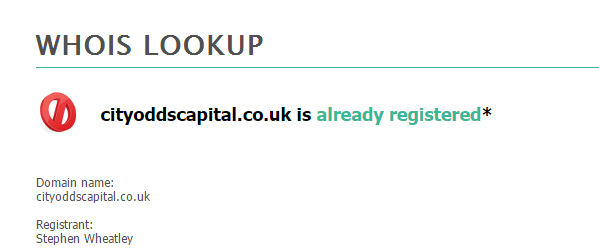

Among those charged is Stephen Wheatley, a director of the now suspended binary options provider City Odds Capital Plc. Interestingly, Wheatley was also a director of a short lived company called Go Markets Management which was registered with the same office address as City Odds Capital. However, the CEO of the FCA-regulated FX broker Go Markets verified to Finance Magnates that Wheatley has no connection with the UK firm. We have reached out to Mr. Wheatley and his lawyer and will update if and when a response is provided.

Stephen Wheatley registered the firm's internet domain

In a classic pump-and-dump manner, the stock price was made to soar with fraudulent promotional campaigns and then the shares were dumped on the unsuspecting public. Allegedly conducting the pump phase were Alexander and Thomas Hunter, two brothers already accused by the SEC in 2012 of promoting penny stocks using a fake stock picking robot. The Hunter brothers published false stock newsletters and took other steps to hype the stocks.

“As alleged in our complaint, the defendants made millions of dollars in illicit profits at the expense of the investing public and attempted to conceal their misconduct through complex offshore networks that were revealed in our investigation,” said David Glockner, Director of the SEC’s Chicago Regional Office.

The investigator explains that after the stock value was artificially inflated, the scammers dumped 45 million shares on the market without registering the transactions, making over $78 million in illicit profits in the process. Jammin’ Java’s share price and volume began to collapse a few days after the company disclosed in May 2011, that it became aware of an unauthorized online stock promotion.

Screenshot of the now suspended City Odds Capital website