London Stock Exchange listed online spread betting and CFDs trading brokerage CMC Markets (LON:CMCX) has expanded its product portfolio today with a range of new binary options. The launch of binary options is said to be part of CMC Markets’ extensive product development pipeline which will see a number of new initiatives launched over the next 18 months.

David Fineberg, Director of Trading, CMC Markets

Commenting on the launch, David Fineberg, Director of Trading, CMC Markets said: “I’m really excited about our new binary offer which has been completely developed in-house. Our ambition was to offer clients an intuitive, feature-rich experience that worked across all devices via one account, combined with the exceptional levels of reliability and servicing that clients expect from CMC Markets.”

According with the current regulatory status of binary options trading in the UK as gambling products, CMC Markets is specifically licensed and regulated by the UK Gambling Commission to offer binary options in addition to its FCA license for CFDs.

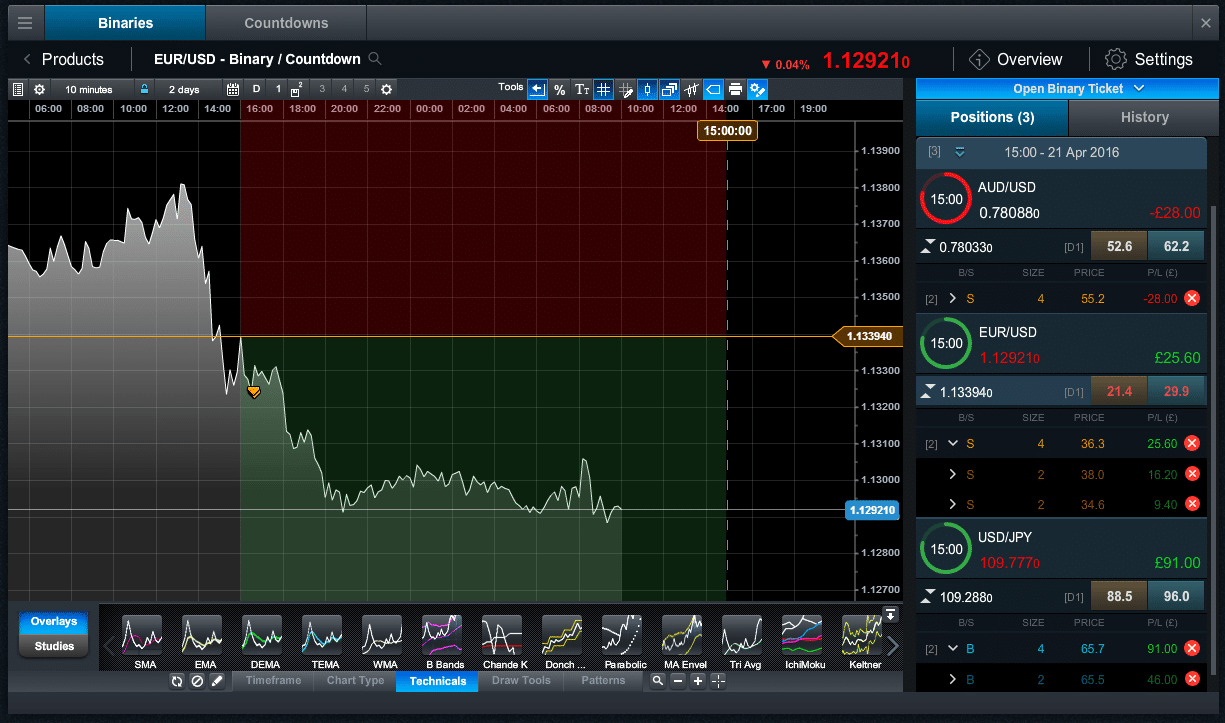

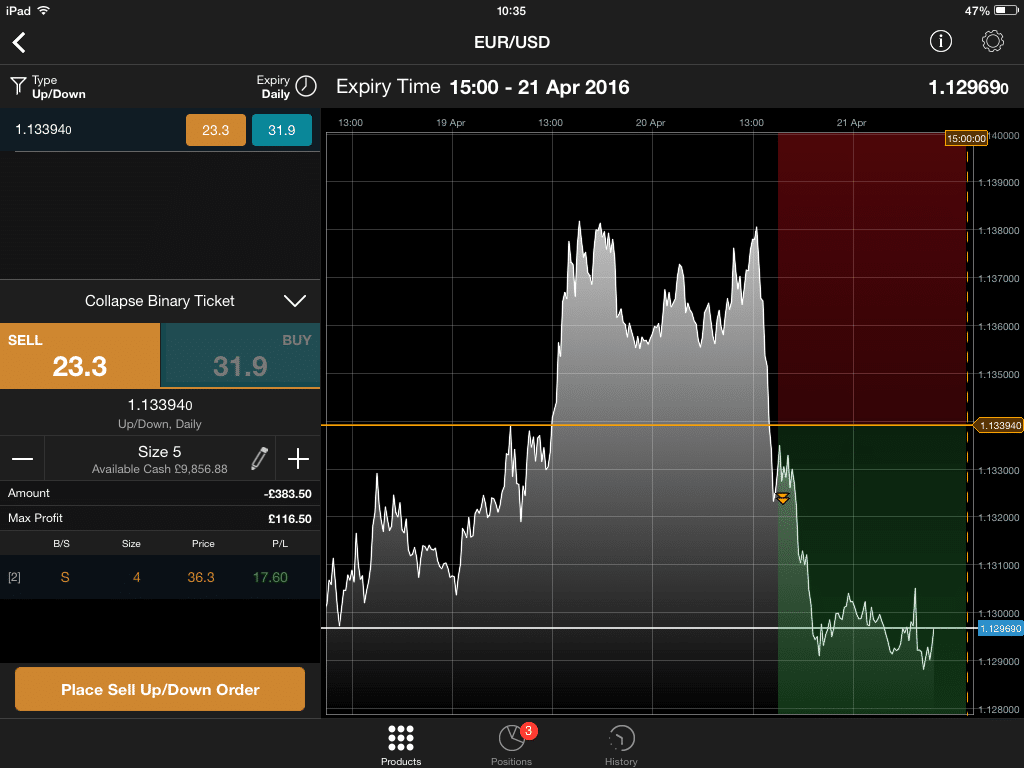

The binary options offering will work on a specially crafted interface with CMC Markets’ Next Generation platform and current clients of the firm can access them with their existing account. The instruments will cover a broad range of popular FX pairs, indices and commodities and will feature four specific binary types: Ladders, One Touch, Up/Downs and Range.

The new offering is distinct from the 'Coundowns' products CMC Markets launched in July of last year. The main differences are that there are four types of 'Binaries' (mentioned above) compared with only one type of Countdown; Binaries includes a Volatility element to the price which determines the profit or loss while Countdowns are non-volatility based; a trader can close out of a binary trade that is in progress (but can’t with Countdowns); and Countdown time-frames start from 30 seconds while the new binary time-frames start from 5 minute intervals.

Screenshot: CMC Markets Binaries

Screenshot: CMC Markets Binaries

In an IPO back in February 2016 the online brokerage raised about £218 million, including a £15 million ($21.8 million) primary capital raise and £203 million ($295 million) of secondary shares. The company sold 90.6 million ordinary shares, which comes to about 31% of CMCs issued share capital on admission to trading on the LSE.