The Cyprus Securities and Exchange Commission (CySEC ) has just released a consultation paper regarding its proposed reforms to the regulatory framework of binary options trading under its jurisdiction.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong.

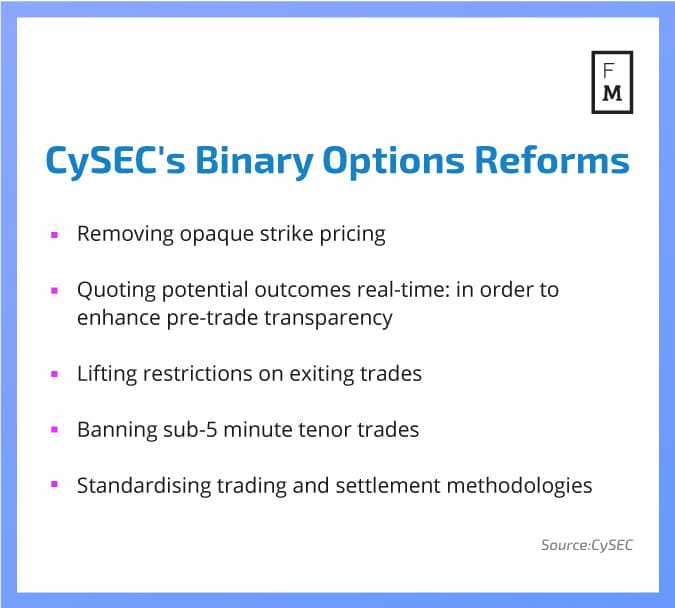

CySEC proposes five fundamental reforms that it says will eliminate deficiencies in the existing framework, and establish new conduct standards and measures to ensure retail investor protection.

Click on the image for the full circular:

Demetra Kalogerou, Chair of CySEC, said: “Binary Options products as we know them today carry deficiencies and do not provide retail investors with adequate protection when investing in such high risk and complex financial instrument.

The proposed reforms now under consultation will enhance the nature, characteristics and trading methodology of this type of retail financial instrument. The new proposed standards regarding the Digital Options Contracts will seek to eliminate the causes of concern regarding the practice that are found commonly to be followed by those providing binary options products, ensuring firms act in an honest, fair and professional manner.

Crucially, these reforms will standardize trading in Binary Options, bringing significantly greater transparency to investors and better terms for the investors when executing orders, thus provide enhanced investor protection.”

The reforms proposed include:

- Removing opaque strike pricing: strike prices must be the same for all clients and floating strike prices are not permissible.

- Quoting potential outcomes real-time: prices must be quoted as an evolving bid-ask spread, representing clearly the percentage probability of an outcome occurring.

- Lifting restrictions on exiting trades: CIFs must provide continuous, two-way pricing and clients must not have to wait until the contract’s point of expiration to exit the position.

- Banning sub-5 minute tenor trades: in order to remove shorter-term Volatility and protect against “binary bets”, contracts must have a minimum tenor of 5 minutes.

- Standardising trading and settlement methodologies: algorithms for the calculation of expiration and settlement values of the underlying market must follow CySEC’s predetermined methodology. Individual methodologies are not permissible.

The consultation period will run until 3rd March 2017 after which the board of CySEC will issue a circular on any definitive changes to the regulatory framework.