They say it ain't over until the fat lady sings, and the Israeli binary options industry might not be finished yet.

Discover credible partners and premium clients in China's leading event!

Finance Magnates has got hold of a recent decision by the Israeli Supreme Court that provides the leaders of this endangered industry with new hope. In the decision, issued yesterday by judge Daphne Barak-Erez, the court asks the Israel Securities Authority (ISA) and the Knesset to clarify the reasons that the law prohibiting binary options from within Israel should not be rescinded. The regulator and legislative branch have until January 10 to respond.

Court responds to petition

This decision is a result of a petition from technology and services provider Yukom and businessman Yossi Herzog.

The petition states: “The ruling that prohibits the management of trading arenas (platforms, brokerages) in the field of binary options contradict the foundation of freedom of employment. The Israeli regulator has disqualified an entire industry, which is recognized and regulated by many countries in the world, by using a personally identified correlation between a financial industry and a negative campaign that has been created against Israel, as the basis for his claims.”

Yukom and Herzog have requested an immediate discussion regarding the ruling, which is to come into effect on January 26, 2018. The new law will prohibit any activity that is directly or indirectly related to binary options in Israel.

Yukom claims that the law revokes basic human freedoms, including freedom of employment, and does not represent the values of the State of Israel. It also claims that the ruling does not fit the basic viewpoints of a general democratic government.

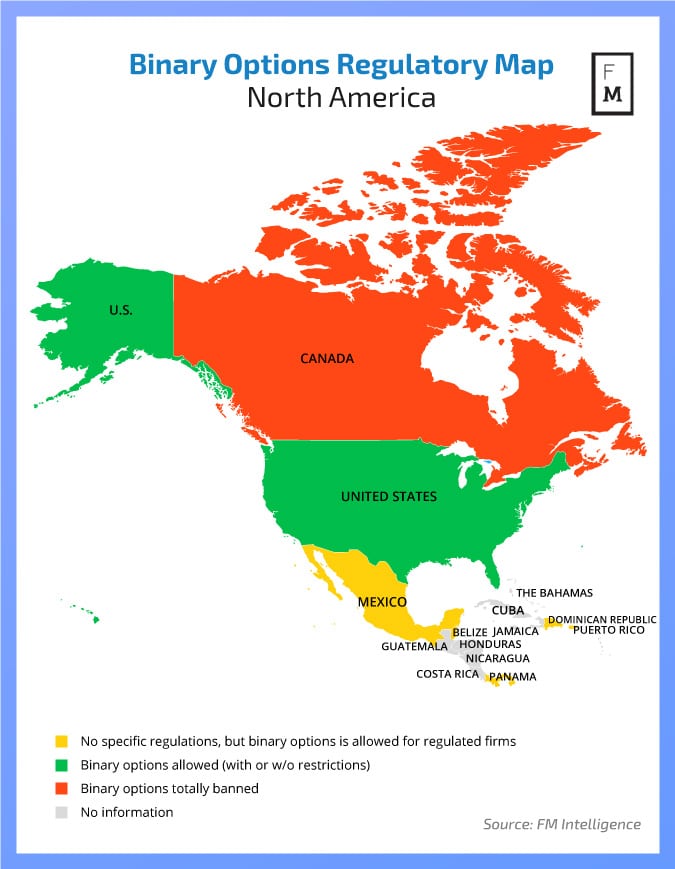

According to Dr. Gesser, an expert in finance, whose opinion has been attached to the petition, there are regulations in place in Western countries which focus on creating order in the industry. Examples include the US, the UK, Australia and New Zealand.

In the US for example, binary options trading takes place on organized exchanges and private trading 'arenas', monitored by financial regulators. In the UK, it is regulated by the Gambling Commission. In Australia, the industry is regulated by an organization that is in charge of monitoring and regulating financial services.

The petitioners claim that the law in its current state would lead to the end of the entire industry in a way that will force many to forfeit their source of income and stop residing in the country.

“I hope that the Supreme Court of Israel will end the witch-hunt"

The petition also claims that the new ruling is comprehensive and extra-territorial in nature, and that the Israeli regulator is overstepping its bounds in controlling the conduct of Israeli citizens in foreign countries, even when those countries allow and regulate the activity.

The petition also emphasized that while binary options is a financial instrument, discussion of the topic has become one based on morality, which has affected the decision-making process of the ISA.

Moreover, the petition claimed that there were several “stray individuals” within the industry, from around the world, which led the Israeli regulator, it appears, to lead an unprecedented attack against anyone who participated in the industry, including those who acted in accordance with the law.

According to the petitioners, claims of a connection between the industry and a negative campaign against Israel do not acknowledge physical evidence.

In the initial injunction (shutdown phase), the ISA described binary options as gambling. However, the supply of technological services to the global gambling industry by Israeli high-tech companies is permitted, receives public support, and is even used as a glorifying object of portraying Israel as the 'Startup Nation'.

Yossi Herzog: “I hope that the Supreme Court of Israel will end the witch-hunt of exporters of technology and services, who are abiding by the laws of Israel. Over the years, they have supported thousands of families, and have provided an influx of billions of shekels in taxes to the government. The unrestrained slander of the Israel Securities Authority, which I and others like me are experiencing, does not distinguish between stray individuals and others who act in accordance with the law, which provides support to criminals and extortionists. This incitement has recently reached an extreme when it led to the arrest of Ms. Lee Elbaz in the US, the former CEO of Yukom. This arrest is directly connected to the harsh public criticism that has been created. It created a cushion for criminal individuals who forged materials, stole information, extorted without interference, and set up Ms. Elbaz. With regard to this issue, the necessary information has been transferred to the relevant authorities. I believe in the integrity of the Israeli court to protect my basic rights and to stop this dance.”

Total ban

In October, the Israeli parliament unanimously passed a law banning local firms from selling binary options overseas, after passing a similar legislation with regard to local citizens. This move and the steps that preceded it led some industry members to move most of their activities abroad, and eventually shut down all binary options offerings altogether.

The Israeli binary options industry has drawn broad international criticism over allegations of fraudulent practices. In response, the Israeli authorities, lead by the ISA, prepared legislation to close down the entire sector. It employed thousands of Israelis through more than 100 companies. “This phenomenon gained ground and darkened Israel’s image in the world in general and the Israeli market in particular,” Hauser was quoted saying at the beginning of 2017.

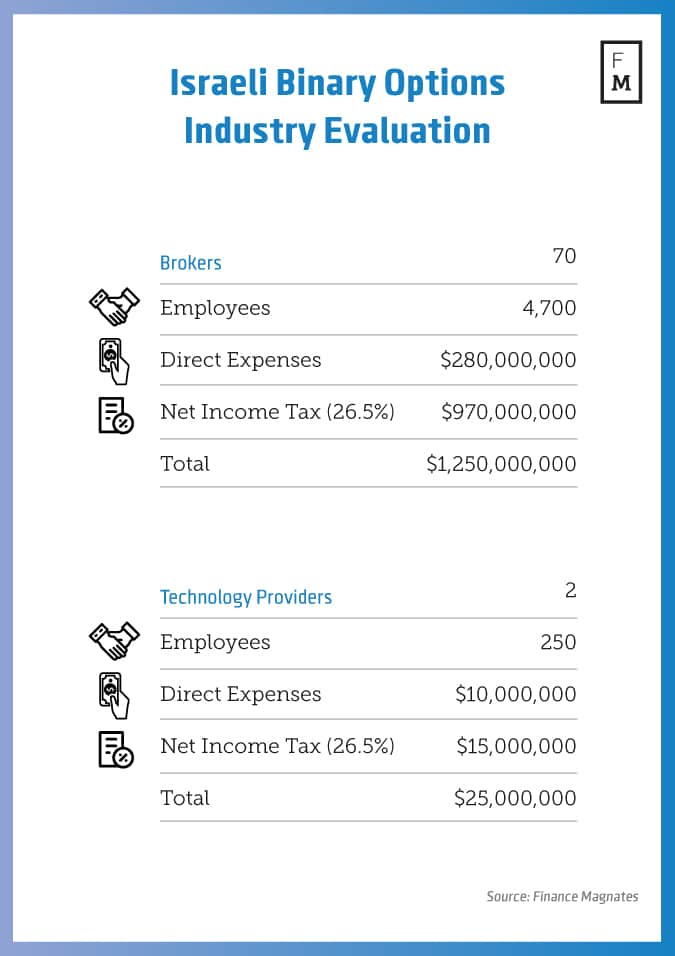

Last year, Finance Magnates’ estimates showed that the Online Trading industry enriches the Israeli treasury with over $2.0 billion a year, representing almost 0.7% of the startup nation’s Gross Domestic Product (GDP). Out of this figure, the binary options sector was responsible for $1.25 billion alone, the remainder coming from its parent Forex industry. These industries together employed 8,000 Israelis in a wide range of capacities.