When simplified trading solutions provider TechFinancials (AIM: TECH) set out to go public and sought investors’ trust, one of its explicit goals was to extend its Asian market reach. Now it is starting to realize its strategy by signing a joint venture agreement with the owners of Optionfortune Trade Limited, a Marketing company registered in Hong Kong and operating several trading brands.

The deal is subject to approval by the firm’s shareholders in the next 30 days. TechFinancials will own 51% of the new business entity, which will receive an $800,000 loan from the two parties. TechFinancials will also expand its Hong Kong office as part of the joint venture.

Optionfortune Trade Limited (certificate number 2019182) was incorporated in December 2013. The firm’s brands address Asian traders and have been using TechFinancials’ software since its inception. The announcement says that during this time the group has seen “significant growth”, compared to the market in which, according to the statement, average monthly trading volume in January 2015 – September 2015 was $8.56 million.

The agreement’s structure stipulates that the Hong Kong group’s trading activity will be transferred to the new entity. If it yields $2 million in net profit, or $4 million in revenues, in calendar year 2016, TechFinancials will pay the local group’s owners $1.54 million in shares.

Decency as Key Differentiator

Asaf Lahav, Group CEO of TechFinancials, commented by saying that the joint venture is significant in “keeping with our strategy stated at IPO, which is to grow our business into new territories and markets.” He reiterated the firm’s focus on the potential of Asian markets for binary options, explaining that the deal will “strengthen the long-term sustainability and consistency of our growth expectations while generating extra cash flow.”

Speaking with Finance Magnates, Co-CEO of TechFinancials, Eyal Rosenblum, added that the new partner stands out in his reputation. “Working closely with clients as a platform provider, I have seen both local and Western firms try to enter the Asian market and fail. Mostly, it has to do with culture gaps, and lack of understanding of local traders’ needs and the kind of product that they will engage with,” he said. “That was not the case with Optionfortune. On top of their impressive results of optimized localization, they have ferociously stuck to standards of decency and transparency, even when it cost them a lot.”

Rosenblum says that the group's high standards were translated into client lifespan 4 times longer than the industry’s average. “We watched their activity as our clients for two years, and understood they are a perfect fit for TechFinancials,” he concluded.

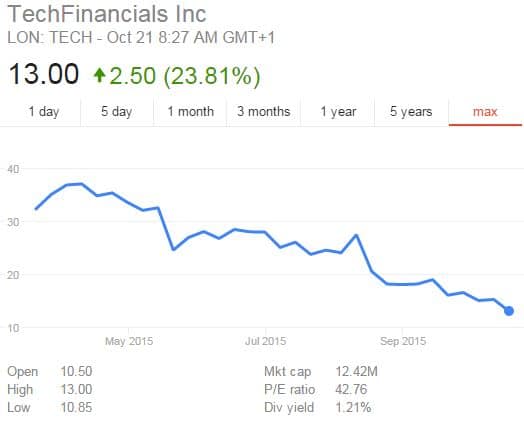

TechFinancials recently reported its 2015 H1 figures, where higher revenues were coupled with decrease in profitability due to heavy R&D expenses.

Source: Google Finance