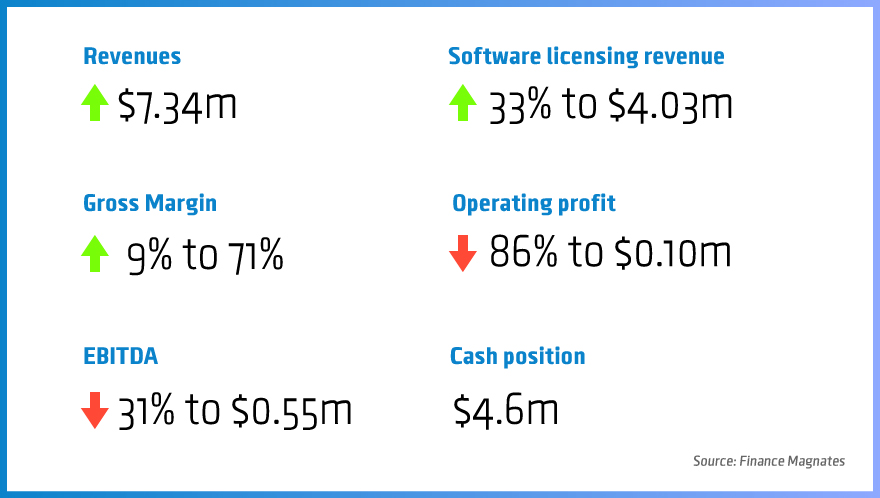

One of the major binary options providers in the industry, TechFinancials (LON:TECH), has just released an unaudited interim report for the first half of 2015. The software developer which is white labeling its platform to online brokers, has announced that for the first six months of 2015 the company's revenue increased by 2.5 per cent to $7.34 million.

Revenues from core software licensing at TechFinancials (LON:TECH) increased by 33 per cent to $4.03 million, while gross profit rose 16 per cent to $5.18m. This makes for a gross margin reading of 71 percent which is higher by 9 points when compared to the same period last year.

As revenue figures ticked higher, operating profits decreased materially by 86 per cent to $0.1 million. The report explains the decline with an increased amount of Research & Development (R&D) expenditure being expensed through the P&L account. The net change totaled $0.58 million in the first half of 2015 when compared to last year. Non-cash expenses rose $0.39 million.

TechFinancials key metrics, © Finance Magnates

Earnings before interest, taxes, depreciation, and amortization (EBITDA) decreased by 31 per cent to $0.55 million primarily due to a greater proportion of R&D being expensed as opposed to capitalized last year. The cash position of TechFinancials (LON:TECH) remains solid with $4.6 million in the company's coffers set aside for marketing and more R&D. Earlier this year the company has launched a simplified version of Forex trading catering to unexperienced traders.

The number of brokers who are using the trading solution which TechFinancials (LON:TECH) provides to the market has increased by 17 brands when compared to the beginning of this year, to a total of 65.

Commenting on the results, the firm's CEO, Asaf Lahav, said, “Notwithstanding a decrease in profit, the Group’s operational performance has been positive and the board remains confident about the Group’s future prospects. We have a strong cash position as a result of our AIM listing in March 2015, and it will be utilised to further invest in marketing and R&D as well as evaluating potential joint venture and acquisition opportunities to help facilitate future growth.”