The Texas State Securities Board (TSSB) is following through on its promise to crack down on Online Trading fraud. Today, the TSSB ordered 15 FX, binary options and cryptocurrency brands to cease operations immediately, alleging that the investment fraudsters are basically operating double-your money scams.

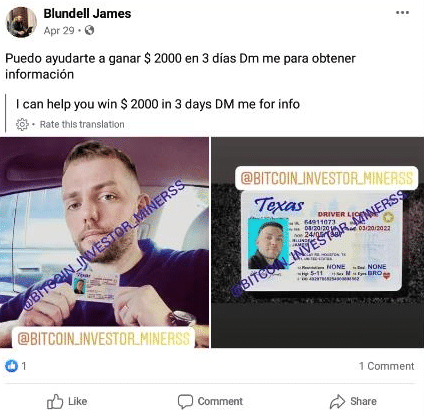

The board calls Seabrook resident, James Blundell the mastermind of 10 internet investment platforms, which lured victims using social media accounts – including at least three Instagram accounts, seven Facebook websites and one Linkedin.

James Blundell

The ten brands named in the first order include Proactive Expert Trading, Reliable Miners, BitcoinFX Options, Sure Trade Earnings, CryptoTradeFXWay, Proactive ExpertTrade, ReliableFX Internal Trade, MaxFX Internal Trade, AntPoolTop Mining and ExpertTrades247.

The investors were induced by the defendants to open accounts with false claims that they would earn significant profits, promising quick and lucrative returns over a term of mere hours.

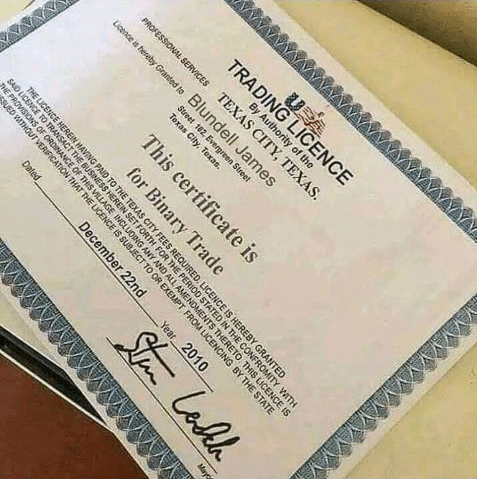

According to TSSB documents, Blundell was caught touting his false experience in trading FX, binaries and crypto markets. This particular fraud artist leverages his broad social media presence to publish bogus documents to promote his scam, including a trading certificate that purports to be a binary options trading license issued by Texas regulators.

Three Other Brands under the Radar

Additionally, a second emergency action names three online platforms that the regulator says were soliciting investments in phoney FX and crypto trading schemes. Binary Trade Forex , FX Trades and IQTrade brands were accused of falsely claiming a Texan authorisation, as well as promoting too-good-to-be true cashflow for their investments, with a 100% written money-back guarantee.

According to a non-appealable cease and desist order, the three platforms also claimed their investments are regulated not by the securities agency but instead as e-gaming.

Throughout the write-up, the state of Texas lists a number of details, but it seems that the main issue that the authority has was that the defendants promised quick returns even though most investors actually lost their money. It accuses them of allegedly misrepresenting their business model, saying that their interests were aligned with those of their investors when in fact they were not. The brokers also misrepresented their financial expertise, compensation structure, physical location and identity.

Finally, Commissioner Travis J. Iles notes that get-rich-quick schemes gain momentum, elaborating that several recent cases have involved fraudulent trading built around alleged new artificial intelligence or secret software.

Texas’ watchdog is one of the most active state regulators in the crypto arena, joining federal authorities in going after businesses trying to avoid proper registrations.