The US presidential election results are in, and Donald Trump scored a resounding victory, sweeping the electoral college and the popular vote. There are a huge number of takeaways from this emphatic resolution to a dramatic and unorthodox presidential race, but let’s focus on Bitcoin and blockchains and consider the implications for the crypto industry from this point on.

A Crypto-Focused Campaign

From the top, it’s important to note that there has never previously been a presidential campaign that featured crypto as prominently as that just run by Donald Trump. His push for the presidency received advice and backing from David Bailey, the CEO of Bitcoin Magazine. The campaign accepted donations in crypto, and in July, Trump was the headline speaker at the Bitcoin 2024 Conference in Nashville.

At that event, Trump made a series of very clear, pro-bitcoin pledges, including intentions to stockpile BTC as a national strategic reserve asset and replace Gary Gensler, who is perceived as having overseen a crypto-hostile regulatory environment, as Chair at the SEC.

Trump also promised to protect and bolster the Bitcoin mining industry in the US and put an end to Operation Choke Point 2.0 (an alleged behind-the-scenes strategy by US officials to cut crypto off from banking services). He also pledged to commute the sentence of Ross Ulbricht, who is serving life in prison for making and running the online, BTC-accepting black market Silk Road.

Besides that, Trump appears to be surrounded by a tech-centred, demonstrably crypto-friendly inner circle. This includes, most famously, Elon Musk, whose car company Tesla holds 9,720 BTC, and Vice President-Elect JD Vance, who reportedly personally holds a significant amount of BTC.

Additionally, last week, news broke that Strive Asset Management–the firm founded by Trump surrogate Vivek Ramaswamy–has launched a wealth management business that integrates Bitcoin. Trump and his sons, Donald Jr., Eric, and Barron, are all closely involved in a DeFi project called World Liberty Financial.

Pro-Crypto Politicians Enter the Stage

Advocacy group Stand With Crypto, which aims to build political support for the crypto industry in the US, reports through its election tracking service that, currently, 247 candidates it categorizes as “pro-crypto” have been elected to the House of Representatives, compared to 113 it labels as “anti-crypto”, while in the Senate, the numbers are 15 pro-crypto compared to 10 anti-crypto.

Additionally, a key individual battle has turned up a pro-crypto result in Ohio, where Sherrod Brown, Chair of the Senate Banking Committee and markedly antagonistic to the crypto industry, lost his seat after almost twenty years in the Senate, to Bernie Moreno, who is strongly supportive of crypto.

This has resulted in plenty of speculation about what happens next for crypto under the new Trump administration. A plausible scenario is that the US shifts from a country with no regulatory clarity to becoming one of the world’s most crypto-friendly regions, integrating Bitcoin and further accelerating broader crypto adoption.

Simultaneously, other related shifts occurred during the presidential race, including, notably, independent media and podcasts overtaking legacy media as a major source of influence, with new media perceived as enabling unfiltered discussion in front of large audiences.

The key example here is The Joe Rogan Experience, on which Donald Trump appeared and racked up tens of millions of views after also participating in several other long-form podcast discussions.

Additionally, prediction markets proved more accurate than traditional polls as a gauge of public opinion and a predictor of events. The breakout platform in this regard was Polymarket–which runs on crypto rails– while Kalshi also provided valuable indicators.

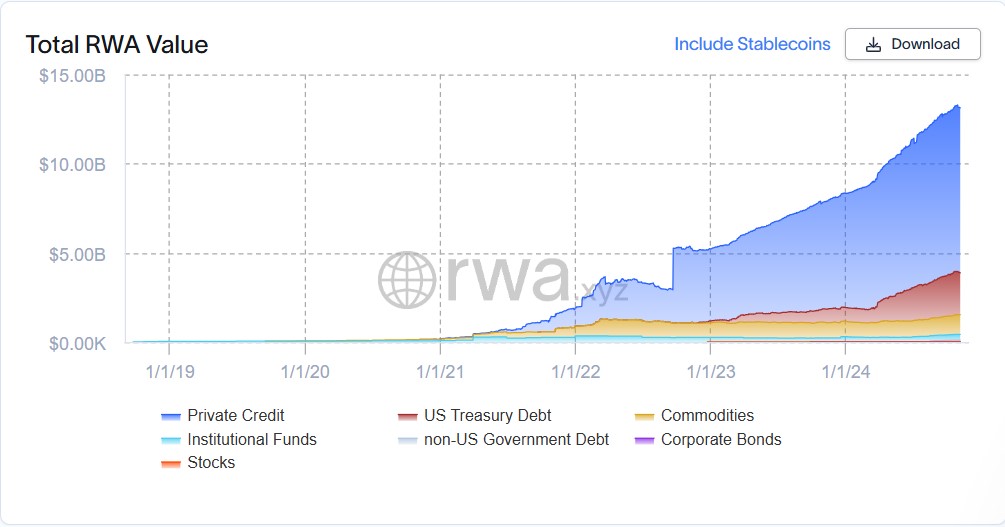

It can be claimed that Polymarket demonstrates the advantages of decentralized mechanisms, and relatedly, we are witnessing the increased adoption of tokenized products within traditional finance.

This can be seen in this year's launch of tokenized RWA fund BUIDL, from BlackRock, while Franklin Templeton manages tokenized fund FOBXX, and there are similar developments at UBS, which last week announced plans for a tokenized investment fund project called the UBS USD Money Market Investment Fund Token (uMINT).

This crypto-linked TradFi trend is likely to experience tailwinds in a clearer, more permissive regulatory environment, and the same can be said of crypto ETFs.

In 2024, spot BTC and spot ETH ETFs were launched in the US, but several operators already have applications filed with the SEC for SOL, XRP, and Litecoin ETFs (21Shares is interested in SOL and XRP ETFs, Canary Capital is interested in SOL, XRP, and Litecoin ETFs, VanEck is interested in SOL ETFS, and Bitwise is interested in XRP ETFs).

And so if, as expected, the SEC tilts in attitude under a new, pro-crypto SEC Chair, these kinds of altcoin-based funds may begin to launch, although whether or not they can replicate the explosive growth of the spot BTC ETFs would remain to be seen.

Ultimately, though, the prevailing sense is that crypto will be afforded room to breathe and develop in the US as an integrated part of the country's tech landscape from now on, at the very least, as an openly Bitcoin-friendly administration takes office for the first time ever.