Binance, the largest crypto exchange in terms of trading volume, has withdrawn its bid for a collective investment fund. This application was previously submitted to the financial market regulator in Abu Dhabi. The decision to retract its bid stems from Binance's ongoing reassessment of its “global licensing needs", according to the company.

Is Binance Rethinking Its MENA Strategy?

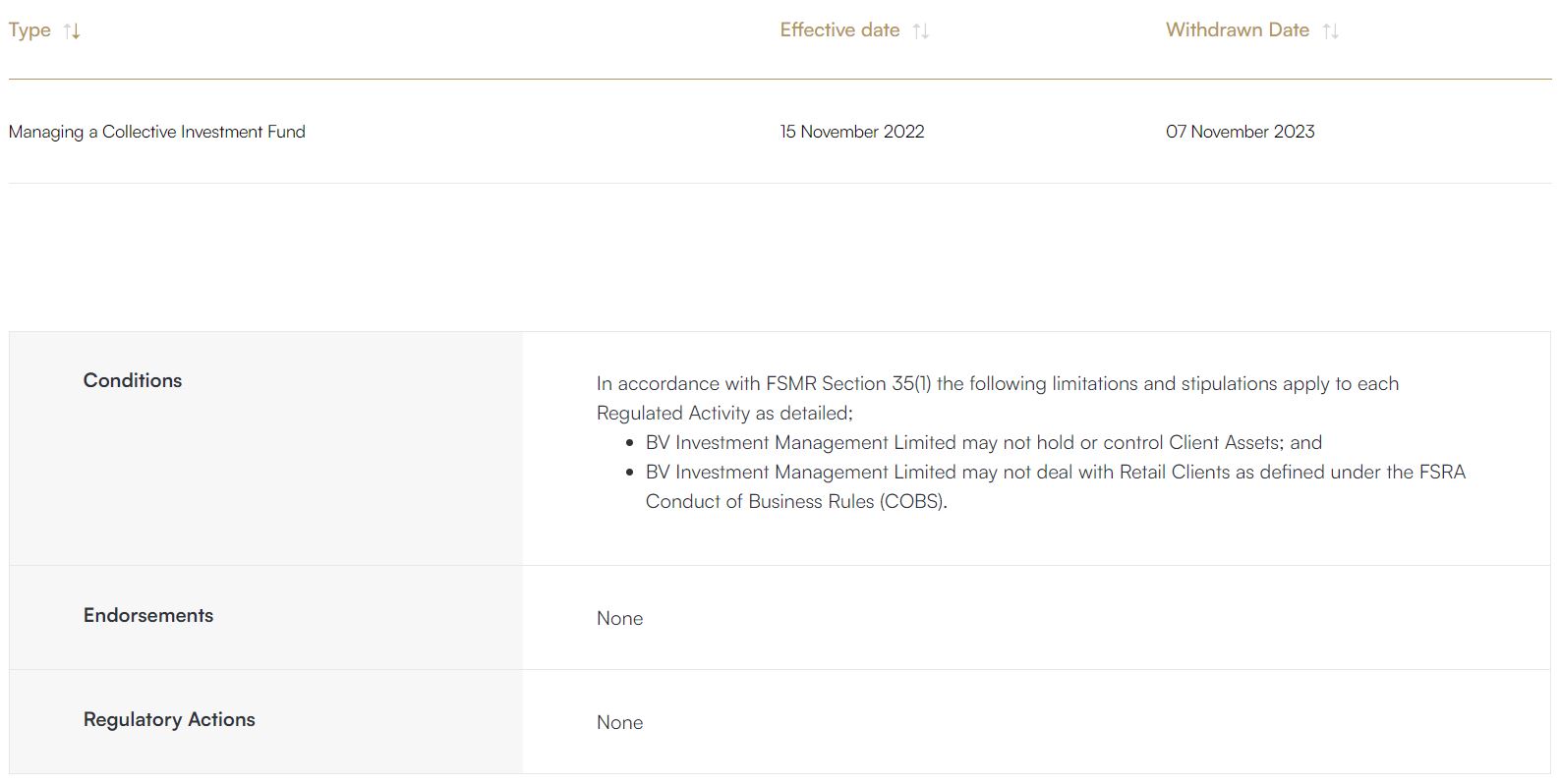

As seen on the Abu Dhabi Global Market (ADGM) register, Binance’s local subsidiary, BV Investment Management Limited, applied for the license on 15 November 2022 and withdrew the application on 7 November 2023. The license would have enabled the exchange to offer services to professional clients.

Notably, during those decisions, Changpeng Zhao was still in charge of Binance as the CEO. Zhao stepped down last month, following his plea agreement with the US prosecutors, handing over the charge to Richard Teng, who previously led the exchange’s regional operations and is also a former regulatory executive.

“When assessing our global licensing needs, we decided this application was not necessary,” a spokesperson from Binance said in a statement circulated across media houses. “Abu Dhabi has emerged as a leader in the virtual and digital assets ecosystem, a global hub that encourages innovation and responsible growth, while diligently guarding user interests.”

An Exchange Still Without Headquarters

Binance, which started to operate as a crypto exchange in 2017, was first based in China but relocated to Japan to escape the Chinese government’s crackdown on crypto exchanges. Later, the company established a base in Malta while maintaining its status as a firm without any fixed headquarters.

Although the initial growth of the exchange was aggressive, it started to receive regulatory warnings and enforcement actions in many jurisdictions. Most recently, the exchange settled with the US federal prosecutor, paying $4.3 billion for anti-money laundering and sanctions laws violations.

The exchange once highlighted its focus on growing its operations in the Middle East, a relatively crypto-friendly region with specific laws. According to its website, it holds other crypto licenses from Abu Dhabi, Dubai, and Bahrain regulators. It further holds registrations and licenses in Europe, Asia, and other parts of the globe. Meanwhile, it agreed to completely exit the United States as a part of its settlement agreement.