More than nine months after regulatory turmoil in the United States undermined the future of Binance's stablecoin, the exchange has decided to withdraw from its lending completely. According to an official statement released this week, Binance USD (BUSD) loans will be suspended as of 25 October 2023. This is another step towards the complete termination of token support, which is planned for February of next year.

Binance Pulls Out of BUSD Lending

The latest statement announced that the Binance Loans service will close all existing BUSD loans and collateral positions by 25 October. The platform is urging users to repay any impacted loans before 07:59 (UTC) on the final date to avoid potential losses.

Binance Loans will continue to support other stablecoins, including FDUSD, which it is currently promoting as an alternative to BUSD. Until now, users could borrow their own BUSD tokens at a projected annual interest rate of 3%.

Finance Magnates reported in late August that Binance was preparing to withdraw support for BUSD.

This was the first time the exchange encouraged its users to transfer the stablecoin to other tokens, including FDUSD launched by the Hong Kong-based First Digital Group in June.

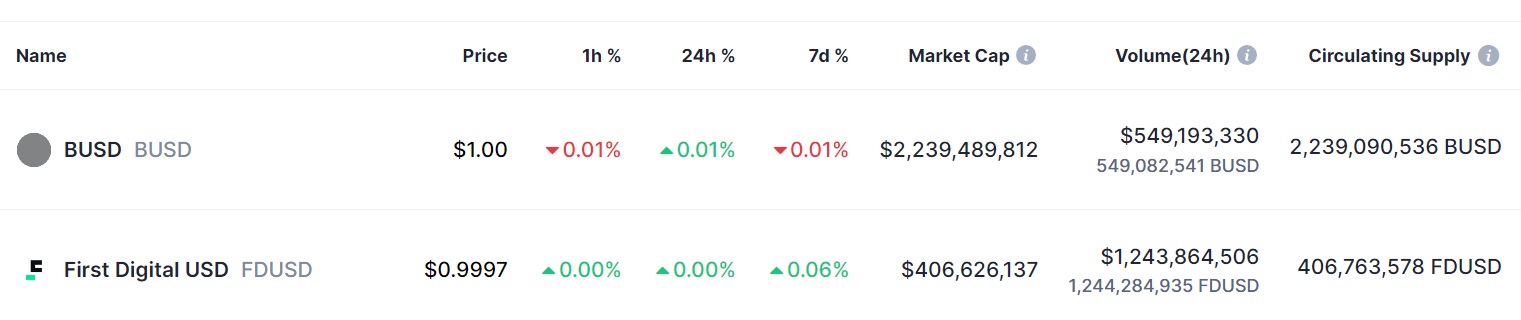

Despite promoting FDUSD over BUSD, the stablecoin that has existed for several months is still far less popular than Binance's own token. The current market capitalization of BUSD is $2.24 billion, while FDUSD's is only $406 million.

However, looking at transaction volumes, the latter is more active. Transactions worth $1.3 billion are carried out using FDUSD within a day whereas daily transactions for BUSD are worth about $500 million.

The exchange ultimately aims to halt support for BUSD by February 2024 completely. However, Binance stated that BUSD will always maintain a 1:1 peg with the stablecoin.

It All Started with Paxos Issues

Binance will withdraw support for its stablecoin a year after the cryptocurrency firm Paxos faced a lawsuit from the Securities and Exchange Commission over violations of user protection regulations. Additionally, a separate lawsuit against the company was filed by the New York Department of Financial Services (NYDFS).

As a result, the company decided to halt the minting of new BUSD tokens. The chart below shows how this has dramatically affected the decline in the stablecoin's market capitalization.

In the meantime, Binance encountered several other regulatory hurdles, including issues with handling traditional currencies. As Finance Magnates reported in late September, Binance is suspending EUR operations offered through Paysafe. Earlier in May, support for GBP payments was suspended.