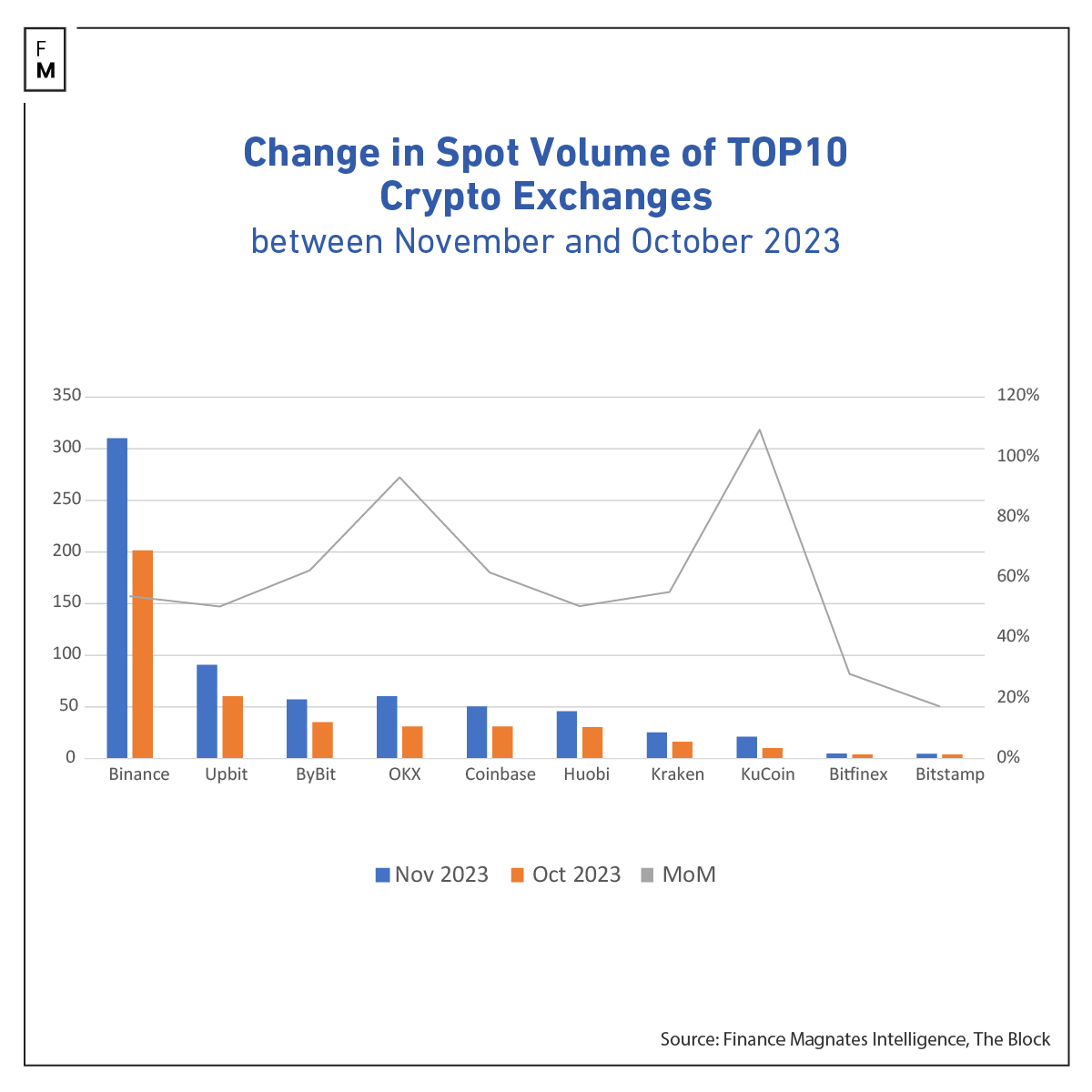

Bitcoin's (BTC) rise to 19-month highs in November caused retail investors to trade cryptocurrencies much more eagerly last month. This translated into the spot volumes of major crypto exchanges, which grew 58% to the highest levels in eight months.

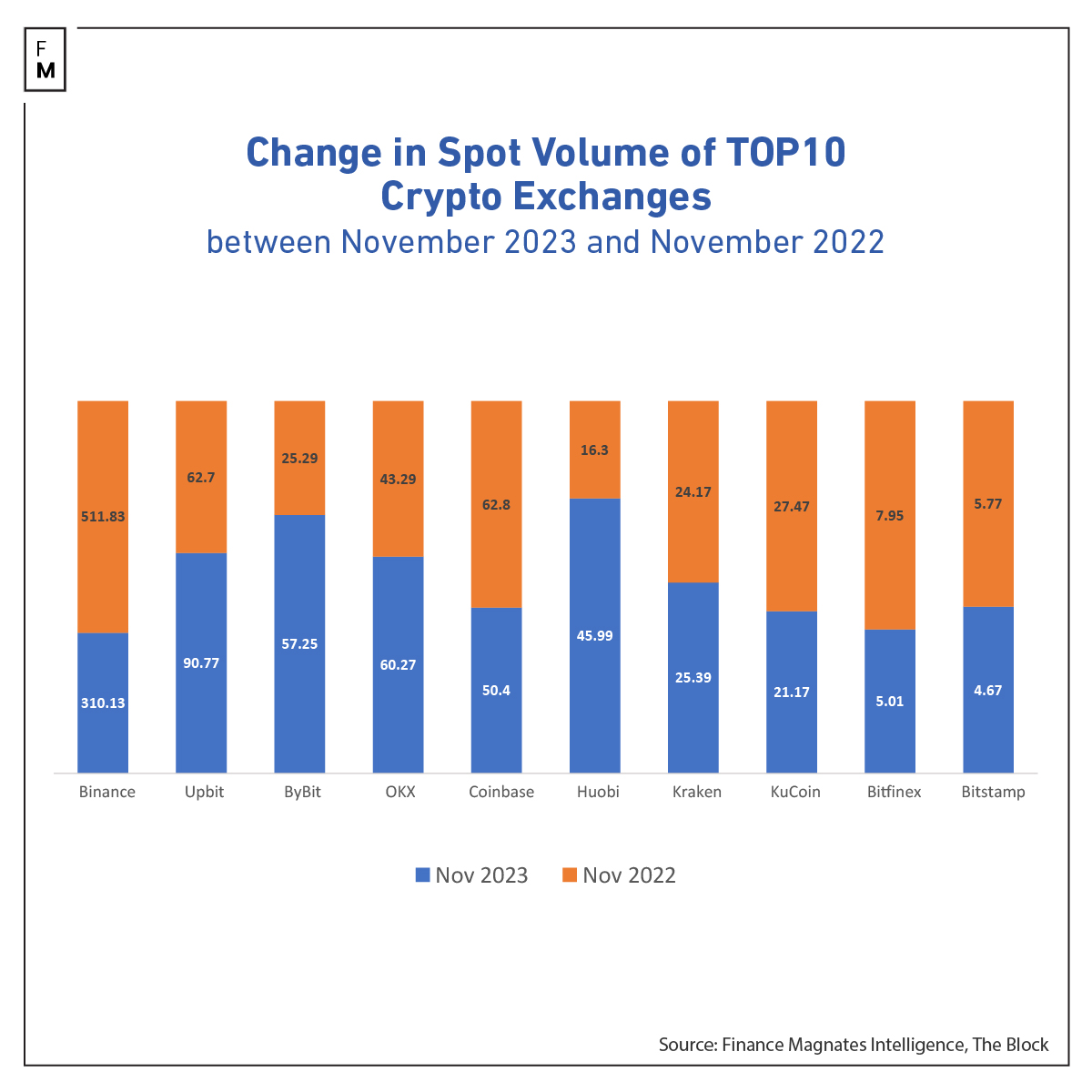

Data from Finance Magnates Intelligence shows a month-over-month (MoM) jump in total trading volume from $424 billion to $671 billion. Despite this robust monthly performance, the figures fell 15% short compared to the $787 billion reported in November 2022.

Crypto Volumes Soar in November

Following an above-average October for cryptocurrencies , expectations were high for November, and the market did not disappoint. Bitcoin climbed an additional 9%, closing the month at $38,000, its highest since May 2022.

The upbeat mood and evident uptrend in the crypto market led to some exchanges experiencing monthly volume increases of up to 100%. OKX's November figures soared 93% to $60.3 billion, and KuCoin's volumes surged 109% to $27.5 billion.

"Trading activity on centralized exchanges continues to benefit from the positive sentiment in the market as we approach the deadline for the spot Bitcoin ETF decision," CCData commented in their crypto volumes report.

Binance Remains the Leader

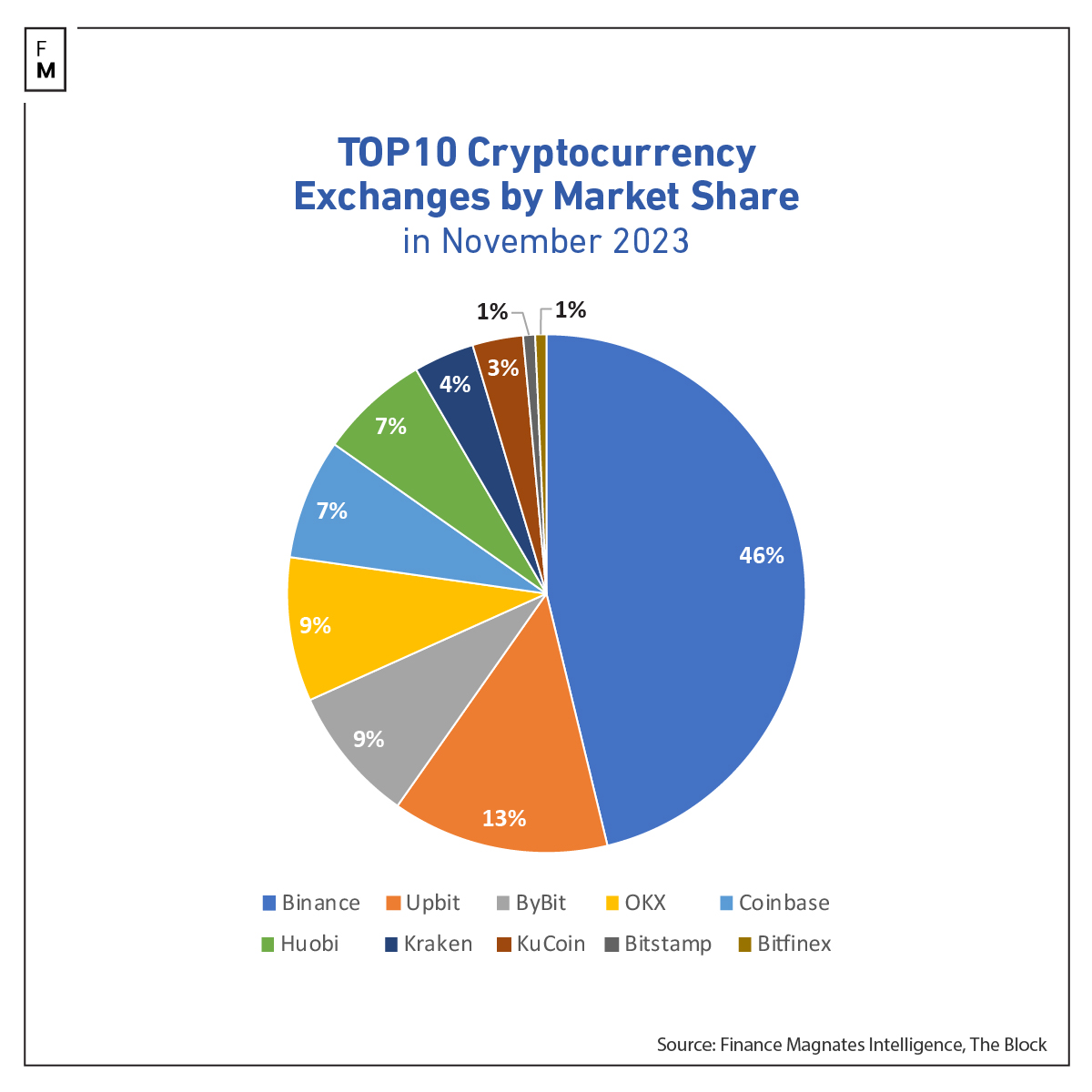

Market leaders also experienced significant growth, with Binance continuing to dominate the market share (46%). The exchange's volume reached $512 billion, a MoM increase of 54%, although it marked a year-over-year (YoY) decline of 39%.

Upbit took second place with a volume of 50% higher MoM and 45% YoY at $91 billion, while OKX, with over $60 billion, moved up to third place, surpassing ByBit. Coinbase and Huobi rounded out the top five, with volumes of $50 billion and $46 billion, respectively, both registering MoM increases of approximately 55%.

Some positions were additionally changed at the lower end of the list. A volume increase of 28% allowed Bitfinex to overtake Bitstamp, whose November performance was marginally lower by $300 million.

Best Crypto Volumes Since March 2023

According to CCData, the total spot volume for all cryptocurrency exchanges and the top 10 analyzed by Finance Magnates reached its highest level since March 2023.

"The market benefitted from the settlement of US charges by Binance as it minimizes further systemic risk in the industry," the company added.

Significant changes further occurred in crypto derivative trading volumes, with trading on the CME exchange rising 18.4% to $67.9 billion, the highest since November 2021. Consequently, the open interest of BTC futures trading on CME surpassed values observed on Binance, leading in terms of open interest.

Although December has just begun, Bitcoin continues its bold rally, adding over 15% to its value in the last week, testing the area of $45,500. If Santa's rally continues, the volumes of crypto exchanges for the last month of the year should once again positively surprise.