The recently launched US Bitcoin exchange-traded funds (ETFs) have captured the attention of investors, drawing an impressive $1.9 billion in just the first three days of trading.

According to a report by Reuters citing data from issuers and analysts, this surge, led by industry giants BlackRock and Fidelity, has sparked a significant shift in crypto investments. The inflows into these newly introduced spot Bitcoin ETFs have outpaced the initial investments into the ProShares Bitcoin Strategy ETF and the SPDR Gold Shares ETF.

However, the inflows fell short of the most optimistic estimates, raising concerns about the potential of these funds. Analysts anticipate the inflows into the funds to range between $50 billion and $100 billion by the end of the year. However, the volatile nature of the market raises questions about the longevity of this trend.

Factors Driving Investor Interest

Lower fees and brand recognition have emerged as pivotal factors influencing investor decisions. With fees below the industry average, BlackRock's iShares Bitcoin Trust ETF (IBIT) and Fidelity's Wise Origin Bitcoin Fund have attracted significant investments.

While BlackRock and Fidelity dominate the initial inflows, other issuers like Bitwise and the joint venture of Ark Investments and 21Shares are not far behind, initially waiving fees to attract investors. However, with a fee of 1.5%, the Grayscale Bitcoin Trust faces outflows as investors shift towards more cost-effective options.

As spot Bitcoin ETFs continue to gain the attention of retail investors, the challenge lies in winning acceptance among institutional investors, including pension funds and investment advisers. The next six months are expected to clarify the role of spot Bitcoin ETFs in institutional portfolios and their long-term viability.

BlackRock's iShares ETF Tops

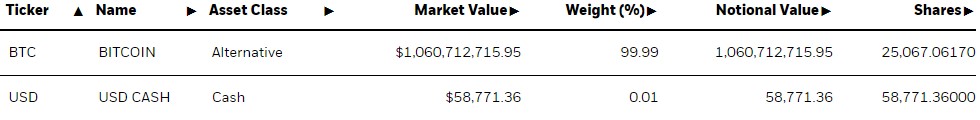

IBIT surged past $1 billion in assets under management within a week of its debut. The rapid success of this spot Bitcoin ETF marks a significant milestone for BlackRock and the broader cryptocurrency investment landscape.

According to the data from iShares, IBIT's closing price on Wednesday, at $24.41, reflects a slight premium of 0.42% relative to spot Bitcoin prices. The fund's trading activity is reflected in its average daily trading volume of 14 million shares.

Recently, BlackRock and Ark Investment Management reduced the fees for their spot Bitcoin ETFs. This move, which happened ahead of the approval of the funds, is seen as a proactive measure to attract investors and secure a substantial portion of the expected capital inflow.

IBIT reduced its fees from 0.30% to 0.25%, while Ark Investment Management adjusted the fees for its 21Shares Bitcoin ETF from the initial 0.25% to 0.21%.