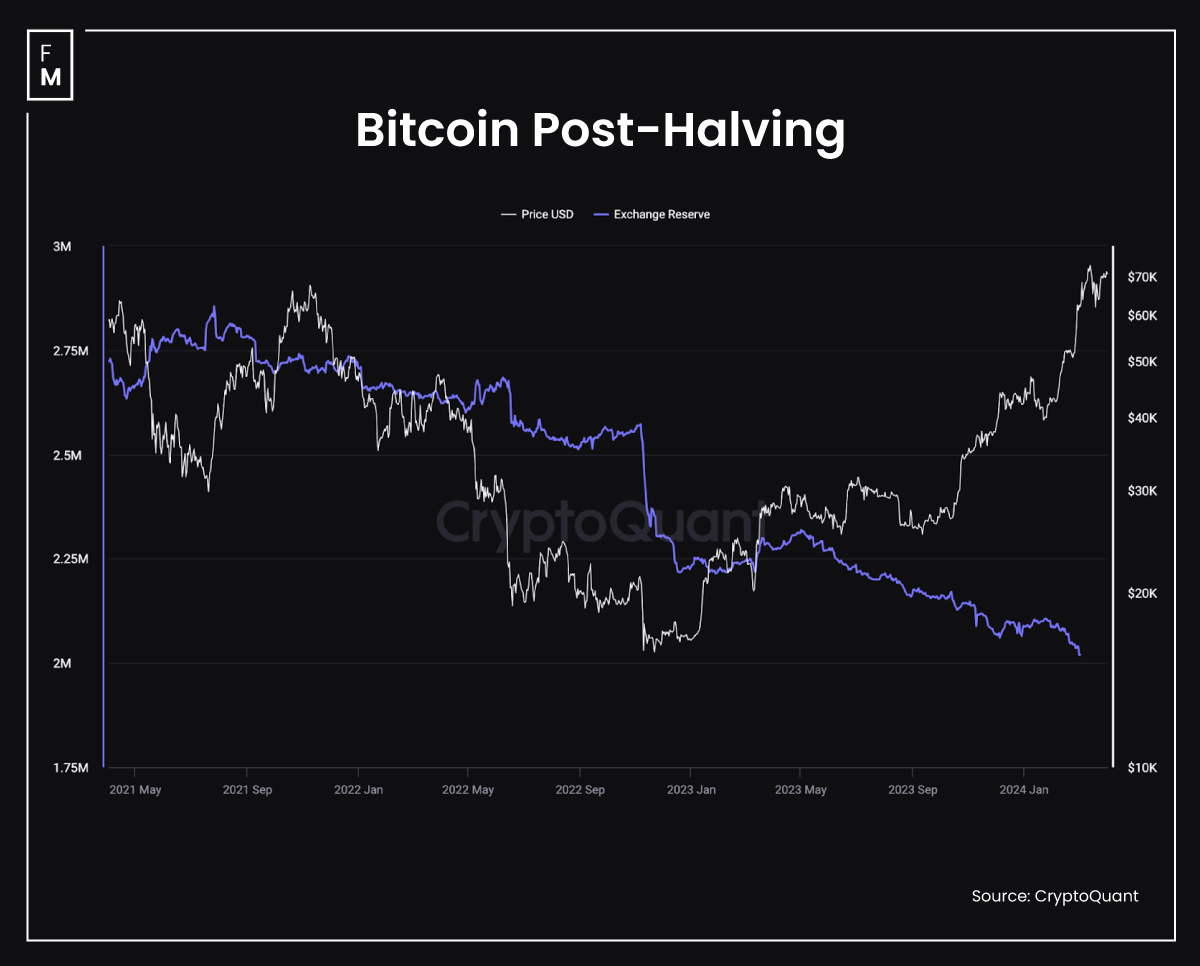

Cryptocurrency exchanges have only nine months' supply of Bitcoin at current prices, with three days left to Bitcoin halving. According to the latest analysis by Bybit, with just 2 million Bitcoins remaining and a daily inflow of $500 million to spot Bitcoin ETFs, approximately 7,142 Bitcoins will exit exchange reserves daily.

Bitcoin Supply Hits Unprecedented Scarcity

The much-anticipated halving event, which reduces the supply of Bitcoins by 50%, is expected to make the digital asset more scarce. Bybit highlighted the rapid reduction of Bitcoin reserves across centralized exchanges post-halving. This trend indicates that it will take about nine months to exhaust all remaining reserves.

Ben Joe, the Co-Founder and CEO of Bybit, mentioned: "Each Bitcoin halving sharpens the narrative of Bitcoin as not just a currency, but a scarce digital asset, akin to digital gold. This upcoming halving in 2024 will thrust Bitcoin into an era of unprecedented scarcity, making it twice as rare as gold."

The report differentiated between Bitcoin and gold, emphasizing Bitcoin's increasing rarity post-halving. The Stock-to-Flow (S2F) ratio, a measure of scarcity, is projected to double from 56 to 112 after the upcoming halving, surpassing gold's S2F ratio of 60.

Institutional Adoption of Bitcoin

This comparison solidifies Bitcoin's status as a scarce digital asset, positioning it as a viable alternative to traditional safe havens like gold. Additionally, Bybit highlighted the adoption of Bitcoin by institutional investors following the recent approval of spot Bitcoin ETFs in the US.

This trend indicates that institutions have recognized the importance of the digital asset as a safe investment option. This has led to heightened investment activity ahead of the halving. The correlation between Bitcoin and other cryptocurrencies remains strong, further boosting Bitcoin's reputation.

Bitcoin's deflationary model is based on the halving event, which occurs roughly every four years, Finance Magnates recently reported. This mechanism halves the block reward, limiting the supply of the leading digital asset. As the upcoming halving approaches, reducing the block reward from 6.25 Bitcoins to 3.125 Bitcoins, historical trends suggest a potential surge in the price of Bitcoin.

Additionally, analysts anticipate a modest decrease in Bitcoin mining hashrate after the halving, attributed to current high profitability and efficient mining equipment adoption. Despite short-term dips, the resilience of the mining industry is expected to drive a swift rebound.

Meanwhile, the renowned author of "Rich Dad Poor Dad," Robert Kiyosaki, recently expressed optimism about Bitcoin reaching $100,000 by September due to concerns over global economic instability and debt issues. While market analysts project a potential surge in Bitcoin, concerns linger about selling pressure and potential price slumps during the halving period.