September is historically one of the worst months for Bitcoin (BTC) and the cryptocurrency market. This year, however, the oldest digital asset bucked the trend, rising by over 7% and defending the psychological level of $60,000. The lack of a clear direction for another consecutive month caused investor activity to decline significantly, and with it, the volumes of the top 10 largest crypto exchanges. On average, they shrank by 20%.

Spot Volume of Leading Crypto Exchanges at Lowest Since November 2023

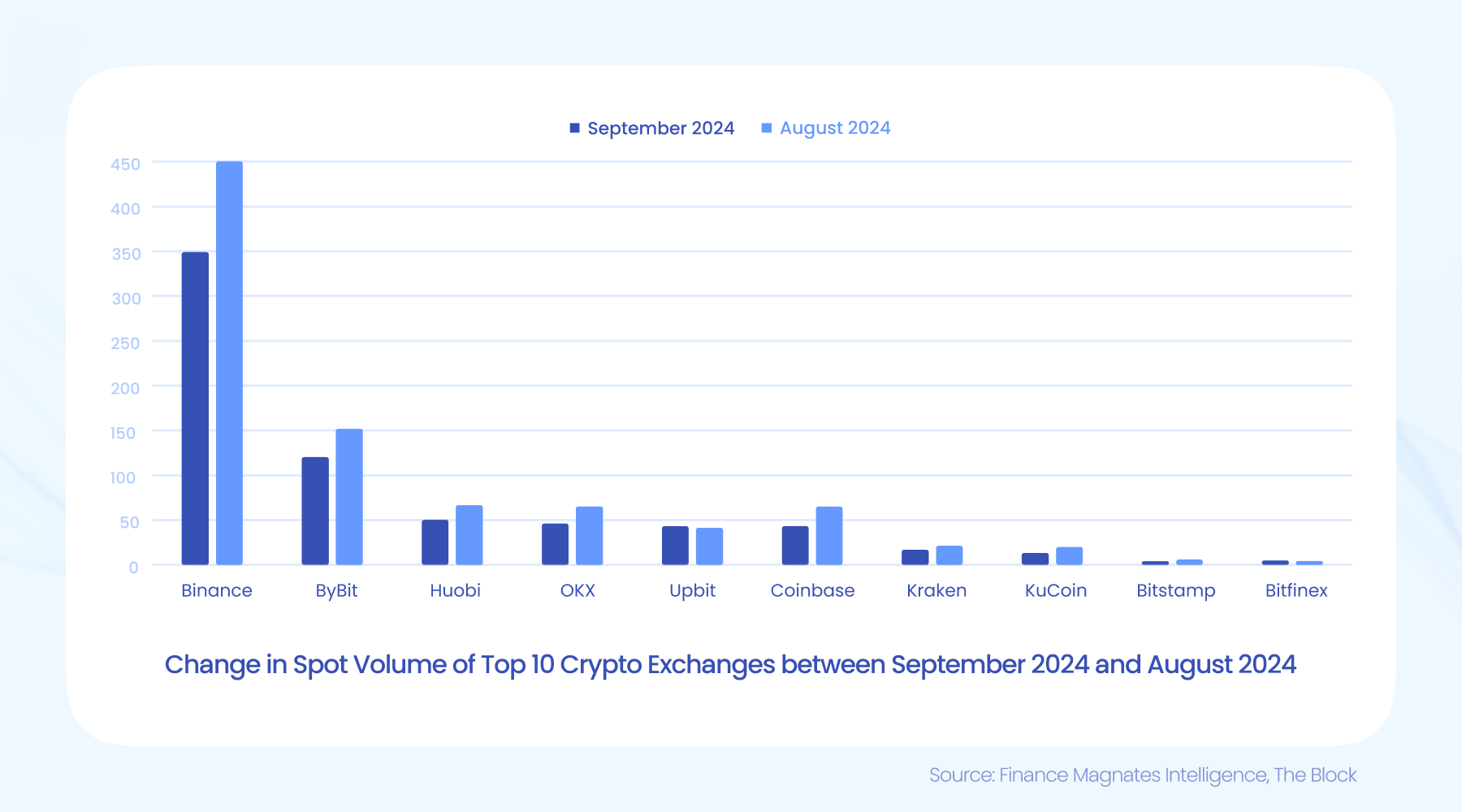

According to the latest analysis by Finance Magnates Intelligence, the total spot volume for the 10 largest centralized exchanges in September was $715 billion, falling by one-fifth from the level of over $909 billion reported a month ago.

This is not only significantly less than in August but also less than in any month this year. The last time the volume for the analyzed platforms fell this low was in November 2023, when it amounted to $671 billion. At that time, however, the price of Bitcoin was almost twice as low and hovered around $35,000.

“The drop in monthly trading volume aligns with the final month of the seasonality period, which is typically marked by lower trading activity,” CCData commented in its newest report.

Binance Still Dominates, Upbit Jumps into Top Five

Only Upbit managed to break the negative month-to-month trend, with its volume growing by 5% to $46.5 billion. This allowed it to surpass Coinbase in the group of the five largest exchanges, which in turn recorded a stronger decline of 31% to $46.4 billion. The difference between these two turned out to be marginal.

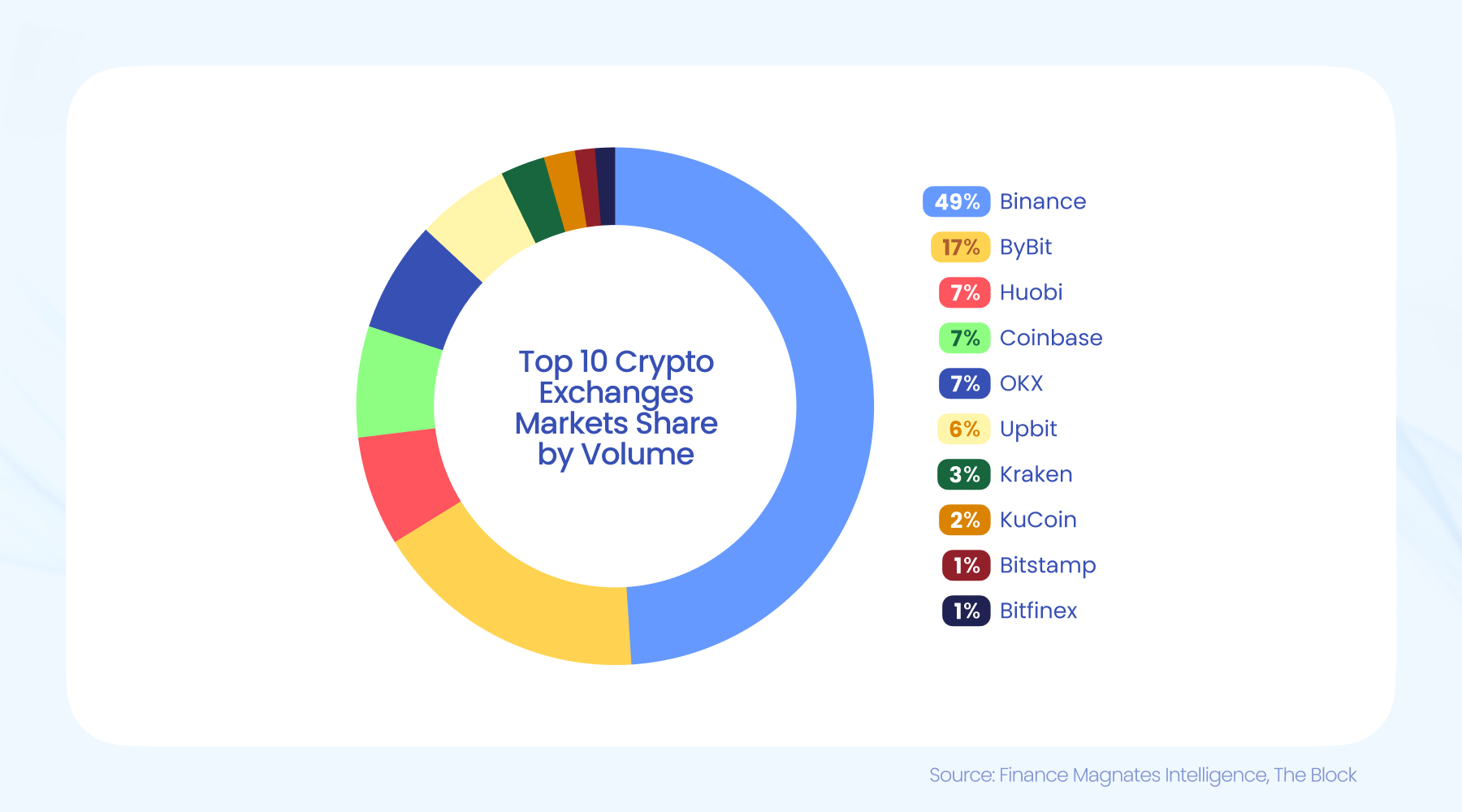

As for the podium, the composition remained unchanged. Binance still dominates with almost a 50% market share. ByBit accounts for nearly 1/5 of the market, and Huobi is in third place.

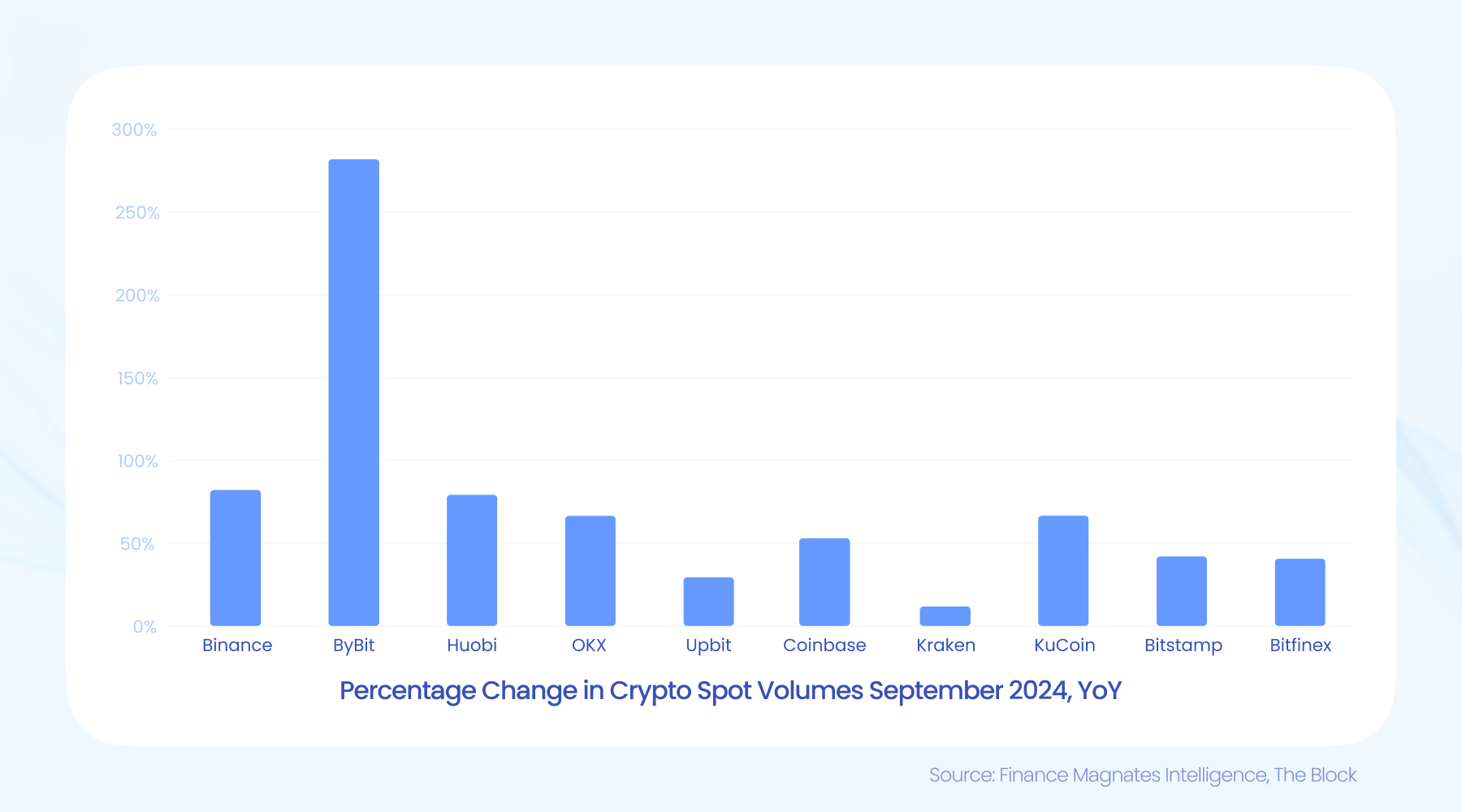

Better Results Compared to September 2023

Although the results from September 2024 are not optimistic compared to August and the last 10 months, they look much better compared to the same period a year earlier.

During this time, volume grew on average by 68% from the level of $401 billion reported 12 months earlier. Again, Upbit shows the strongest year-over-year jump, with its turnover growing by 250%, from $35 billion to over $123 billion.

What awaits us in October? Given that Bitcoin has managed to return above $64,000 and with the upcoming US presidential elections, the cryptocurrency's volatility may be greater.

“Historically, Q4 has recorded the highest quarterly volumes in six of the last 10 years,” CCData added.

As a result, we can also expect more investor activity and, consequently, exchange volumes. However, only time will tell.