A new survey from Bitget reveals bullish investor expectations around Bitcoin's upcoming "halving" event in April 2024. 84% of respondents predict Bitcoin surpassing its all-time high of $69,000 in the next bull run.

Investor Sentiment Upbeat Ahead of 2024 Bitcoin Halving

The Bitget study engaged nearly 10,000 crypto investors globally to analyze sentiment and potential market impacts. Key findings from the extensive research reveal that 70% of participants indicate plans to raise their crypto investments in 2024. Regarding Bitcoin's potential post-halving price stabilization, 55% expect a range between $50,000 and $100,000, while 30% forecast over $60,000 valuation during the halving timeframe itself in April 2024.

"The findings reflect a broad spectrum of expectations and investment plans, indicating that 2024 will be a significant year for the Bitcoin market," said Gracy Chen, the Managing Director at Bitget.

Halving has historically catalyzed appreciation for Bitcoin 's value. Investors seem poised to capitalize on potential gains, with bullish outlooks especially notable across Latin America, Asia, and MENA respondents. Europe presented more conservative expectations, both mid-term and long-term.

"We are pleased to see such positive sentiment emerging as market conditions continue recovering," Chen added. "The road ahead remains bright."

A Bitcoin halving is a planned reduction in the reward miners receive for mining new blocks and processing transactions on the Bitcoin network. The halving happens roughly every 4 years and cuts the mining reward in half. The goal is to control supply and prevent cryptocurrency inflation over time.

How Gender and Age Influences Your Bitcoin Investments

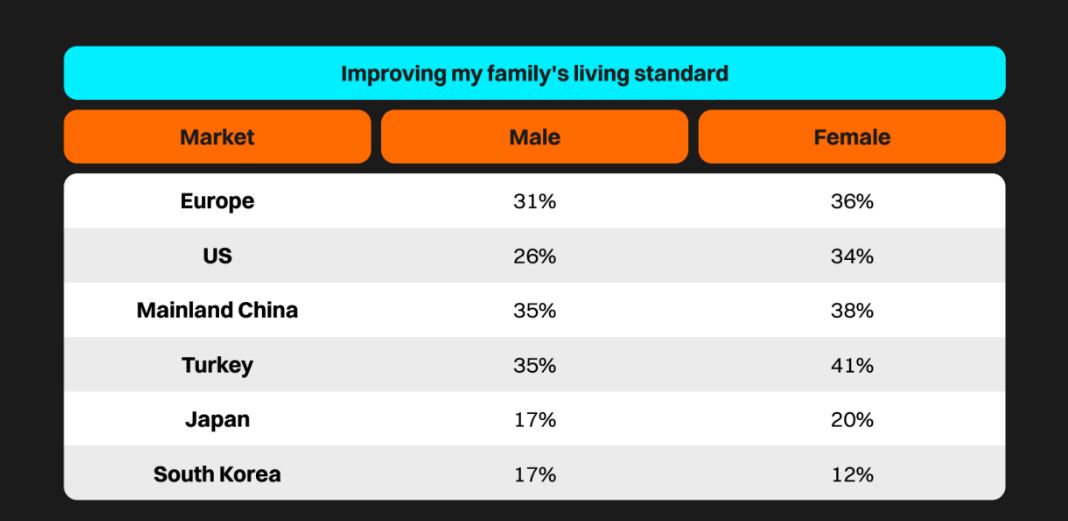

In recent reports by Bitget, the impact of gender and age on cryptocurrency investments was analyzed, revealing insightful trends about investor demographics and their motivations. It was discovered that gender significantly influences financial goals, with a notable trend in South Korea and Japan, where a higher percentage of female investors focus on personal finances compared to their male counterparts. Specifically, 49% of women in South Korea and 41% in Japan prioritize personal finance management, whereas only 17% and 30% of men in these countries do so.

The August report delves into the age distribution among cryptocurrency investors, particularly those using Bitget's copy trading feature. It identifies Gen Z users as the largest group of copy traders, accounting for 44% of the total, showcasing their tech-savviness and susceptibility to social media influence.

They are followed by individuals aged 25-35 (32%), those in the 35-55 range (17%), and participants over 55 (7%). Among these, 72% of traders under 25 and 65% of those between 55 and 64 rely on Bitget primarily for its copy trading capabilities, indicating a strong preference for this investment approach across diverse age groups.

Bitget, established in 2018, serves over 20 million users globally through its crypto exchange and Web3 solutions. In 2023, it recorded a jump of 94% in spot volumes on its platform.