The Bitcoin market continues to develop and mature as we enter the final months of an interesting year. The price rises witnessed through June and July seemed to signal an end to the 12-month downward spiral. However, the recent market has most certainly been influenced by the large quantities of venture capital funds directed towards the Bitcoin industry.

Price

The Bitcoin price has reached close to $300 per BTC on three occasions so far this year, in January, March and July, providing speculators with a brief sense of optimism that the negative trend experienced since mid-2014 could finally be set to change. The situation in Greece was thought to be responsible for the surge in prices, particularly as much of the growth experienced seemed to fall away after its resolution. All of the upward movement has since reversed and, at the time of writing, the Bitcoin price sits at $228 per BTC. The latest price drop is seemingly linked to difficulties at Hong-Kong based exchange, Bitfinex, with a 14% drop in prices attributed to a ‘Flash Crash’ on the exchange, and a later 3.8% slip thought to be a result of Bitfinex halting trading for several hours. The latest fall in prices also coincides with a growing rift in the community over a solution to the block size issue.

Issues

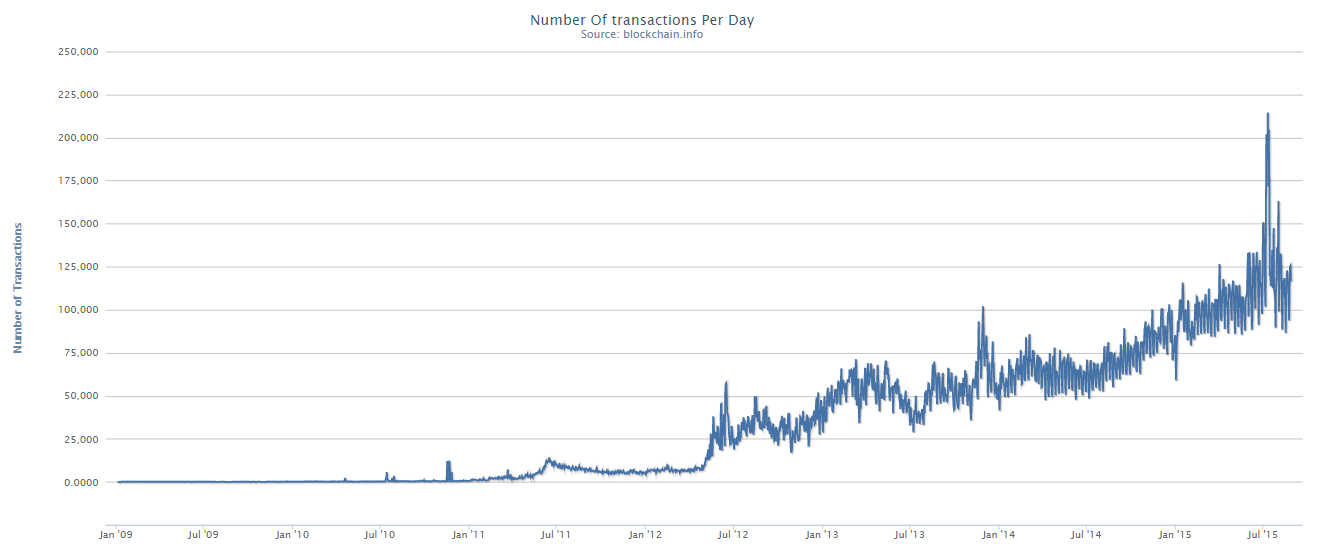

The Bitcoin community continues to approach a literal fork in the road, as the block size debate heads towards a forced conclusion. The Bitcoin Core developers and industry heavyweights have been in constant discussion over necessary changes to help Bitcoin move forward. Since capacity testing saw the Bitcoin network flooded with low value transactions, most can agree that the current 1 MB block size limit will cause the network to grind to halt somewhere in the future, if the transaction volume increases as predicted.

However, the community is divided as to how best to solve the issue; Mike Hearn and Gavin Andresen, two prominent Bitcoin core developers, recently included Bitcoin Improvement Proposal 101 into an alternative implementation of the Bitcoin software, called Bitcoin XT. The changes are designed to force a hard fork in the Blockchain , wherein new blocks will have an 8 MB limit, which doubles every two years.

However, a large proportion of the community, including a number of the large China-based mining groups, are expressing a reluctance to move to this new implementation. Another Bitcoin core developer, Jeff Garzik, has submitted two alternatives in Bitcoin Improvement Proposals 100 and 102. The first, BIP100, suggests a hard fork which removes the static 1 MB limit, and miners must then “vote” on block sizes. BIP102 is essentially an “emergency fallback” if the Bitcoin community does not reach a consensus soon, and allows for further experimentation before a final decision.

Growing daily transaction volume. The peak visible in July 2015 is as a result of the network capacity testing completed as part of the block size debate. Chart source: Blockchain.info

The debate continues and estimations indicate that growing transaction volumes will result in delays and a market for fees if the 1Mb block size is not increased. It is worth noting that the concerns from some of the Bitcoin community relate to a degree of centralisation being brought about by changes, as a greater block size makes it more expensive and difficult to run a full node on the network. The fear that changes will damage the decentralised nature of Bitcoin are not unfounded, but these changes could simply be necessary if Bitcoin is to be able to grow and scale, such that its benefits can be experienced by a greater number of people.

Investment

This year has seen a great deal of attention towards Bitcoin and blockchain technology, from governments and large financial institutions alike. Although interest has been building for some time, the last few months have seen many of these bodies go public with their interest by announcing various trials and research programmes.

A report released by Santander's InnoVentures suggested, “It is only a matter of time before distributed ledgers become a trusted alternative for managing large volumes of transactions.” This suggests that banks will look to utilise this technology within the existing currency paradigm, to ensure they are not left behind in the financial technology revolution. The VC interest in Bitcoin and blockchain start-ups has been notable this year too, with huge amounts of money being directed towards the industry. As an example, Ripple Labs' first round, which finished in May, gathered a substantial $28 million and BitFury took in a further $20 million from its third round of funding.

Despite a degree of uncertainty in the air, many of us remain optimistic over the future of Bitcoin. The interest from powerful banking institutions should be encouraging to all those operating in the Bitcoin space. It is worth remembering the reservations expressed by the banks towards e-commerce and online Payments before they became the vital part of the global economy we know them as today. Bitcoin still has a great deal to offer and, as always, is an incredibly exciting industry to be involved with!