Cboe Australia has listed new exchange-traded funds (ETFs) from iShares by BlackRock. This step places BlackRock among the major asset management firms listing its iShares ETFs on every Cboe exchange globally.

Dave Howson, the Executive Vice President and Global President at Cboe Global Markets, mentioned: "This latest listing of iShares ETFs on Cboe Australia is a major milestone and a significant step forward to deliver on Cboe's global listings vision. Cboe is the only exchange network in the world facilitating access to global capital and secondary liquidity by offering an efficient path for asset managers to list across our five listings exchanges."

iShares ETFs Enter the Australian Market

The newly listed iShares ETFs on Cboe Australia include iShares MSCI World ex Australia Momentum ETF (Ticker: IMTM), iShares MSCI World ex Australia Quality ETF (Ticker: IQLT), and iShares MSCI World ex Australia Value ETF (Ticker: IVLU). Cboe is one of the largest ETF listing venues in the US, hosting over 680 ETF listings. According to the press release, Cboe Australia accounts for up to 40% of the Australian ETF daily trading volume.

Last month, The US Securities and Exchange Commission approved the applications of 11 asset management firms for spot Bitcoin ETFs. These ETFs were authorized to be listed on US stock exchanges, including NYSE Arca, Nasdaq, and Cboe BZX. The approved issuers are ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, Grayscale, Bitwise, Hashdex, and Franklin Templeton.

Bitcoin ETFs Poised for Record Inflows

Analysts speculate significant inflows into Bitcoin ETFs, estimating between $50 billion and $100 billion in the first year of their approval. However, the SEC’s Chief, Gary Gensler, clarified the scope of the approval, emphasizing that it does not reflect authorization for crypto asset securities.

The recently launched Bitcoin ETFs in the US experienced an inflow of $1.9 billion in the first three days of their debut. BlackRock and Fidelity led the upsurge. Lower fees and brand recognition played a significant role in attracting investors to specific ETFs.

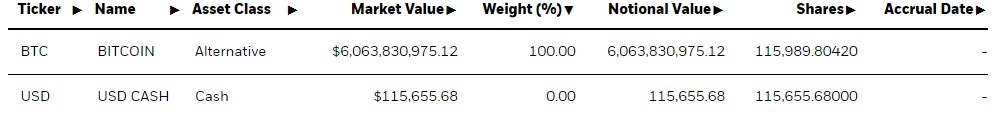

The challenge for spot Bitcoin ETFs lies in gaining acceptance among institutional investors, including pension funds and investment advisers. Currently, the value of iShares Bitcoin Trust is more than USD $6 billion.