Trading volumes on Coinbase (NASDAQ: COIN) have fallen so sharply in the past quarter that they are now below the levels seen in April 2021, when the exchange debuted on Nasdaq. According to CCData, trader activity was valued at $76 billion, a decrease of 52% compared to the previous year's third quarter.

For Coinbase, Trading Volume Is a Significant Revenue Driver

The exchange itself admits that transaction revenue accounts for more than half of its total income. When investors remain inactive and trading volumes decline, the platform's profits also shrink considerably.

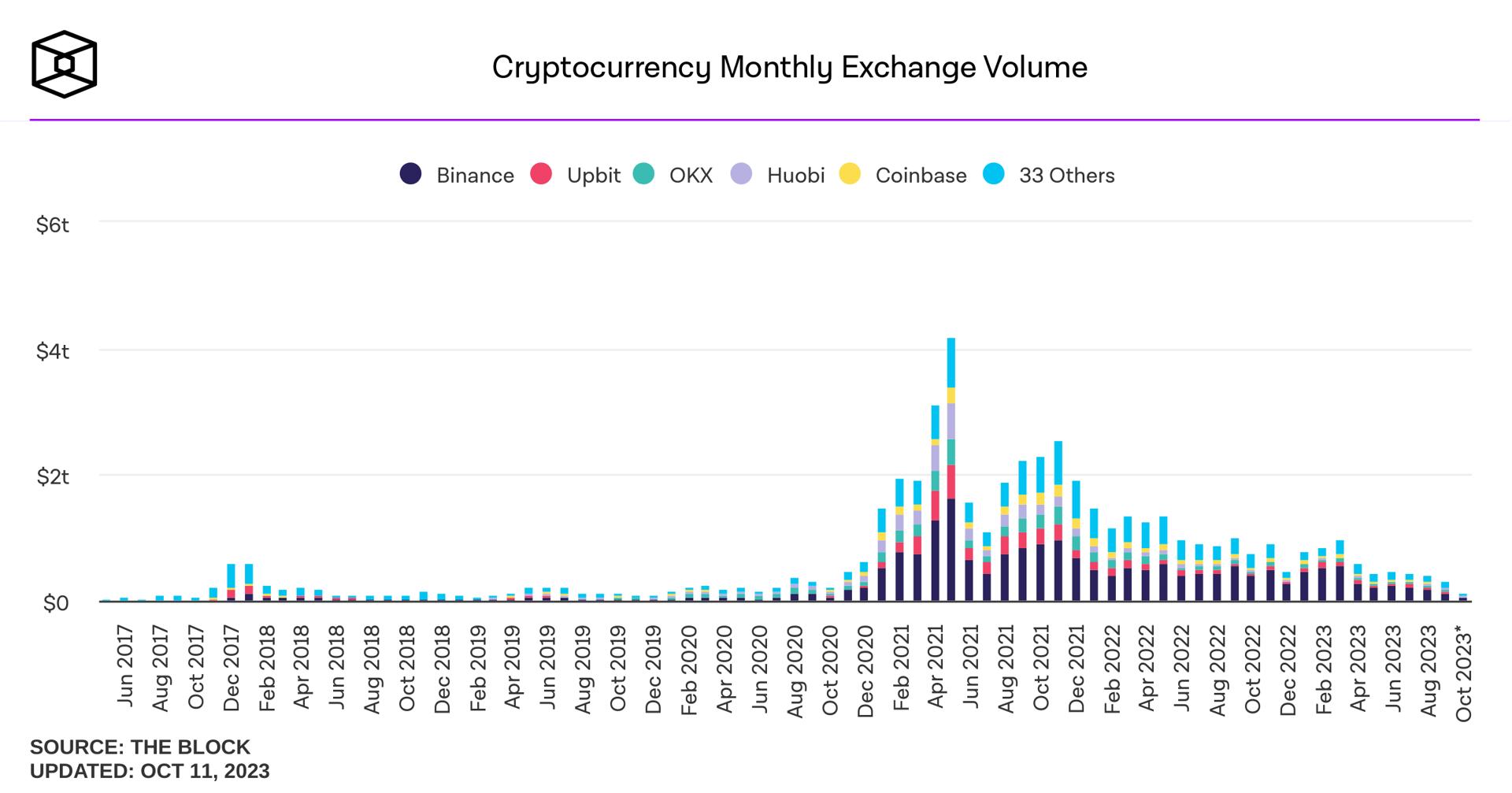

Although Coinbase remains one of the larger exchanges in terms of reported volumes, it has seen a significant drop in this key metric over the past year. This trend also affects other platforms and is a result of lower cryptocurrency prices, scandals, and high-profile exchange collapses.

Coinbase achieved record volumes in May 2021 when cryptocurrency prices soared to historic highs. In that single month, turnover reached $259 billion. However, it was more than ten times lower in September, at $20 billion.

Analysts are already more than certain that the company will report its seventh consecutive declining quarter when it releases its report next month. For example, Mizuho Securities believes that Q3 2023 revenue will be 10% lower than official forecasts.

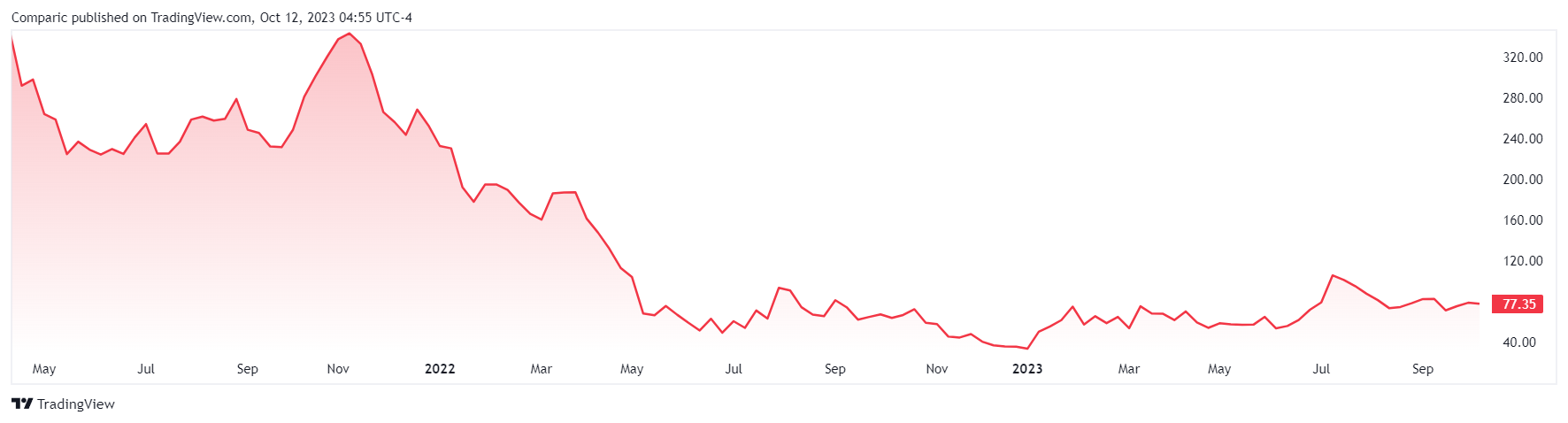

Despite this, Coinbase's stock has risen by nearly 120% this year. Some might say that the shares have nowhere to fall, as they have lost over 80% of their value since their debut in 2021. However, the chart shows that since May 2022, they have been consolidating in the same volatility range and currently cost just under $80.

Singapore and Bermuda, but Not Europe

The San Francisco-based cryptocurrency exchange has been strategically expanding its global footprint. After a year of provisional approval, the company recently secured a Major Payment Institution license from Singapore's Monetary Authority. This follows Coinbase abandoning its earlier plan to enter the Singaporean market by acquiring the now-defunct Zipmex exchange in 2022.

In addition to its Singaporean venture, Coinbase has received regulatory approval from Bermuda's financial authority, allowing it to offer perpetual futures trading to qualified non-US customers. This new offering will be available on the Coinbase Advanced platform in the near future.

However, the company has put its European expansion on hold, specifically its plans to acquire FTX Europe. Initially aimed at breaking into the European derivatives market, the acquisition was suspended due to regulatory hurdles in the US. FTX Europe, known for its significant share in the European trading volumes, was a key target for Coinbase, as it holds nearly 75% of the global crypto derivatives trading volume.