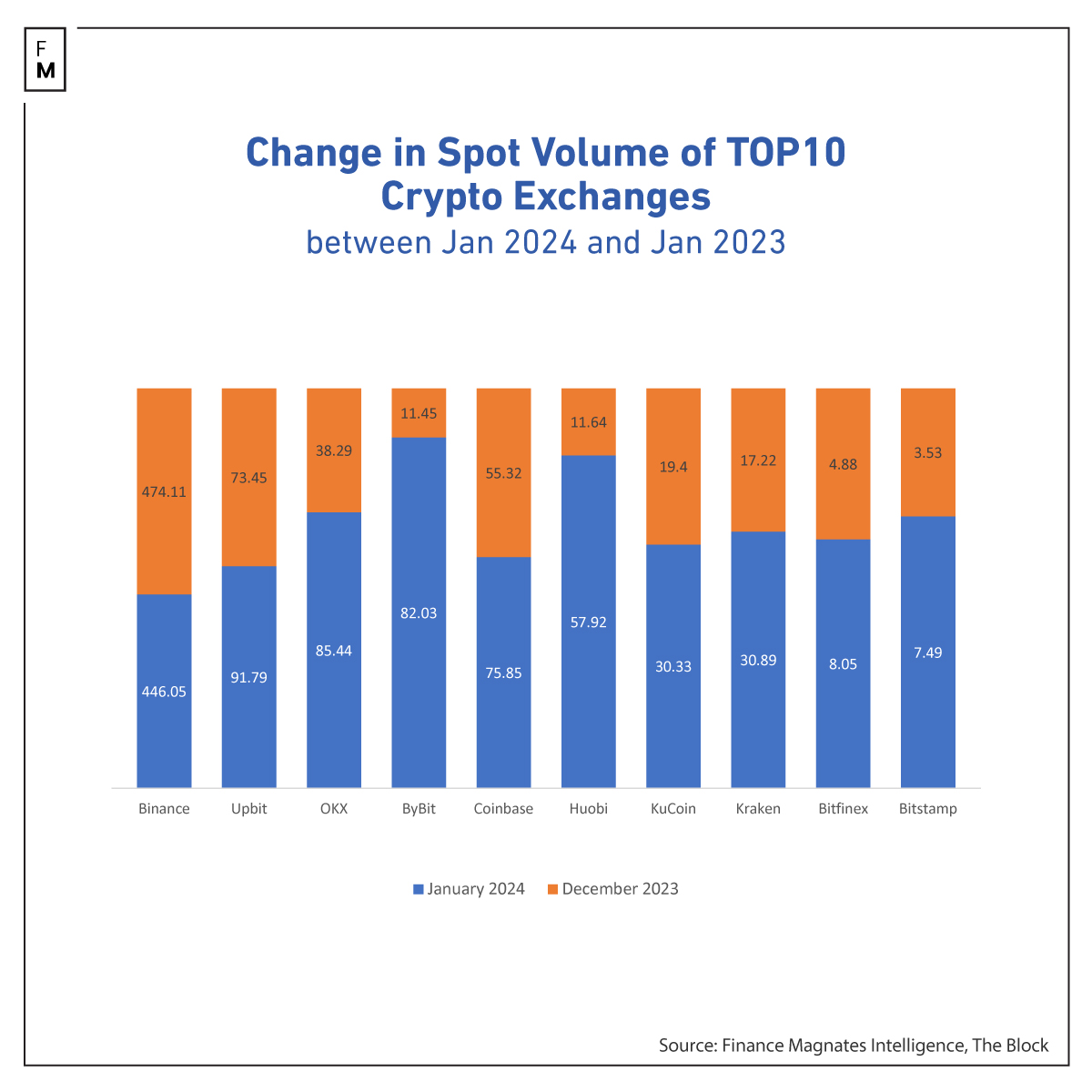

After a strong year-end, the spot volumes of the largest cryptocurrency exchanges recorded only modest monthly gains, averaging 3%. However, comparing statistics from January 2024 with the same period twelve months earlier, we see that the total volume grew 23% to $915.84 billion. In the case of the top performer, the jump was as much as sixfold.

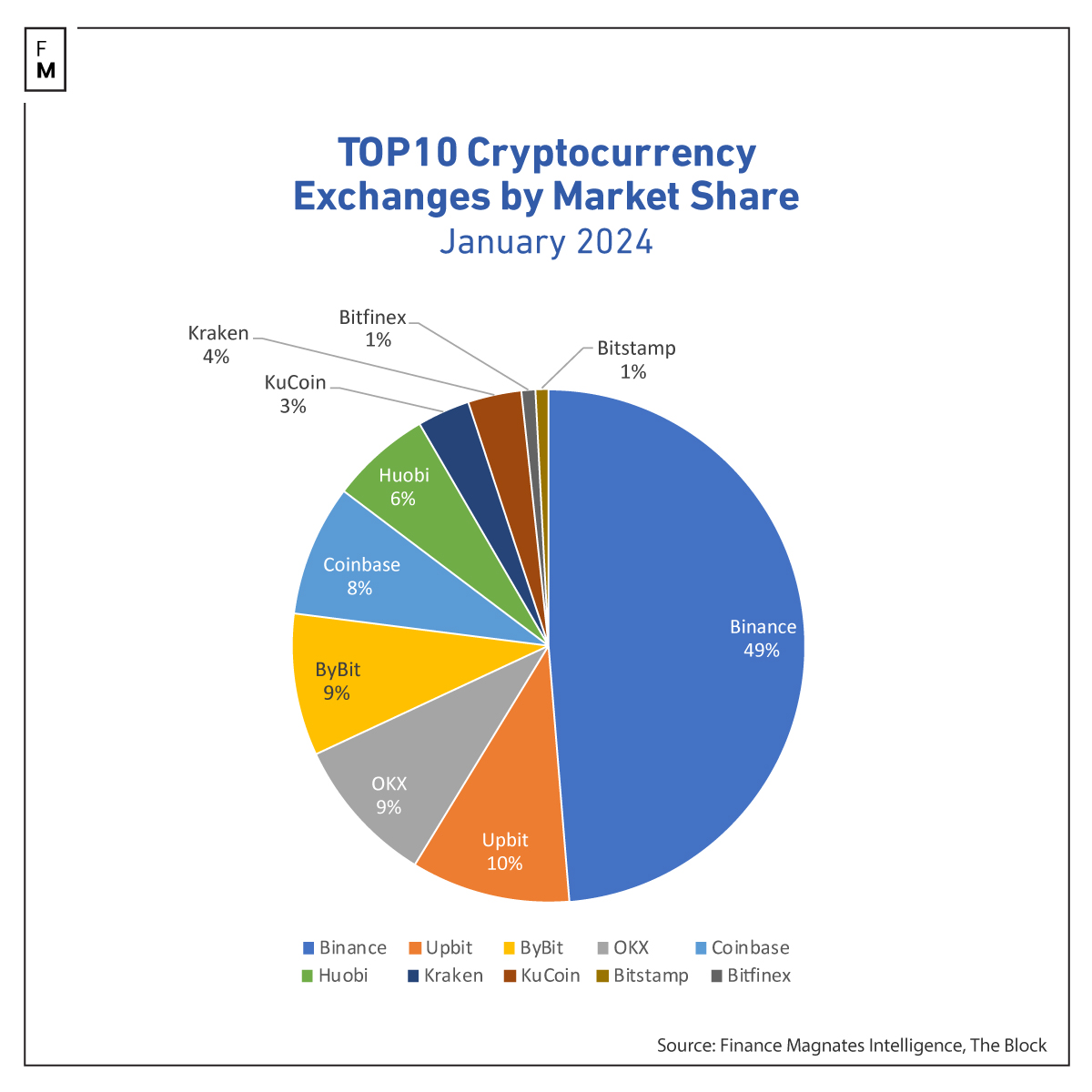

Binance Remains the Unquestioned Leader with a 49% Market Share

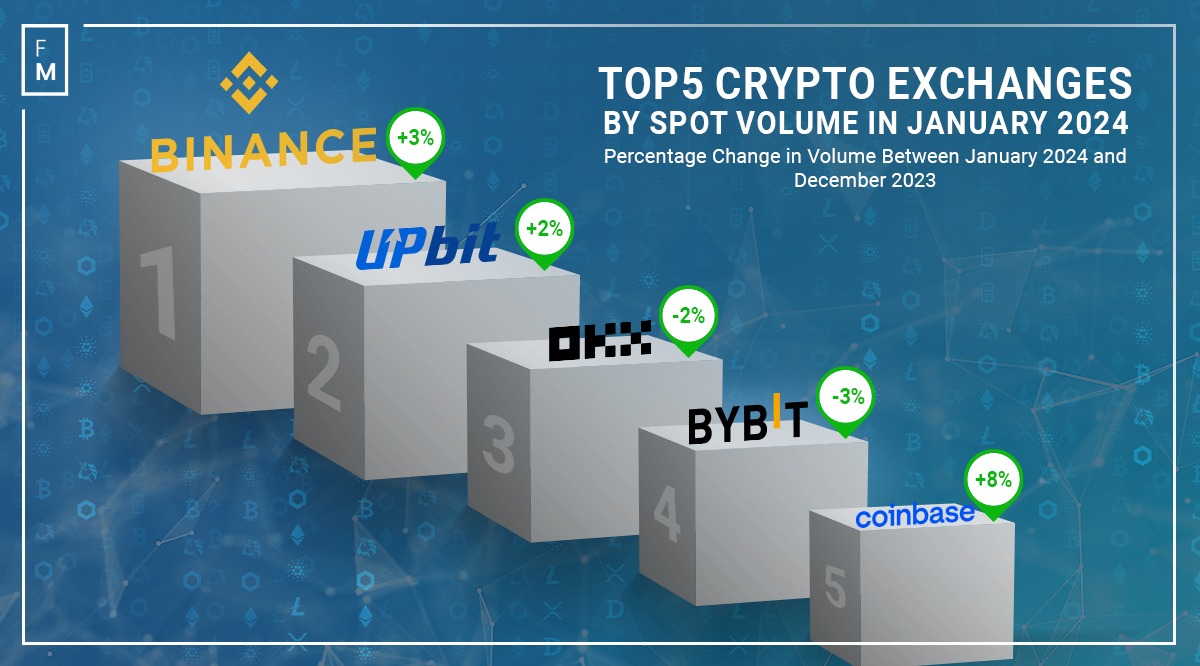

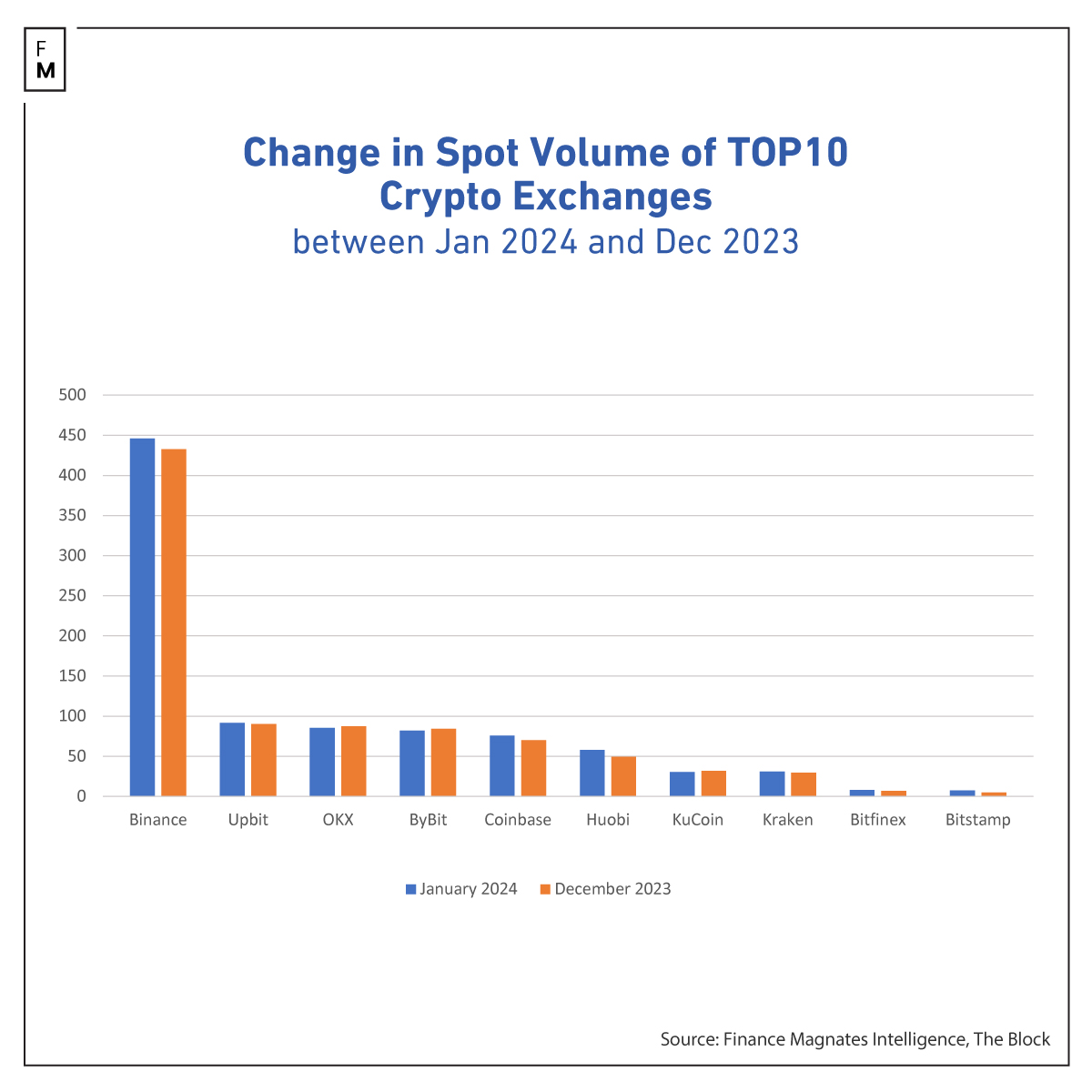

Finance Magnates Intelligence analyzes spot volumes for the top 10 cryptocurrency exchanges each month, checking how the dynamics of the digital asset market change. As in recent months, Binance unquestionably holds the leading position, with volumes amounting to $446.05 billion in January, representing an increase of 3%compared to $432.65 billion reported in December.

Upbit remained in second place as last month with $91.79 billion, and OKX completed the podium with a volume of $85.44 billion, experiencing a monthly decrease of 2%. However, it recorded a jump of 128% on an annual scale.

Bybit reclaimed the fourth spot with $82.03 billion, and Coinbase rounded out the top 5, reaching $75.85 billion. The composition of the leaderboard remains unchanged over the past few months, with no changes in the ranking compared to December. Although monthly volumes increased modestly and decreased for some exchanges, the annual average growth rate is much more satisfactory at 23%.

"Trading volumes remain at a heightened level, with spot volumes In the last couple of months growing to levels not seen since 2022, driven by the approval of spot Bitcoin ETFs in the US," CCData researches commented in the recent report.

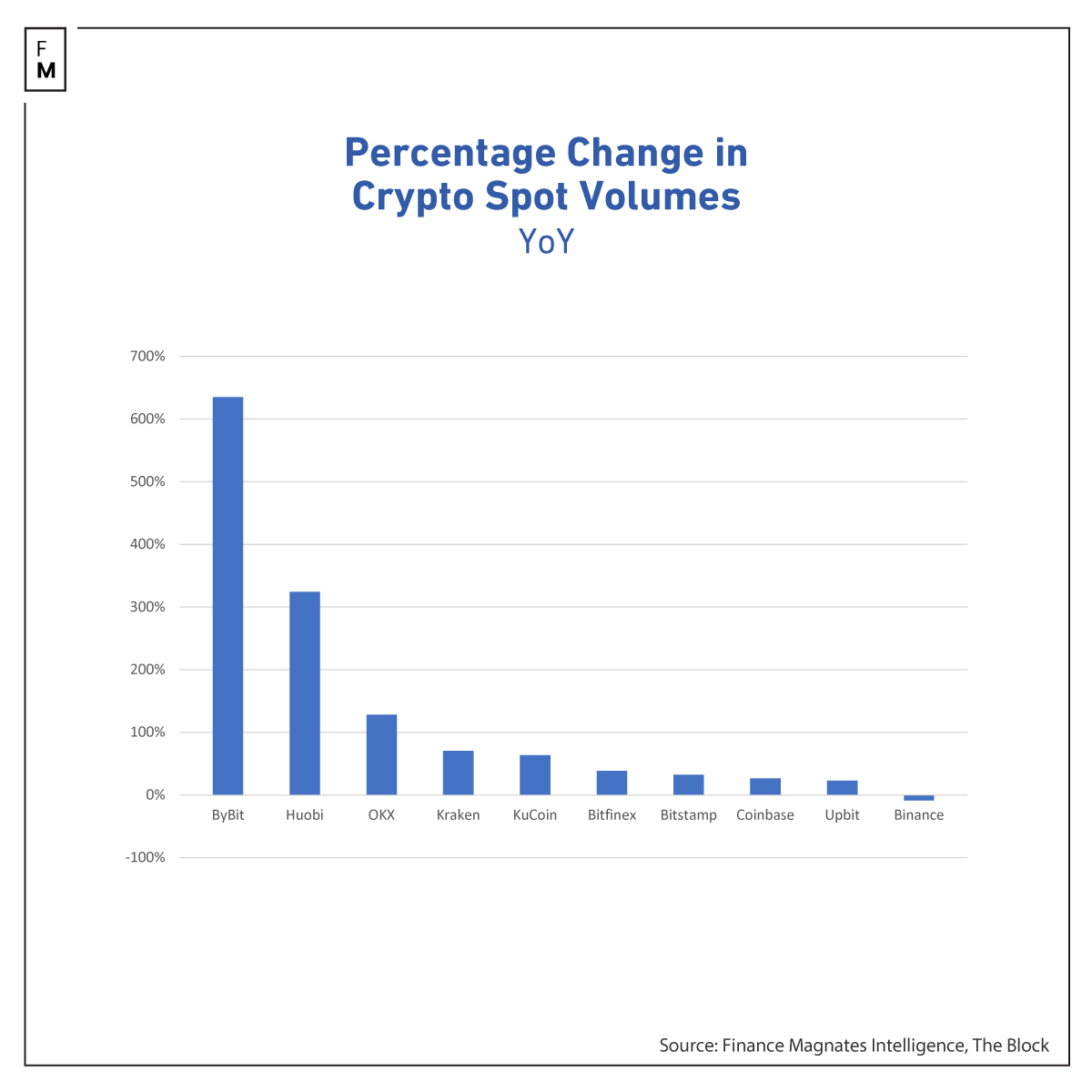

Crypto Exchanges See Significant Yearly Growth, ByBit Leads

If our ranking were based on the percentage growth of volume on an annual basis, ByBit, Huobi, and OKX would be on the podium.

ByBit increased its volumes compared to January 2023, rising by 635% from $11.45 billion. The jump coincides with exchange 's 5th anniversary and surpasses the milestone of 20 million registered users.

Huobi increased its turnover more than threefold, from $11.65 billion to nearly $60 billion last month. In the case of OKX, the increase was 128%, from $38.29 billion.

Two factors influenced the significant increase in retail investor activity as clients of these exchanges: firstly, much higher cryptocurrency prices than in January 2013, and secondly, the euphoria first sparked by the anticipation and then the approval of the first spot ETFs on Bitcoin .

This is confirmed by the on-chain BTC volumes themselves, which increased to a record $1.21 trillion, the highest level since September 2022. Due to the Bitcoin halving planned in two months, network activity may continue to remain at high levels, along with the volumes.