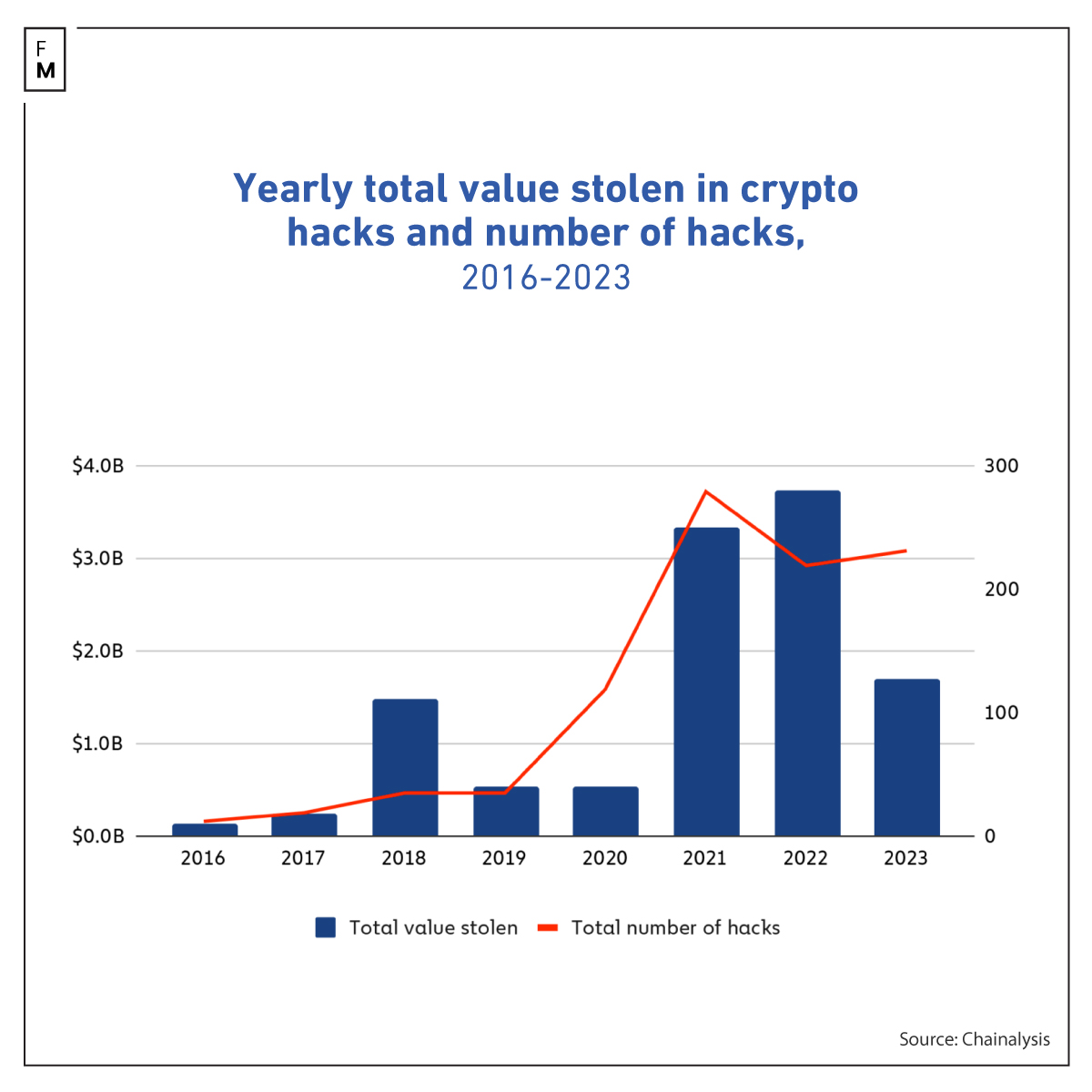

Funds stolen by hackers from cryptocurrency platforms fell by over 50% in 2023 compared to the previous year. However, the number of individual hacking incidents rose, indicating that hacking remains a significant threat for crypto investors.

Crypto Hacking Losses Fall Over 50% in 2023 but Threat Remains

In 2022, hackers stole a record $3.7 billion from crypto platforms. But, according to a new report from the blockchain analytics firm Chainalysis, in 2023, that figure dropped to around $1.7 billion, representing a decrease of 54%.

The main driver of this drop was a major decline in decentralized finance (DeFi) hacking. After exploding in 2021 and 2022, with over $3 billion stolen in each year, funds stolen from DeFi protocols fell by nearly 64% to $1.1 billion in 2023.

Despite this overall drop, Chainalysis reported that the number of individual crypto hacking incidents grew from 219 in 2022 to 231 in 2023. It is worth emphasizing that the total value of stolen assets has remained at record levels for the third year in a row. It was clearly below $1 billion in previous years, exceeding this threshold only once in 2018.

“There’s been a worrying trend in the escalation of both the frequency and severity of attacks within the ecosystem,” Mar Gimenez-Aguilar, the Lead Security Architect and Researcher at our partner Halborn, commented for Chainalysis.

The numbers from the Chainalysis report confirm the independent data of the security app De.Fi, which informed at the end of December that the total value of lost funds reached almost $2 billion.

Hacks in DeFi

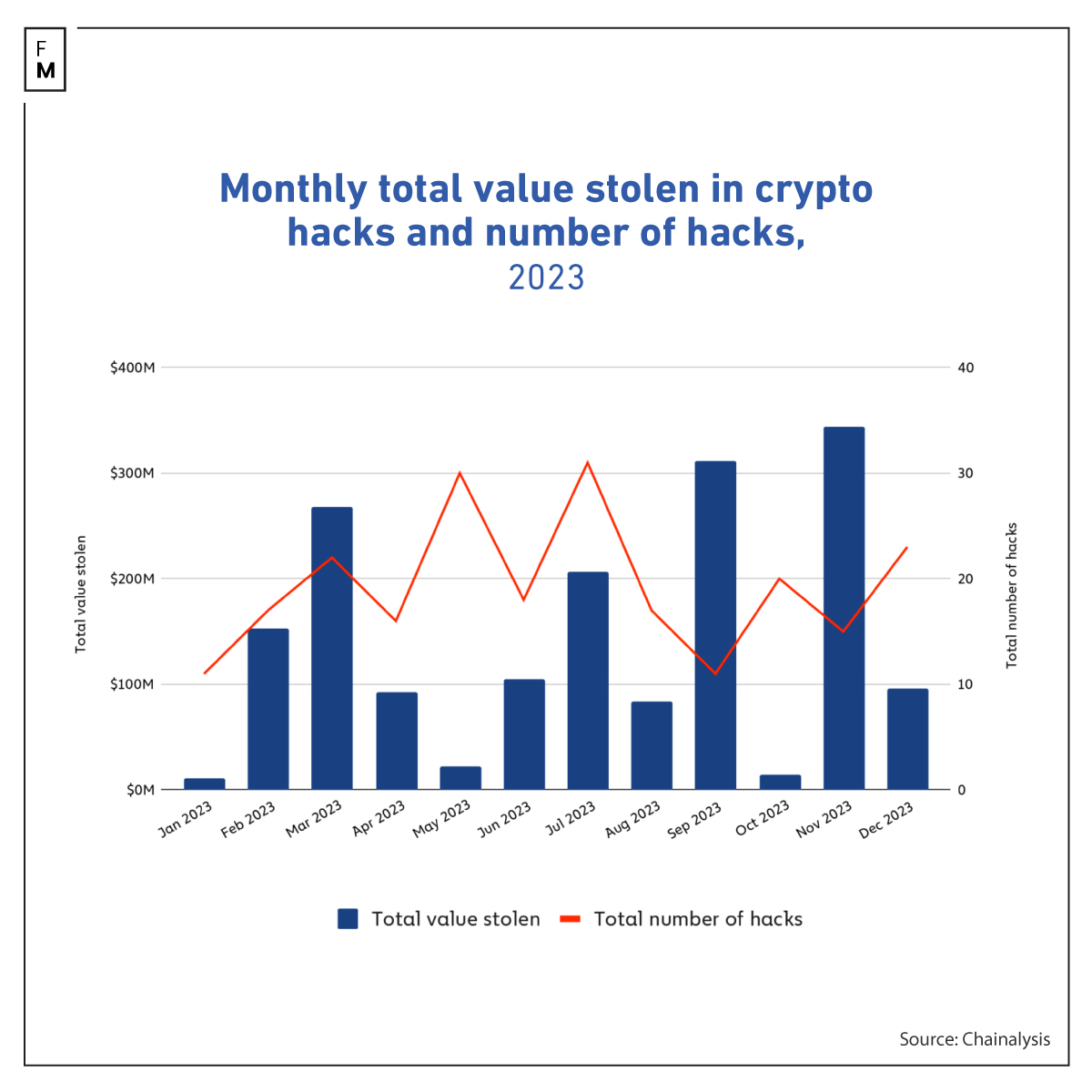

There were also several large hacks of major DeFi protocols in 2023, including $197 million stolen from Euler Finance in March and $73 million taken from Curve Finance in July during a month that saw 33 total hacks.

“Euler Finance, a borrowing and lending protocol on Ethereum, experienced a flash loan attack, leading to roughly $197 million in losses,” the report commented.

Chainalysis worked with the blockchain security firm Halborn to analyze the attack types behind DeFi hacks in 2023. They found that both on-chain vulnerabilities like code exploits and off-chain issues like compromised private keys drove losses. On-chain hacks accounted for most of the losses overall, but the share from off-chain hacks rose later in the year.

While the drop in DeFi hacking is a positive sign, Chainalysis cautioned that it may be partly tied to lower activity and fewer targets, rather than just better security. It advised DeFi platforms to continue improving security practices both on and off-chain even during slower market periods.

With hacking incidents still rising in 2023 despite fewer losses, cyber threats remain a key issue facing the crypto industry. Companies and protocols will need to stay vigilant to prevent hackers from capitalizing on any emerging opportunities.

“Although the total amount stolen from crypto platforms in 2023 was down significantly from prior years, it is clear that attackers are becoming increasingly sophisticated and diverse in their exploits,” the report concluded.

Biggest Hacks of 2023: Poloniex and Atomic Wallet

The year 2023 witnessed some of the biggest cryptocurrency exchange hacks in history. Chief among them were the attacks on Poloniex and Atomic Wallet, which together resulted in losses totaling over $220 million.

In November, hackers exploited a vulnerability in Poloniex's hot wallet infrastructure to steal approximately $120 million worth of assets. According to reports from blockchain analytics firms, the hack prompted Poloniex to take its wallet offline for urgent maintenance and security upgrades.

Before that, in June, Atomic Wallet was breached in an incident that enabled the theft of $100 million in cryptocurrencies. Atomic Wallet developers revealed that the security incident impacted less than 1% of active monthly users. However, the scale of the losses ranked it among the major exchange hacks of 2023.

Participate in Our Fraud Survey: Your Opinion Matters!

We invite you to participate in our joint survey conducted by FXStreet and Finance Magnates Group, which explores prevalent online financial fraud types, platforms used for fraudulent activities, effectiveness of countermeasures, and challenges faced by companies in tackling such fraud. Your valuable insights will help inform future strategies and resource allocation in combating financial fraud.

Social Media Scams: Help Shape the Fight with Your 2024 Survey Participation