Bitcoin (BTC) has been maintaining its multi-month highs for another consecutive month, just a step away from its historical highs. It is driving investor activity and, consequently, the trading volumes of the largest crypto exchanges. In May, the spot volume for the top ten platforms exceeded $1 trillion, growing by 173% compared to the same month a year earlier.

Cryptocurrency Exchange Volumes up YoY, but Falling in 2024

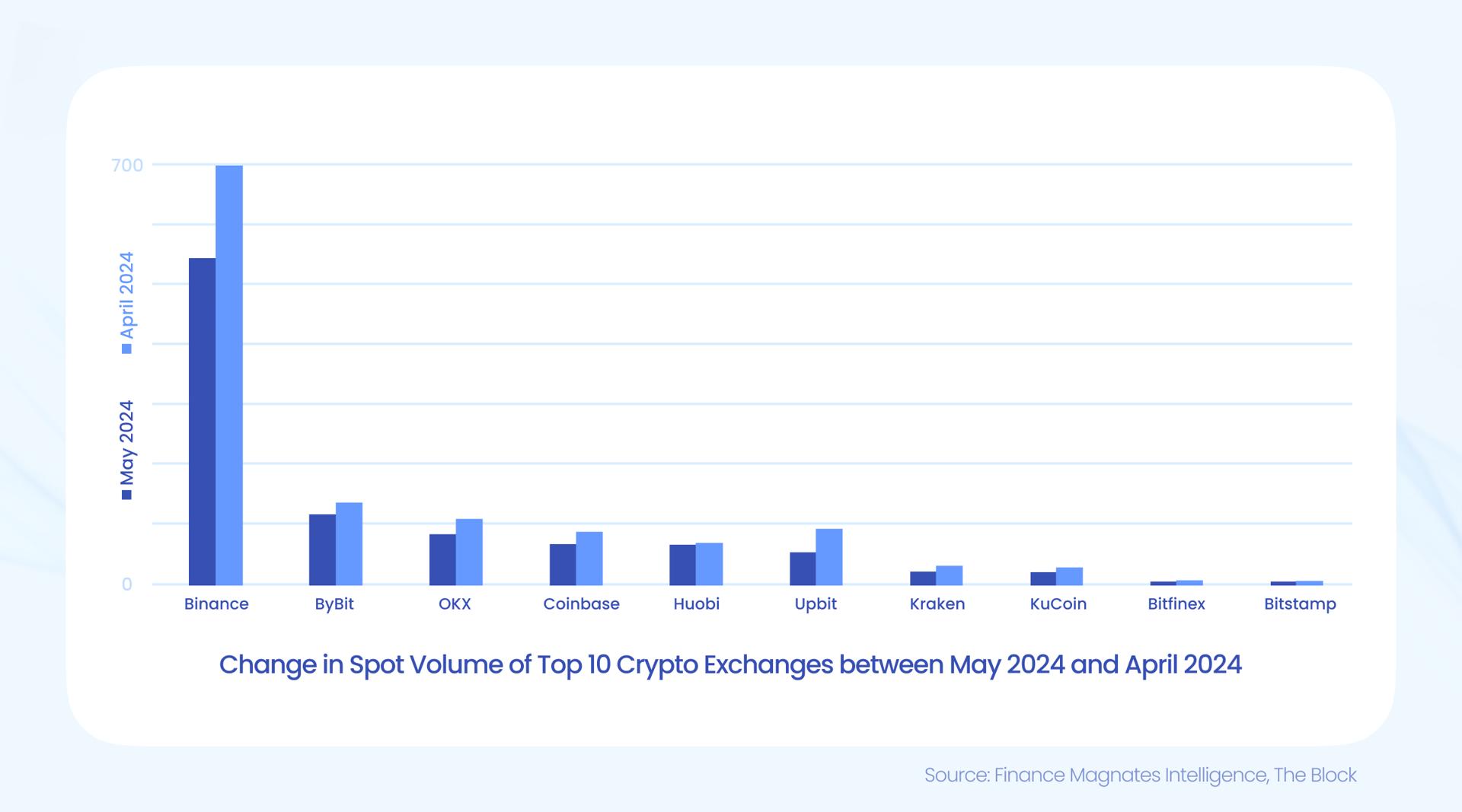

Looking at the statistics of the largest cryptocurrency exchanges in terms of volume, we notice that May brought the second month of declines after a record-breaking March. April saw a 60% plunge post-halving, and the month-over-month depreciation averaged 22% in May.

All exchanges included in the Finance Magnates analysis recorded visible declines between April and May. The leading platform, Binance, gave up 22%, and its volume shrank to just under $550 billion.

“The decline in trading activity follows previous historical patterns, where trading volumes on centralised exchanges decreased in the months following the Bitcoin halving event,” CCData commented in its newest report. “However, the added volatility stemming from the unexpected approval of an Ethereum ETF has boosted trading activity in the last few days of the month.”

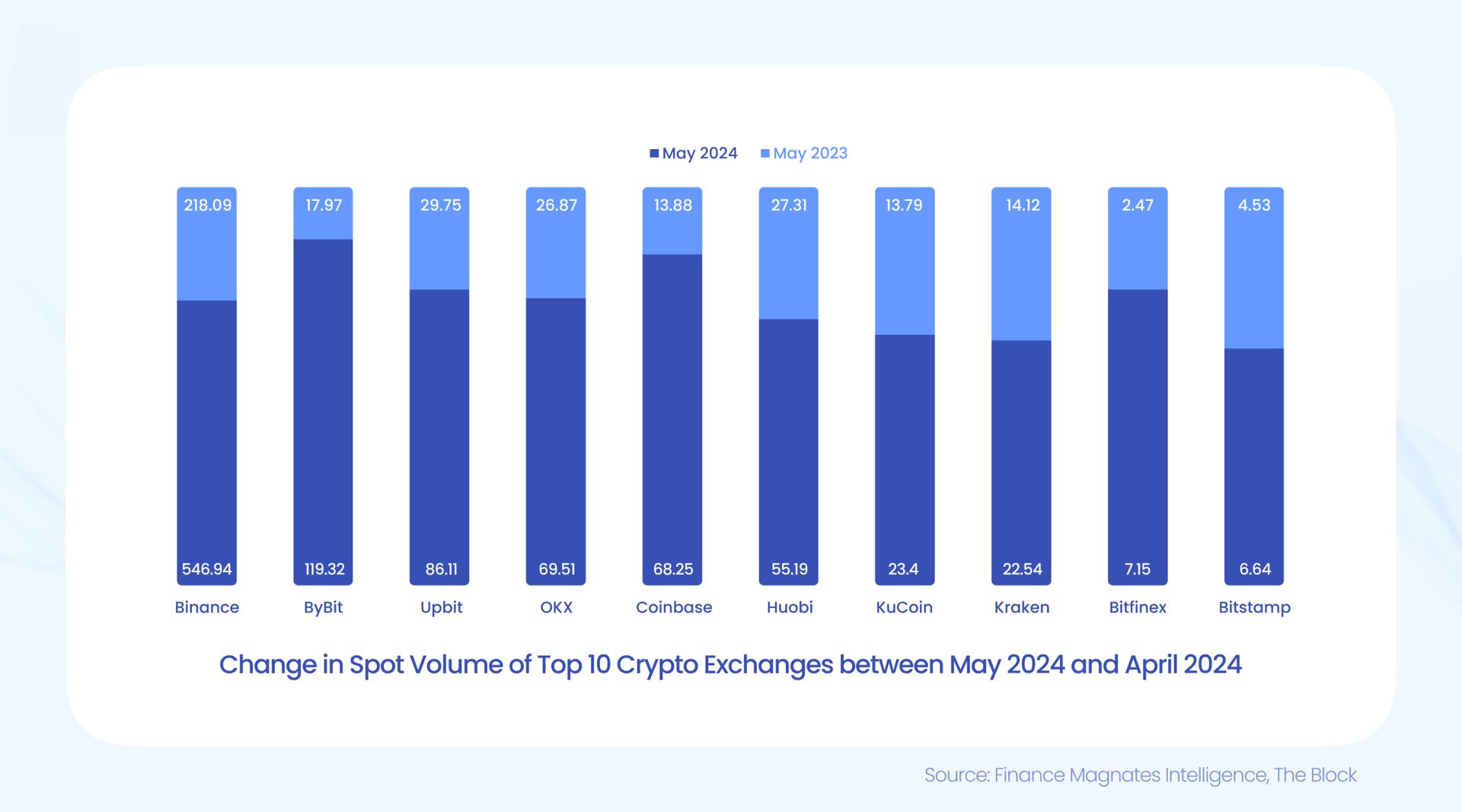

However, it should be emphasized that compared to the previous year, these results are still multiple times better. In May 2023, the total volume for the top ten exchanges was $367 billion, which is less than the current monthly volume of Binance alone. In the meantime, the biggest crypto exchange exceeded the 200 million registered users mark.

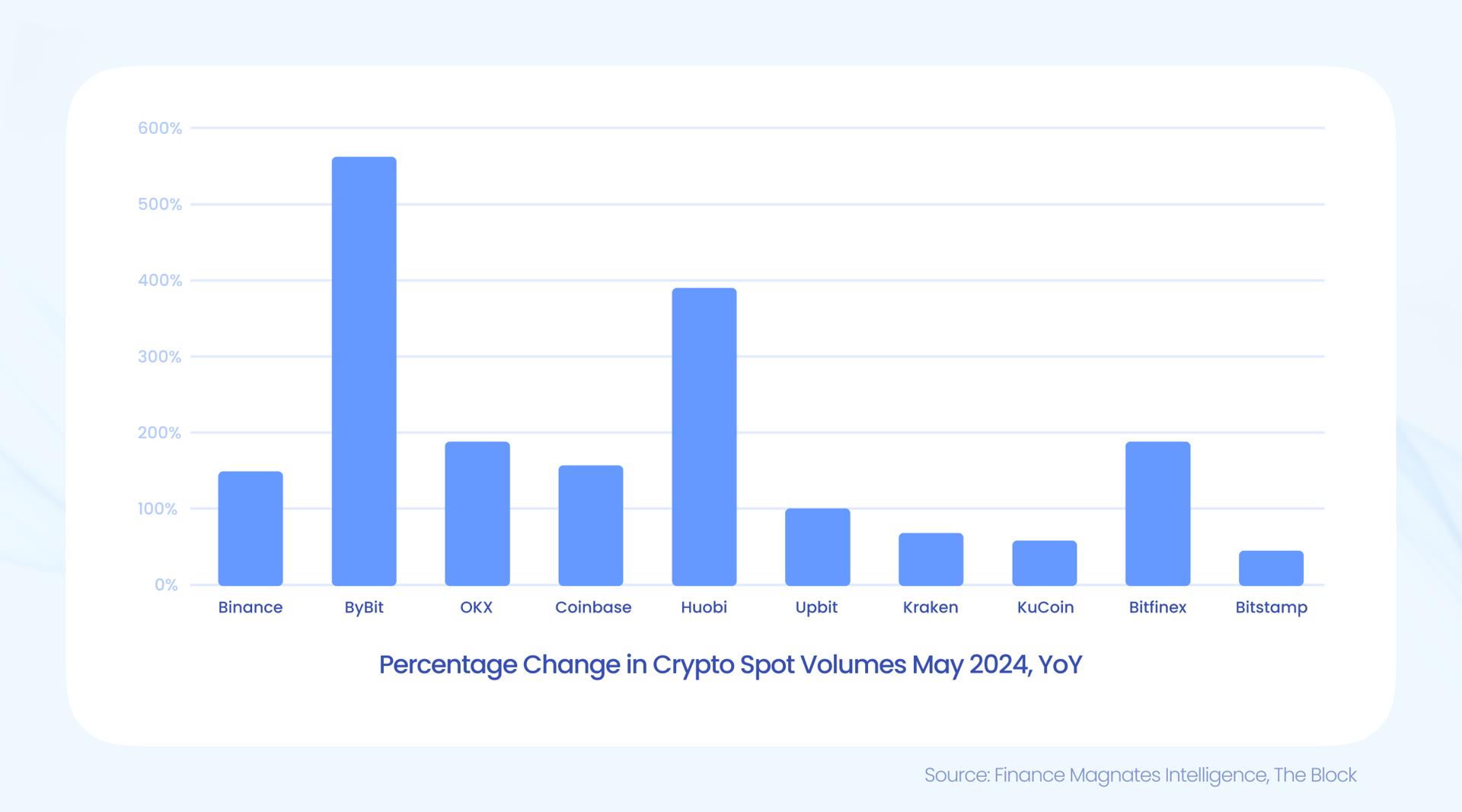

The turnover of Binance, compared to May 2023, grew by 151%. In the case of the record holder, which turned out to be Bybit, the jump was over 560%, from a level of less than $18 billion to $119 billion last month.

Huobi also recorded a significant year-over-year (YoY) volume increase, with this value jumping by nearly 400% from less than $14 billion. Only three out of ten exchanges reported YoY growth of less than 100%.

No Change on the Podium, but with Reshuffles in the Top Positions

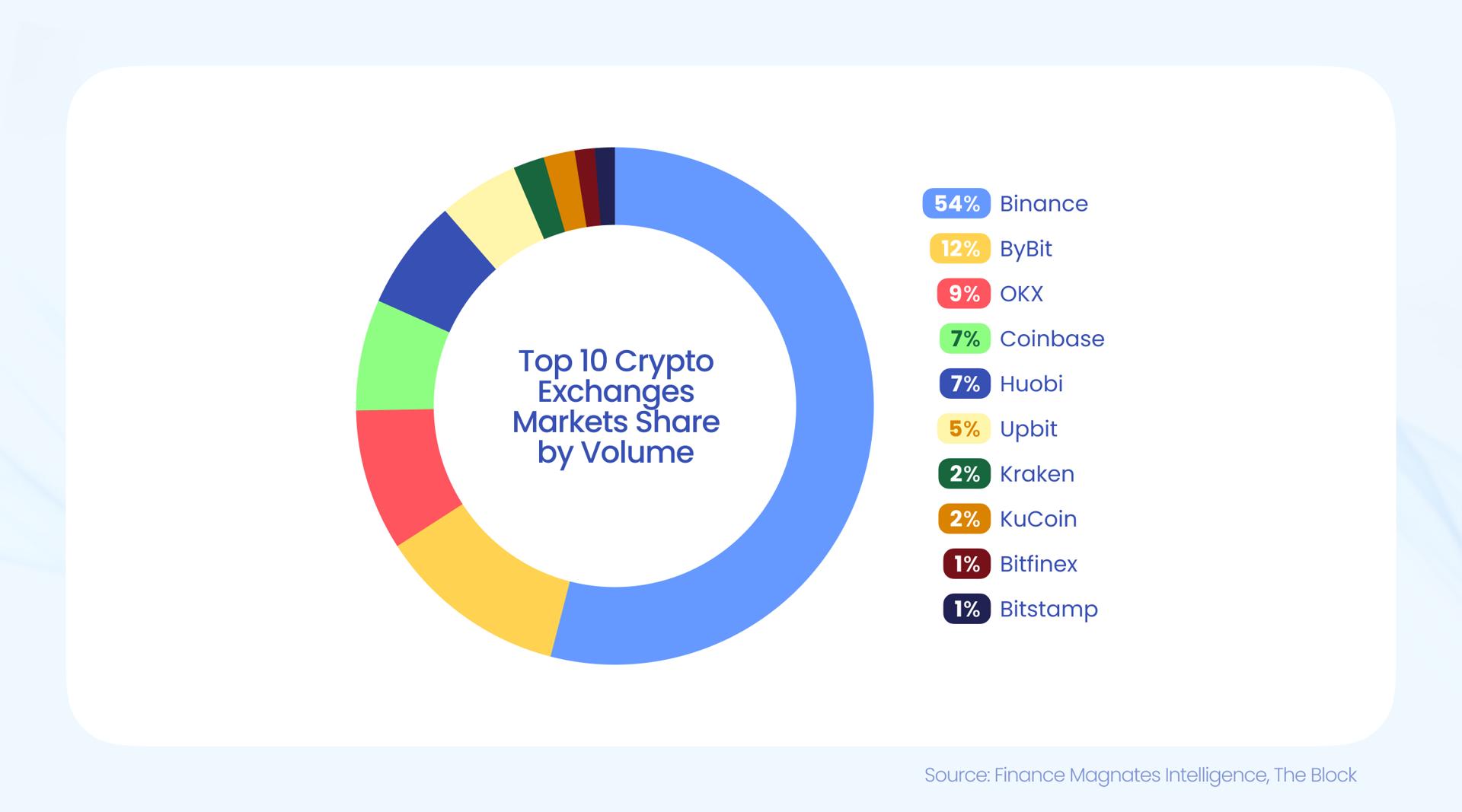

The first three places in terms of volume still belong to Binance, Bybit, and OKX, and they also have the largest percentage share of the market, which totals 75%.

However, there have been changes in the fourth and fifth positions. Due to strong monthly volume declines of over 40%, the Upbit exchange dropped out of the top, while Coinbase jumped to fourth place (volume of $89 billion), and Huobi ranked fifth ($71 billion).