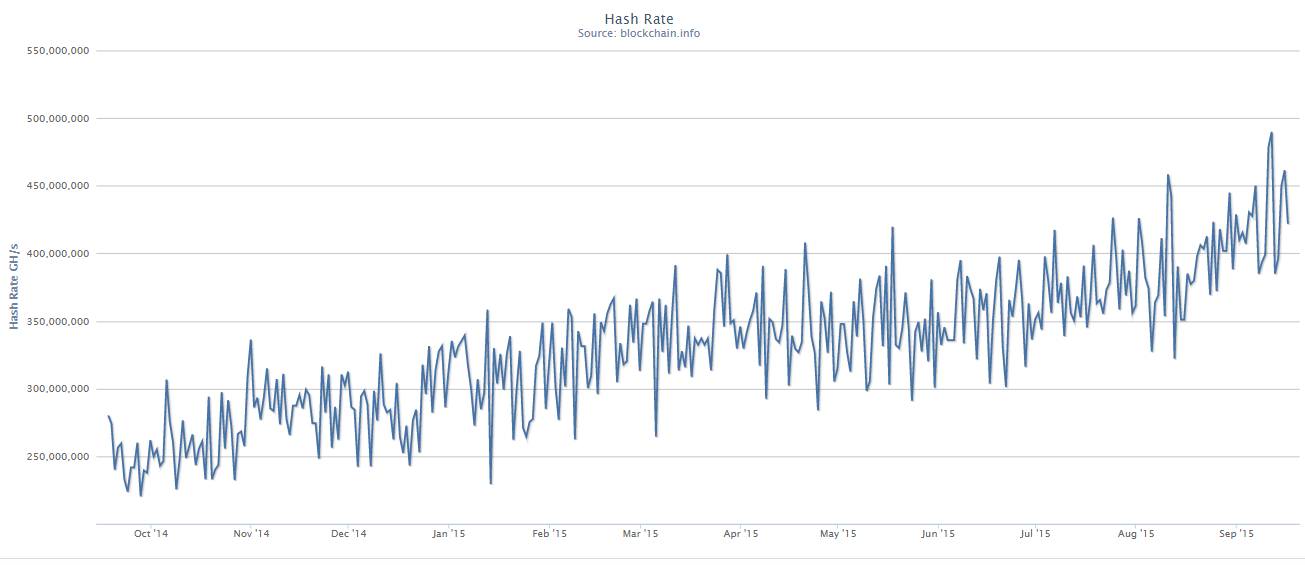

The Bitcoin network Hash Rate has taken a noticeable turn higher this month as a slew of new cutting edge hardware comes online.

After exponential increases in prior years, the recent phenomena of network saturation and bitcoin price declines rendered mining profitable only for those with the most advanced and efficient hardware configurations. The hash rate stagnated near 350 PH/s (1 PH = 1015 hashes, or encryption computations) for much of Q2 this year.

It began to trend higher above 400 PH/s in July, when higher bitcoin prices made it far easier for miners to turn a profit. Prices fell hard in August, though the hash rate held its ground.

Hash rate- Sept 16. Source: Blockchain.info

[gap]

This month, prices have stabilized near $230- the average seen during Q2. But in the world of bitcoin mining, a few months is enough time for the development of next-generation hardware- orders of magnitude more efficient, capable of restoring profitability and rendering old equipment obsolete.

The hash rate recently re-challenged the 450 PH/s mark, briefly spiking as high as 489 PH/s. Correspondingly, the difficulty level has climbed to 57x109, and is projected to break 60x109 upon the next increase (the difficulty is automatically adjusted roughly every two weeks to ensure blocks are mined roughly once every ten minutes). This would be the sixth straight increase, a streak not seen in nearly one year.

2014 witnessed a far lengthier stretch of difficulty increases as the network continued to saturate, and only saw a one-off decrease in December as the equilibrium of slight profitability was tested.

Moore's Law for Mining

Two weeks ago, hardware heavyweight BitFury announced its launch of a 16 nm ASIC (Application Specific Integrated Circuit). It claimed the chip can consume as little as 0.06 J/GH, which would make it by far the most efficient in the industry.

The company commented that the launch would herald the "exahash" era, whereby the total bitcoin network mining hash rate reaches 1 Exahash (EH) per second. A hash rate of 1 EH would represent roughly a 120% increase to the current rate of approximately 455 PH/s (1 EH = 1,000 PH).

Previous predictions anticipated a 1 EH/s rate by July 1 this year, and 2 EH/s by the beginning of 2016. This assumed a bitcoin price of $400, nearly double that of today. More recent predictions foresee the rate reaching between 700 PH/s and 1 EH/s by year’s end, assuming a bitcoin price of $250.

So long as the bitcoin price remains stable, or at worst, declines at a slow rate, Moore's Law-inspired advances in hardware will ensure that the hash rate continues to grow, thereby ensuring stability of the Bitcoin network.

The next big test will come along when the mining reward halves in about one year from now. A significant proportion of underperforming equipment may be forced offline, and it may take at least several months of further advances for the hash rate to recover to its pre-halving levels.

Correction: An earlier version of this article stated that a rise to 1 EH/s represents a 220% increase from current levels. The magnitude of increase is in fact only 120%.