This guest article was written by Ofir Beigel, the founder of 99Bitcoins.

I've been looking for ways to generate a profit from Bitcoin ever since it hit the news back in April 2013. With so many options you sometimes find yourself lost. Should you buy and hold, day trade, mine at home, start a bitcoin exchange, I can practically go on forever about ideas for making money from Bitcoin.

But one idea seems to catch the eye of most of my blog readers more than any other - cloud mining. For those of you who are unfamiliar with cloud mining, it’s basically “renting out” computing power from a company with a mining farm so you can participate in the latest gold rush of Bitcoin mining.

Ever since Bitcoin became popular back in 2013, the difficulty to mine increased drastically. This meant you needed to buy expensive hardware, find a place to store it and of course cool it (since Bitcoin miners tend to heat up quickly), only to exchange it with an even more expensive piece of hardware after 6 months, since the difficulty went up yet again.

The Promise of Cloud Mining

Enter cloud mining. A magical solution to solve your Bitcoin mining problems. No need to buy expensive hardware, find storage space, pay electricity bills or take care of cooling. All you need to do is “chip in” with a larger company on their mining expenses and in return you will get a portion of the earnings.

When you deal with cloud mining you rent out GH/s or TH/s, which measure how much computing power you will be able to mine with. But is this really worth the money you spend on it ?

I have to admit I was never a big fan on mining myself, it always seemed too technical and I preferred to just go ahead and buy my Bitcoins. But since I got so many emails lately asking me to look into cloud mining I decided to put it to the test.

In order to see if a mining contract is worth your money, you basically need to calculate how much money you will make from the money you invest. Just like any other investment, you want to check your ROI. To accomplish this I’m going to use a mining calculator, which is a small piece of software that does all of these calculations for me.

So armed with my mining calculator off I go to test the profitability of cloud mining:

Our first stop is probably the most reputable cloud mining company today, “Genesis Mining”. Founded at the end of 2013, Genesis Mining is a company of 10 employees registered in Bermuda.

The company used to offer Bitcoin mining contracts and Altcoin mining contracts but it seems that today they only offer the former. I’m not sure why this is, but one assumption could be that it’s related to the decline of most altcoins in the past year. Prices start from $22.49 per 0.05 TH/s and all the way up to $19,500 for 50 TH/s.

The interesting part about this pricing model is that unlike other cloud mining companies, there's only a one-time fee and not a monthly fee. Having said that, if you take a closer look at their pricing page, you’ll see that it states, “For lifetime contracts as long as the contract is profitable, a small maintenance fee is deducted”.

It took me a while to find out what the fees are, but it appears that Genesis Mining deducts 0.0015 USD per 1 GH/s on a daily basis for mining Bitcoins. We will keep that in mind in our calculations.

Now let’s see how profitable we can become using Genesis Mining. We’ll start out using the lowest price possible and just get 0.05TH/s. At the current difficulty and exchange rate we would be making about $3.59/month, or $0.1196 a day. Let’s not forget to deduct the fees that would be $0.0015 * 50GH/s = $0.075 daily (this is 62.6% of the total profit!). So this brings us to exactly $0.046 daily, or $1.338 monthly.

This means we will break even after 16 months. Not sure I’m willing to wait that long to get my 20 bucks back. If I take a look at purchasing 1 TH/s for $419, I get a monthly profit of $26.44 which basically gives me the same outcome since the fees are calculated linearly.

Moreover, there is one thing that is missing from this equation. Well...actually two things. We have no idea what the Bitcoin exchange rate will be in five months or a year from now, nor what the mining difficulty will be. This is what makes cloud mining a bit risky.

I mean if Bitcoin booms again, we can cover our whole investment in just one month, but if it goes the other way around….you get the point. Same thing goes for the mining difficulty.

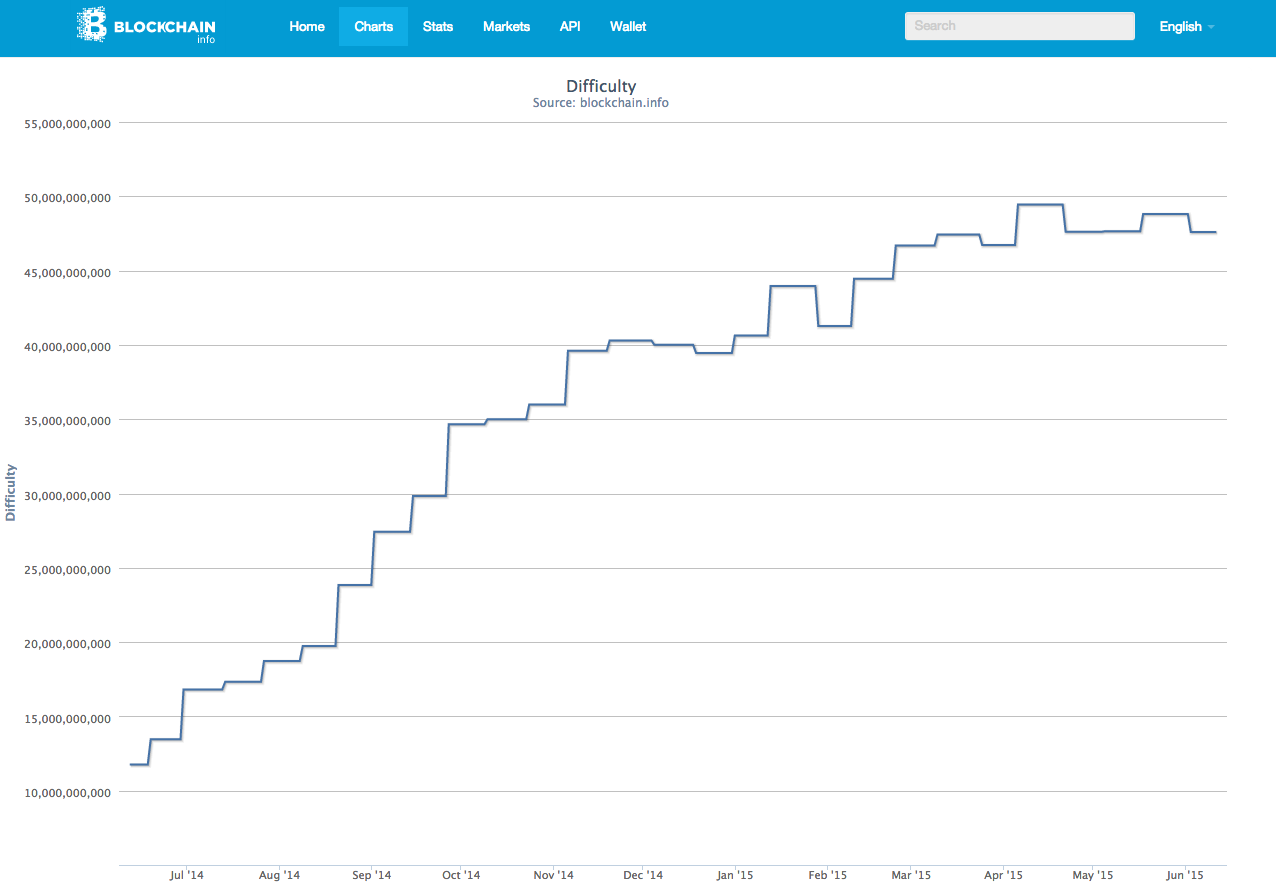

Source: Blockchain.info

It seems that the difficulty is evening out lately, but it’s mainly due to the fact that so is Bitcoin’s exchange rate. These two parameters tend to be in a positive correlation to one another. Meaning if one goes up so does the other. But they have a negative effect - a higher exchange rate makes you richer, while a higher difficulty rate makes you poorer.

But Is It Legit?

But here comes the really interesting part:

Some people consider cloud-mining companies to just be elaborate Ponzi schemes. Meaning there are no huge mining farms located in some remote location and no major mining operations. Some people believe this is just a way of luring in customers and using their money to pay out the customers who came before them.

In my recent research on BitcoinTalk and Reddit I found some interesting perspectives on this. I won't name specific companies but I will review several of the claims made:

- Companies bait you in as a customer using attractive prices when they start out and then change their pricing or fees after they've hooked you in.

“They are still trying to attract new customers to buy at roughly the same price we paid initially... at the rate it is going we are on track to reach negative returns. At which point our contracts would be cancelled after 10 days of negative returns. Meanwhile we are locked into these contracts with no option to sell. Please stay clear of this service!” ~ BitcoinTalk user

- Other than the initial payment for the mining power there are hidden fees which consume most of your profit.

“Last November I invested just over 1 btc... since then I earn daily 1/3 of what I should be making, from my investment, the other 2/3 are fees.. I guess?

And for as for roi, its going be a very, very long time seeing I am earning less then 5 cent a day @ 60 gh/s.” ~ BitcoinTalk user

- Almost a year ago a question was submitted on Reddit asking, “Do mining contracts ever make sense ?” This question was answered by Gavin Andresen, the chief scientist of the Bitcoin foundation, who stated:

“No, they make no sense. I suspect many of them will turn out to be Ponzi schemes.” ~ Gavin Andresen, Chief Scientist of the Bitcoin Foundation

I have yet to find any positive comment, post or thread about cloud mining that seems unbiased. A lot of these cloud mining programs supply referral programs which give people an incentive to sign other people up (another characteristic of many Ponzi schemes).

In conclusion, I guess cloud mining still hasn't proved itself to be a legit and profitable answer to generating a profit through Bitcoin. In my opinion, most of these companies are just Ponzi schemes in disguise and the few who may be legit will take you a long time to profit from. However, in the event of another boom in Bitcoin’s price I may just as well be eating my hat. In the meantime, I’d bet on buying the currency and not mining it.