Stellar: History and About

The Stellar Payment network was created in 2014, by Ripple co-founder Jed McCaleb together with former lawyer Joyce Kim. When the company made its start in 2014, it was given a $3 million loan by tech giant Stripe.

The goal of the company is to ensure anyone and everyone can have cheap access to advanced monetary services. They seek to help battle the current financial conditions of the market and give individuals time to secure their future without having to be burdened with economic constraints.

The company has numerous developers and partners on board, as it is supported by the Stellar Foundation. Those that work on the team include Bartek Nowotarski, whose CV boasts prior work for Yahoo and Facebook. Other notable figures include Lisa Nestor, Keith Rabois, and Nicolas Barry.

How Does it Work?

Like the majority of all other cryptos, Stellar Lumens unique trait can be found in the fact that it is a decentralized platform, an aspect which is the cornerstone of all blockchain tech. The Stellar network functions on a web of decentralized servers which are supported by a global consortium of individuals and entities. These servers support the distributed ledger which keeps track of the network’s data and transactions.

If all goes according to plan, the Stellar protocol will work like PayPal, but with more inclusion and flexibility. To begin using Stellar, you would need to put the funds to an anchor on the network. Like a bank or PayPal, this anchor will then hold your money and give credit to your virtual wallet. Funds can be sent instantly without having to wait a period like you would with PayPal.

Stellar wants to stand out on the basis of innovation. While it has many similarities to Ripple, it is looking to improve its Blockchain network in numerous ways to ensure that transactions can be completed quickly and at the lowest cost possible. Stellar's is targeting giving access to money, to individuals who may not have access to it otherwise, a trait which makes it unique from a charitable perspective.

One transaction processed on the Stellar network costs 0.00001 XLM, an extremely low cost compared to other networks. One could process 100,000 transactions for the cost of 1 XLM, which is far lower than banks transfers, or even PayPal when sending money abroad.

Stellar as an Investment

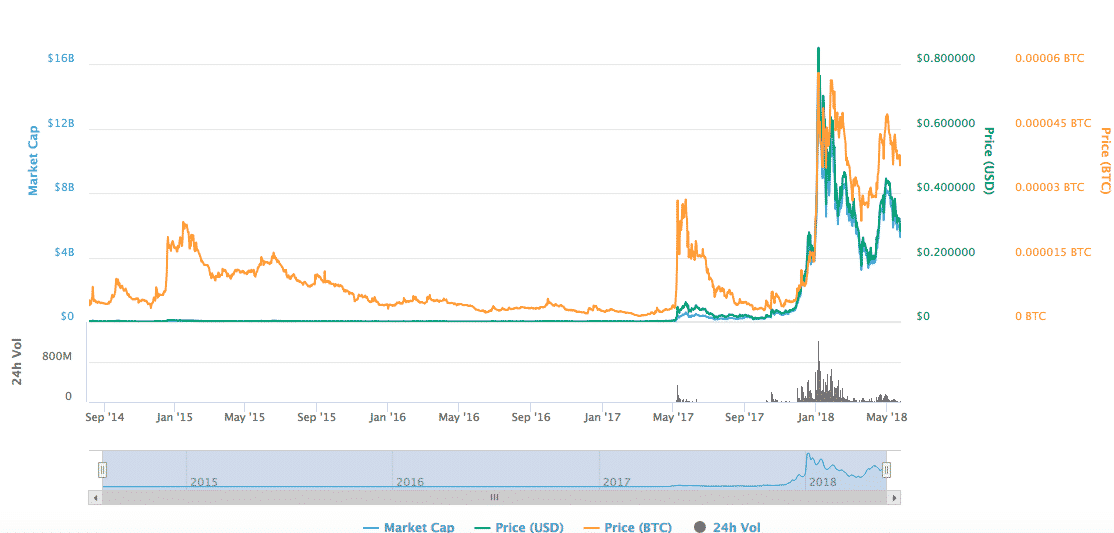

coinmarketcap

Stellar has had a steady and relatively low growth for a sustained period of time before January 2018, when it exploded in a similar fashion to numerous other Cryptocurrencies , reaching a peak market cap of over $12 Billion. Since then the value of the token has subsided somewhat, but it is still in a much stronger financial position than it was this time last year.

Stelar can be purchased on the Binance, Bittrex, and Poloniex exchanges, with more likely to come in the near future.

When it comes to storing Stellar Lumens (XLM) tokens, there are a number of options to consider. Using a hardware wallet can be particularly useful, as it allows you to store offline and keep your tokens in a more secure state than online wallets. This means that your tokens are kept offline and are seen to be the safer option in this respect. Stellar Lumens provide a list of 11 wallets they recommend, which includes Lobstr, a wallet specifically created for XLM tokens.

Stellar's partnerships and relationships that it has cultivated are the main selling points for its potential investors. With IBM, Deloitte and Stripe working closely with them, it would seem the coin does indeed have a bright future. Its commitment for developers also cannot be understated.

One does need to consider the fact that like all cryptos, the key to their success would be the mass adoption of the product. Ultimately, it is still unclear if this adoption will be successful and getting large groups of people to invest in the coin may be problematic and tricky.

The unique aspect of Stellar is, of course, its status as a nonprofit organization, which at the very least can be commended from an ethical standpoint. From an investment standpoint, this can also be helpful as it does help the company stand out.

Scandals and Controversy

Stellar has been fortunate in the fact that it has managed to avoid controversy on the whole. That being said, in mid-January 2018, $400,000 worth of XLM tokens was stolen from wallets that were hosted by Blackwallet.co.

On the whole, there has been little else to report on this front beyond that.