The latest Global Investor Survey released today by Monex Group (TSE: 8698) reveals a number of interesting differences in the perceptions of investors regarding financial markets around the world.

The London Summit 2017 is coming, get involved!

Monex, Inc., TradeStation Securities, Inc. and MONEX Boom Securities (H.K.) Limited, surveyed retail investors with accounts at the companies from Japan, the U.S. and China respectively. The survey was conducted from May 29 to June 5, 2017.

In all three regions, the combined forecast for Equities was positive, indicating that views on world stock markets are optimistic. Despite this, expectations for U.S. stocks specifically fell sharply from the previous survey (conducted in March 2017) among retail investors globally. Technology was ranked top of the list of the most attractive sectors in which to invest in all three regions .

Focusing on the currency market, the percentage of retail investors expecting a stronger dollar fell in each region. However, in both the U.S. and China, the currency that retail investors consider most likely to increase in value in the coming three months was the U.S dollar. The percentage of retail investors in Japan that forecast a weaker yen against the dollar in the coming three months dropped sharply from 53% in the previous survey to 37%.

Monex Group also asked its clients around the world about the impact on their investments of what they called President Donald Trump's “Russia-gate”, referring to allegations of an improper relationship between the Trump administration and Russia. It found that the percentage of retail investors who changed their investment policy due to this was low in all three regions. Especially in the U.S., Russia-gate has had virtually no impact on investment behavior, with only around 6% of people answering that they had changed their investment policies.

Bitcoin Investors Are Still a Tiny Minority

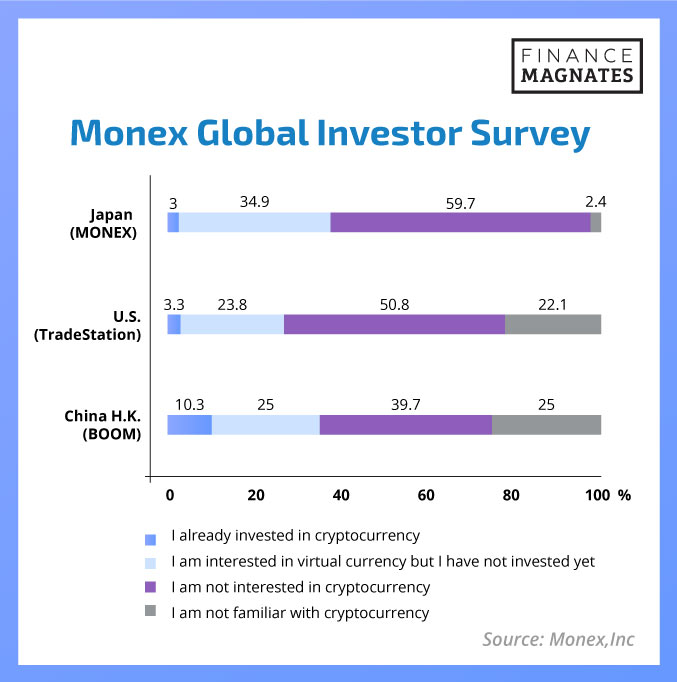

The surveyors also asked retail investors about “virtual currency such as bitcoin”, during this period of heightened media attention due to the recent price rally. The results showed that the percentage of retail investors actually investing is still low, only 3% of retail investors in Japan and the U.S., and only 10% of retail investors in China, answering that they had already invested in cryptocurrency.

Additionally found is that around 20% of retail investors in the U.S. and China answered that they were not familiar with cryptocurrency at all. By this they were setting themselves apart from retail investors in Japan, who are mostly familiar with cryptocurrency even if they have not made any investments yet.