Today's world of bitcoin mining is a very different one than the era of free money that prevailed two years ago, when graphics cards were commonplace and ASICs (application-specific integrated circuits) were barely on the radar.

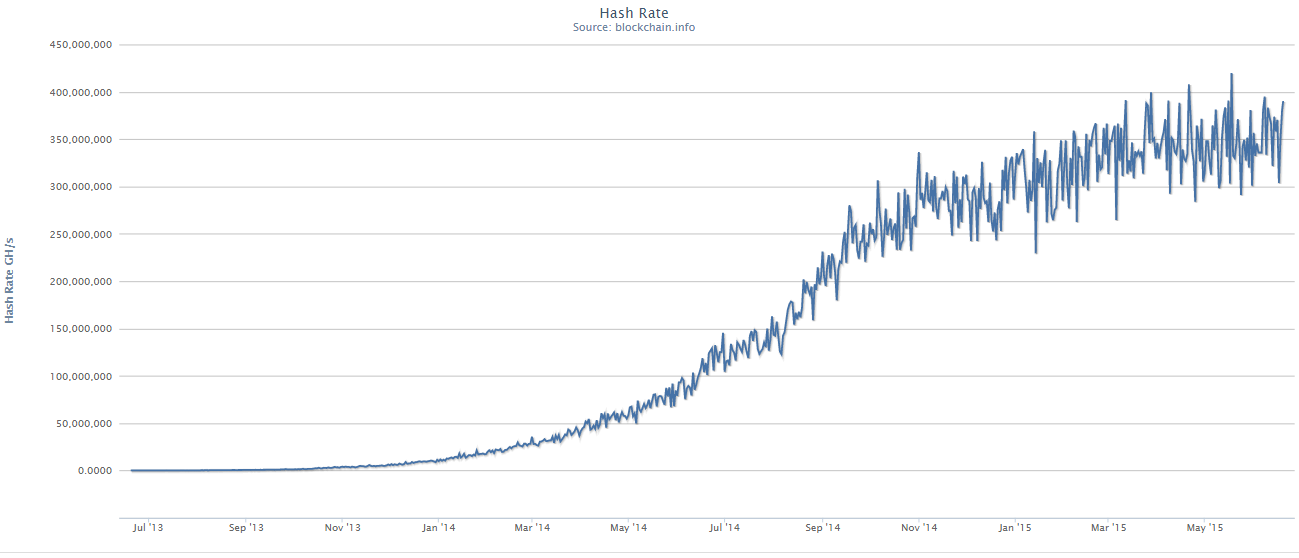

The Bitcoin mining Hash Rate had been growing exponentially, still making up ground with the bitcoin price, which made mining a highly profitable and lucrative enterprise. By March 2014, for example, the hash rate had increased 30-fold during the preceding six-month period.

The hash rate continued to climb throughout 2014, but at a noticeably slower pace than previously. The six-month period ending March of this year saw it fail to even double, and in the three months since, it has been mostly stagnant.

In essence, we are holding in an equilibrium regime whereby mining, due to lower bitcoin prices and a mature network capacity, requires the most efficient equipment just to be profitable. Gone are the days of mining from home.

Source: Blockchain.info

The begging question is if the continued advances in ASIC technology will herald a return of increased hash rate- and without the help of another rally in prices. Or will we see a continuation of stagnated growth, or even a severe decline if another price crash unfolds?

Also, if advances in energy efficiency are enough to make mining profitable again, why aren't we seeing a linear increase in hash rate over time? Put differently, is the current regime of stagnation one where older equipment is gradually replaced with cutting edge ASICs, or are even the most profitable miners taking caution with bringing more hardware online?

Speaking to Finance Magnates, Bitcoin Shop CEO Charles Allen believes that we're seeing a combination of the two. Bitcoin Shop now focuses almost entirely on mining operations, partnering with leading hardware manufacturer Spondoolies-Tech. Said Allen:

"I think we’ll see a combination of two things (1) the gradual replacement of older equipment, and (2) the further expansion of equipment with new ASICs."

He went on illustrate how the network's major players are just starting to implement the latest ASICs:

For instance if you go to Blocktrail's "Pool Distribution", you can see that Bitfury has grown from 8% to 14.6% (rumored spec is around 0.35 J/GH at the wall, air cooling). We expect KNC and Bitmain (Antpool) to start deploying soon as well. Currently KNC has declined from 5% to 2.5% and Bitmain has declined from 19% to 14.5%, indicating that they have yet to deploy their next generation equipment. Also 21 Inc has increased over the last 6 months and is well funded."

Currently, the total hash rate is hovering around 360 PH/s (10^15 hashes, or encryption operations, per second). Allen sees this increasing substantially through the year, mirroring predictions by his new partner, Guy Corem, at last year's Inside Bitcoin's Tel Aviv:

"We believe the hash-rate will be between 700 PH/s and 1 EH/s (= 1,000 EH/s) by the end of the year, assuming $250 per BTC."

Separately, he disagreed with the notion of unlimited quantities of profitable hardware available to come online. Setting up an operation is a major project, and companies need to assess if adding hashing power is worthwhile. He explained:

"The industry landscape has drastically changed and now all the major players (Bitfury, Bitmain, KNC, and ST/BTCS) are focused on design, manufacture and deployment of miners versus selling to the general public. While some or all of the major players may sell to select clients, we expect that most will manufacture enough to fill current and planned facilities and only manufacture additional equipment for sale if it substantially lowers the manufacturing cost through scale, and is sold at a high enough margin to more than offset decreased profits associated with the cannibalization of current operations due to the increase in hash rate."