Bybit, in collaboration with Blocks Scholes, released its latest weekly derivatives analytics report, revealing that Ethereum (ETH) has recently surpassed Bitcoin (BTC) in key trading metrics.

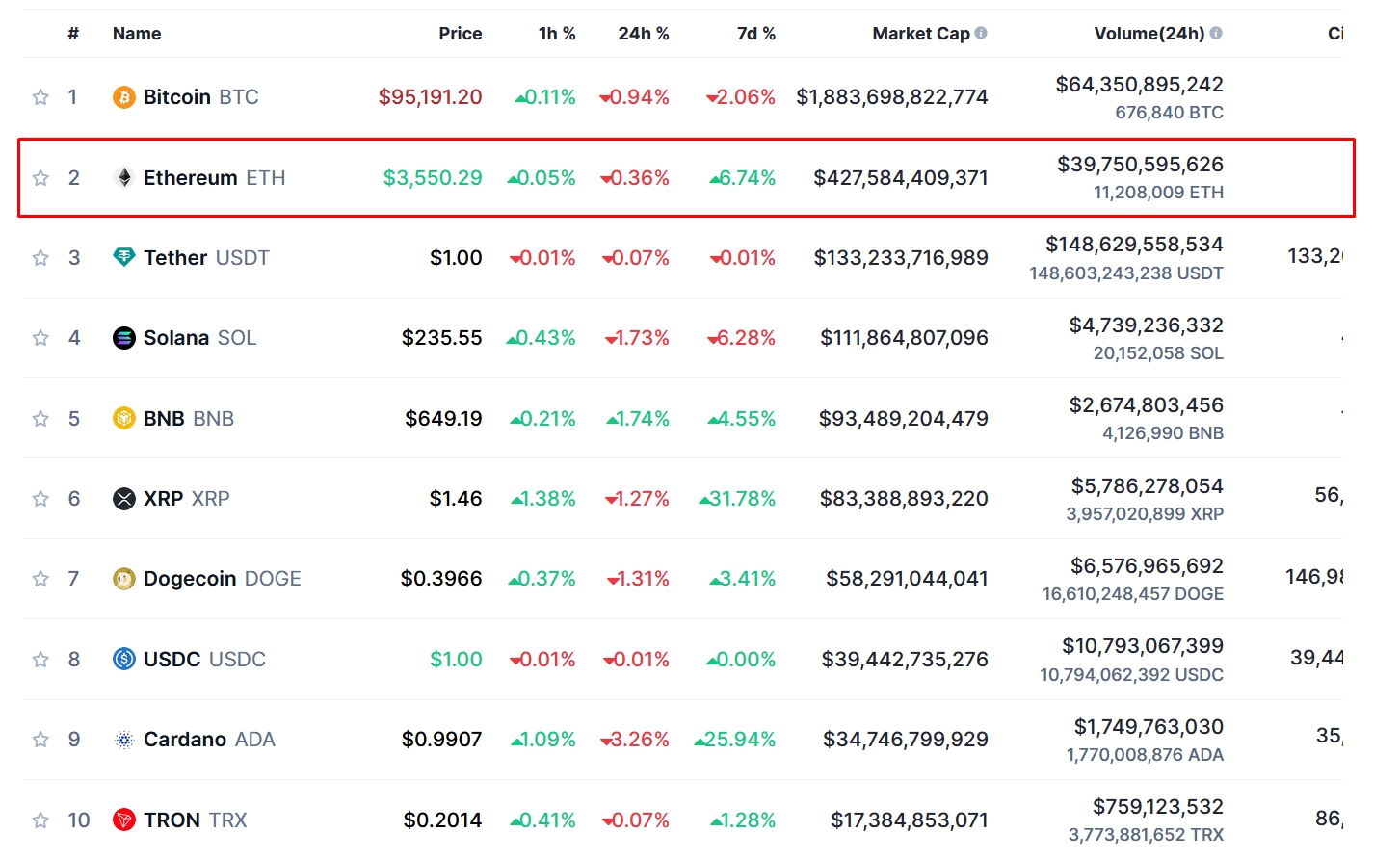

According to CoinMarketCap, Ethereum is among the top gainers in the cryptocurrency market. This surge in ETH’s performance is attributed to news regarding US SEC Chair Gary Gensler's upcoming departure at the end of the Biden administration's term.

Investors are optimistic about a potentially more crypto-friendly SEC Chair after Gensler's exit on January 20, 2025.

Ethereum Surpasses Bitcoin in Trading Volume

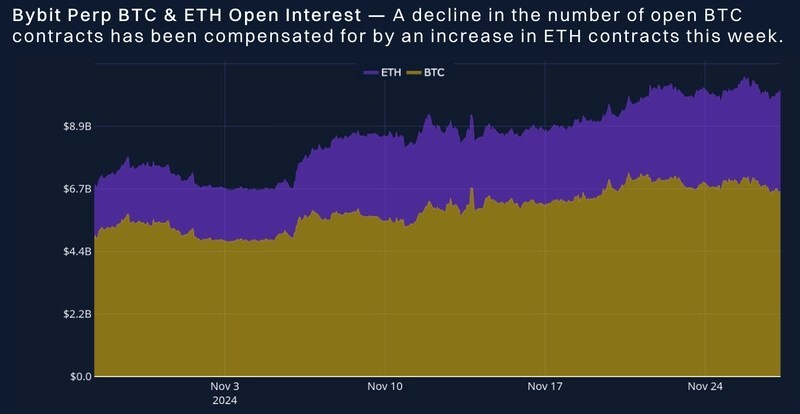

The report highlights that ETH has outperformed BTC in open interest. Data shows a decline in open interest for BTC perpetual contracts, while ETH's open interest has been on the rise.

Over the past six months, ETH has also captured a larger share of daily trading volumes, despite a slower market overall this week. This shift suggests growing interest in Ethereum as investors anticipate less regulatory scrutiny in the near future.

Earlier, The US SEC confirmed Gensler's departure, as reported by Finance Magnates coinciding with Donald Trump's inauguration. Gensler, known for his strict crypto regulations, faced challenges during his tenure, including the GameStop saga. Despite criticism, the SEC credited him with reforms aimed at improving market efficiency and transparency.

CoinMarketCap data shows that Ethereum's market cap stands at $428.06 billion, securing the number two spot, just behind Bitcoin.

BTC Price Decline Leads to Flattened Volatility

On the other hand, BTC has seen a decline in price from its previous high of $100K. This has led to a flattening of the ATM volatility term structure, with short-term options dipping below 60%. This drop in BTC’s volatility reflects a broader trend observed since the US election. While open interest in calls and puts remains steady, the demand for short-term options has stagnated.

In terms of options, ETH shows slightly more bullish sentiment than BTC. Despite market recalibration following the post-election highs, call options for ETH continue to lead in both trading volumes and open interest.