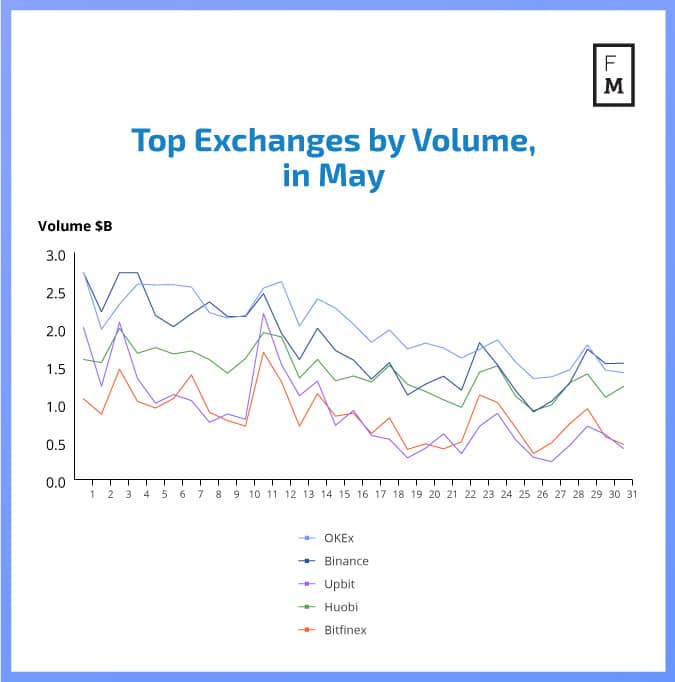

In May we witnessed a fascinating duel between two of the most significant crypto exchanges. The final difference between their market share last month was small, but they both left other competitors further behind.

The market condition of leading Cryptocurrencies , including Bitcoin , was worse in May then it was in April when a small rebound in prices was observed. Correspondingly the volume registered on main exchanges decreased.

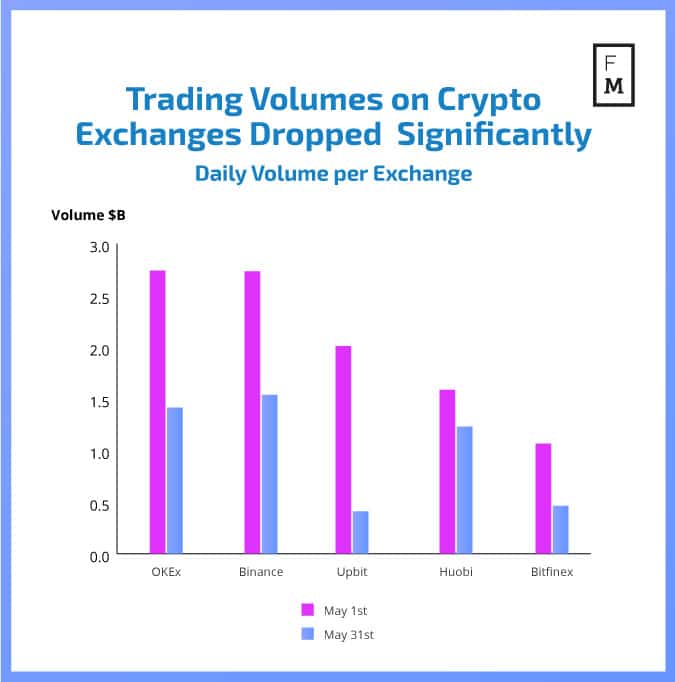

The biggest drop in volumes was registered by UpBit. The Korean exchange started trading last month with a daily volume of 2.008 billion USD and ended the month with 0.4 billion USD of daily volume on May 31. Binance was the exchange that lost the least, closing the month with an average daily volume of 1.53 billion USD – the most among all exchanges.

Overall the biggest turnover in May was registered by OKEx. The Hong Kong-based exchange recorded 62.25 billion USD of volume and was slightly ahead of Binance which had a volume of 54.98 billion USD. Both exchanges had a dramatic confrontation throughout the whole of May. Both exchanges started the previous month with an almost identical daily volume registered on May 1. Eventually, OKEx was ahead of its competitors when comparing the cumulative volume.

It should be noted though that OKEx's volumes are not without controversy. Two weeks ago the price of Bitcoin, as listed on the platform, crashed by more than $2,000 less than it did anywhere else, which led some to suspect market manipulation on the part of the exchange. OKEx denied the allegations and temporarily halted futures contracts to stabilize the price. Finance Magnates also wrote earlier last month that Chris Lee, the CEO of OKEx, has resigned from his post.

This has been the latest publication from the Finance Magnates Intelligence Department. In today’s business world, big-data analysis and access to objective information sources are crucial to success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social, FX, Cryptocurrency, and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of analyses covering various aspects of the cryptocurrency trading industry. These will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.