Over the past years, one key element of the cryptocurrency trading ecosystem has been the reliance of trading volumes on Tether - the chief Stablecoin in the industry. The ninth most-valuable coin on Coinmarketcap is co-owned by iFinex, the group behind crypto Exchange Bitfinex. In recent days, Binance unveiled that it is working on decoupling from the top stablecoin and using in-house alternatives.

According to data from Bitfinex itself, Tether’s current market share among stablecoins is close to 98.7%. Among the vast number of USD-pegged cryptos aiming to compete with it, none has managed to dethrone its importance to the cryptocurrency trading ecosystem.

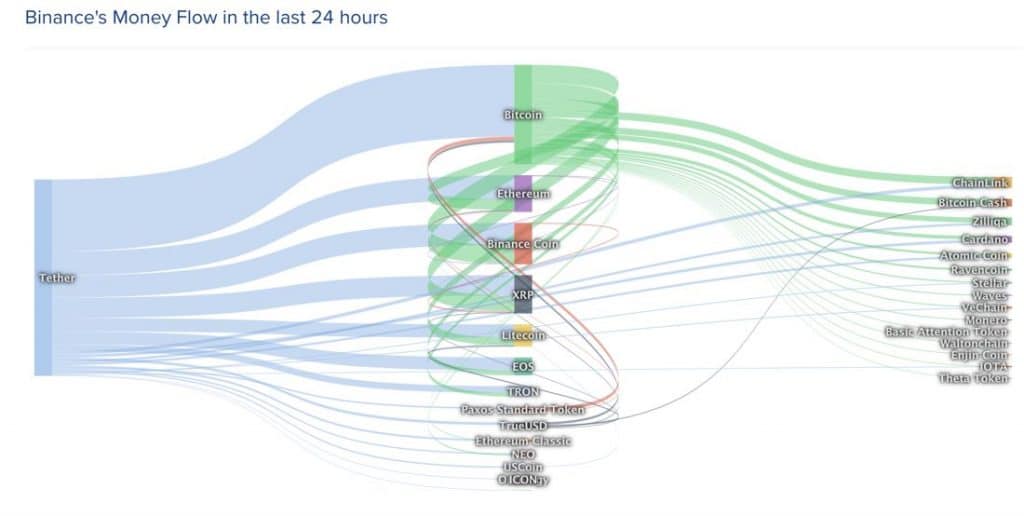

Binance Money Flow for the Past 24 Hours, Source: Coinlib.io

As we see in the diagram above, the stablecoin’s importance is not only crucial to Bitfinex, but also to Binance. The cryptocurrency exchange’s CEO Changpeng Zhao confirmed earlier this week that the company is testing and preparing to create its first in-house pegged cryptocurrency, linked to the British pound.

Tether’s systemic role across the cryptocurrency space has become quite significant over the past couple of years. With the US probe into the conduct of iFinex, the company which is behind both Bitfinex and the leading stablecoin in the industry, Binance is aiming to diversify risks for itself and its clients.

Focus Outside of US Dollar (For Now)

In an interview with Bloomberg, the CFO of Binance, Wei Zhou outlined that the firm aims to start issuing its own stablecoins within weeks. While he didn’t specify which currencies the exchange is planning to cover, its global client base is likely to benefit from a variety of choices.

With the British pound being the first planned issue, the company could also aim at minting crypto euros and Japanese yen. The approach may eliminate a lot of foreign exchange rates inconveniences which users outside of the US are encountering with Tether’s central role.

The step also enables a new use case for the Binance chain, further underpinning the value of the stablecoin of Binance, which is currently the 7th most valuable cryptocurrency with a market cap of $4.47 billion.

For the time being, the company is not planning on issuing a USD-based stablecoin, but the alternatives should reduce the market share of Tether on Binance.

Bitfinex Controversy

Earlier this year, the New York Attorney General announced that is was looking into how Bitfinex lost $850 million. The bulk of the shortfall was apparently covered via a transfer from the sister company of the exchange, Tether.

The company rebutted the claims made by US authorities and has engaged in a legal dispute to challenge the authority of the NY attorney general over the firm’s business and its claims. While the case is ongoing, the parent company of both Bitfinex and Tether has announced at the beginning of May that it is aiming to raise $1 billion in a private token sale.

The UNUS SED LEO utility token issued by iFinex is currently worth $1.67 after making its public debut a couple of weeks ago. The company stated that as it recovers its funds from Crypto Capital, it would be burning tokens.