The first ever trades on Bitcoin in a publicly traded venue have taken place, and a few brave investors are paying a premium.

Barry Silbert's Bitcoin Investment Trust (BIT), a fund offering investors direct exposure to bitcoin prices, debuted Monday on the OTC Markets under the symbol GBTC.

Each share represents apporximately one tenth of a bitcoin.

The security had been approved just over two months ago, the approval process taking around one year. There had been some uncertainty as to how big a secondary market will exist for the shares. The market can grow whenever Grayscale Investments, which sponsors BIT, purchases new bitcoins.

The highly illiquid nature of the security in its current state means that short sellers will likely have a tough time getting a hold of shares to borrow. This may help keep shares overpriced, at least until there is broader market participation. The first trades were executed near $38- representing a 58% premium over the value of 0.1 BTC. Joe Colangelo, Executive Director at Consumers' Research, tweeted the following:

I just purchased 10 shares of $GBTC at $37.98 through USAA pic.twitter.com/trHbpm80Wx

— Joe Colangelo (@Itsjoeco) May 4, 2015I might have been first to purchase $GBTC, here's my trade stub in case anyone is a securities detective pic.twitter.com/FsaPg0ZlPN

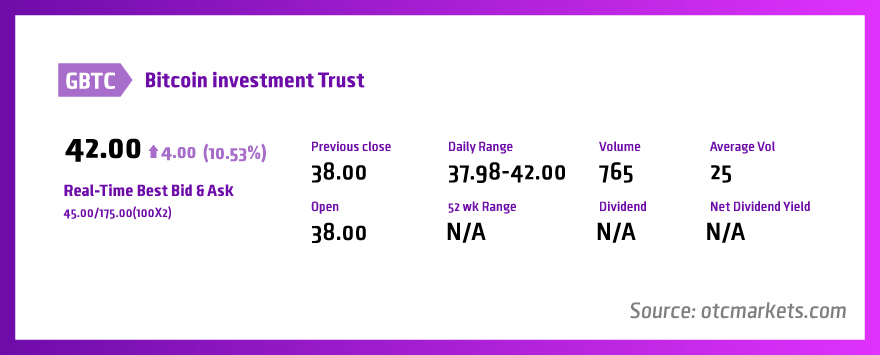

— Joe Colangelo (@Itsjoeco) May 4, 2015According to OTC market data, the opening trade price was $38.00 even, possibly indicating an earlier buyer than Colangelo.

For a while, no buyer had submitted matching bids for the premium-priced ask orders. The last trade of the day was roughly 10% higher at $42- a 75% premium to the prevailing bitcoin prices.

There were even claims of trades getting filled at $133.70- a 457% premium- but the "outlier" data was excluded, perhaps due to OTC Markets protocol.

A total volume of 765 shares were traded throughout the day, representing 76.5 BTC (roughly $18,360). Orders were relayed by Merriman Capital (to function as the fund’s exclusive market maker for 30 days), KCG Americas, Puma Capital, Wedbush Securities, Cantor Fitzgerald, Canaccord Genuity, among others.

The traded prices suggest that perhaps, prominent bidders for the Silk Road bitcoins paid significant premiums as well. None of the winners from those auctions have disclosed their offer amounts.

The launch has indeed placed BIT first at the finish line in the race to launch publicly traded bitcoin. It beats out the Winklevoss Bitcoin Trust and the recently announced Bitcoin Tracker One, which was approved for trade on the Stockholm Stock Exchange for May 18. Bitcoin Tracker One would trade as an exchange traded note (ETN) and become the first bitcoin instrument on a fully regulated venue. BIT is seeking to move in that direction for the long term and is looking upgrade its reporting standards.