Hong Kong-based Exchange MyCoin has reportedly ceased operations without warning and its investors have lost millions.

The incident comes almost exactly one year after the monumental collapse of Japan-based MtGox. A total of roughly 850,000 bitcoins, at the time worth approximately a half billion dollars, vanished. 200,000 were subsequently "rediscovered" and are currently the subject of liquidation proceedings.

The exact amount going missing at MyCoin has yet to be verified. Based on earlier claims by the company, it had 3,000 investors contributing HK$1 million each ($130,000), implying total losses equal to $390 million - a similar scale to those of MtGox. If the company was equally dishonest when making these bold claims, then the scale of loss is likely to be far lower.

The South China Morning Post reports that the company's sole director, William Dennis Atwood, had resigned one month before the exchange was going to officially change trading rules to prevent investors from cashing out on all their bitcoins.

About thirty clients reportedly approached Leung Yiu-chung, a local lawmaker, informing him of the losses. They accused the exchange of luring them with a promised HK$1 million return over four months through a HK$400,000 contract producing 90 BTC upon maturity.

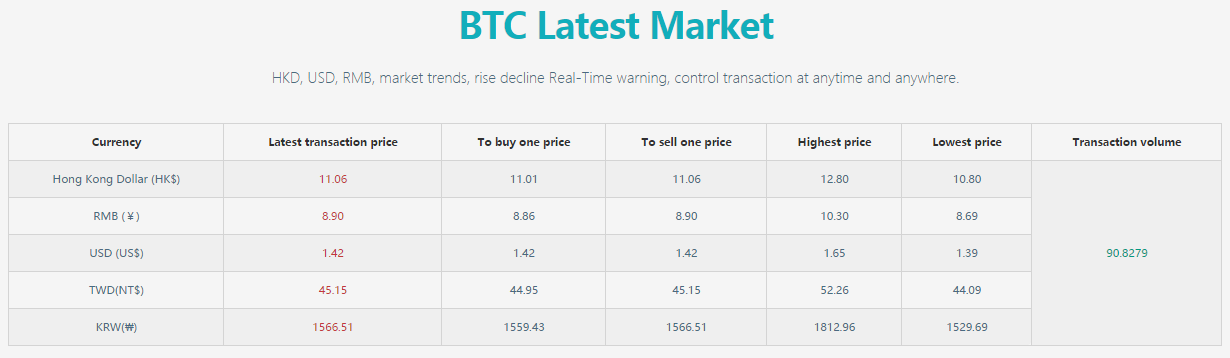

They also say the exchange started artificially lowering the value of their holdings to HK$20 per Bitcoin , a fraction of the market rate of roughly HK$1,700. The exchange's site currently shows conversion rates of $11 (HKD) and $1.42 (USD).

Clients said that they have tried unsuccessfully to get in touch with company management, and senior sales staff have reportedly said that they've been deceived. The company reportedly boarded up the doors of its physical office last month for what it said were renovations.

Clients also claim that Atwood was chief executive of Kryptogroup, which lists MyCoin and a bitcoin mining operation, Kryptomine Cloudhashing, among its controlled entities.

After resigning, Atwood was reportedly replaced by a woman named Wong Lok-yan, listed as a director for 167 companies.

On the exchange's website, the company has a dedicated section titled "Who Are We" with a sub-section titled "Team" which extols the talents of its team without mentioning names. It has reportedly staged events at luxury hotels, including a road show in Macau last August.

Clients were reportedly offered rewards for recruiting others into the alleged pyramid scheme, with one saying that she was told by higher-ranked members that she would not get her money back until she recruited new members.

The incident would also be the second major multi-million dollar disaster for a bitcoin exchange this year. In January, a hacking of Bitstamp's hot wallet cost it 19,000 bitcoins, worth roughly $5.1 million at the time.

It could also be yet another setback for the industry, which is trying to highlight the future promise of Bitcoin and fight off a stigma associating it with Ponzi schemes, theft, fraud and drug trade.