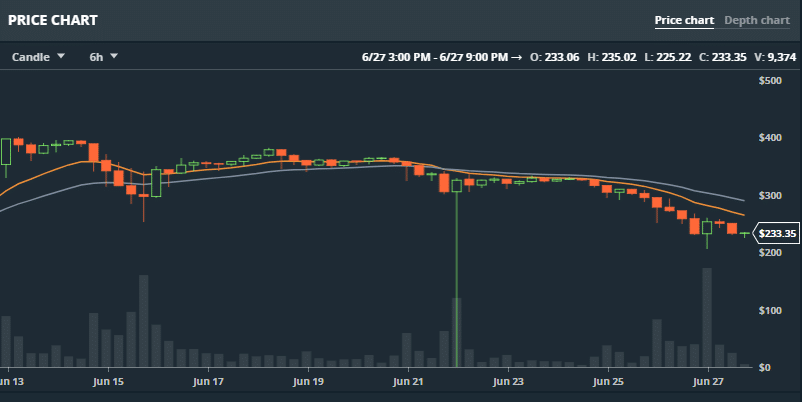

Last week someone with a massive holding of Ethereum cashed out on GDAX, the institutional Exchange of platform of Coinbase, leading the ETH market to temporarily trade as low as $0.10 whipping out many margin traders. After first announcing that "these trades are final," Coinbase has reversed course and decided to reimburse those affected.

The London Summit 2017 is coming, get involved!

Adam White, Head of GDAX, explained the situation:

“GDAX is just over two years old and has grown to become one of the world’s leading digital asset exchanges. We launched our first version of margin trading earlier this year and have generally seen strong customer demand and positive feedback.

Adam White

Our long-term ambition, however, is to be a leader among all exchange platforms and we are committed to serving as the most trusted provider to the world’s largest institutions and professional traders. We are confident that all trades this week were executed properly, however, some customers did not receive the quality of service we strive to provide and we want to do better.

We will establish a process to credit customer accounts which experienced a margin call or stop loss order executed on the GDAX ETH-USD order book as a direct result of the rapid price movement at 12.30pm PT on June 21, 2017. This process will allow affected customers to restore the value of their ETH-USD account to the equivalent value of their ETH-USD account at the moment prior to the rapid price movement.

To clarify:

For customers who had buy orders filled — we are honoring all executed orders and no trades will be reversed.

For affected customers who had margin calls or stop loss orders executed — we are crediting you using company funds.

We view this as an opportunity to demonstrate our long-term commitment to our customers and belief in the future of this industry.”