Mizuho Bank has failed to convince an American court that it would be too difficult for its lawyers to handle a Bitcoin Exchange related case outside Japan or that it has no jurisdiction because the infamous MtGox was based in Tokyo. On Monday a U.S federal judge in Chicago gave the go ahead to a class action lawsuit accusing the Japanese bank of not revealing the full extent of the problems faced by the exchange from American depositors.

Once the world’s largest bitcoin exchange, MtGox went bankrupt in February 2014 when it reported the disappearance of 850,000 bitcoins in a cyber attack, worth over $450 million at the time. Last year, the former CEO of the firm Mark Karpeles was arrested by the Tokyo Metropolitan Police department and hit with allegations that he misappropriated more than $50 million from corporate accounts belonging to MtGox.

According to the lawsuit, Mizuho managed all of MtGox’s American fiat deposits and withdrawals. It allegedly compounded clients’ losses by limiting withdrawals starting in the middle of 2013 when the trouble at the exchange started to surface, while at the same time kept accepting unlimited deposits. MtGox and Karpeles told clients at the time that they were only facing technical problems, and while Mizuho would know this is not true, it "stood silent while allowing the public to continue being duped."

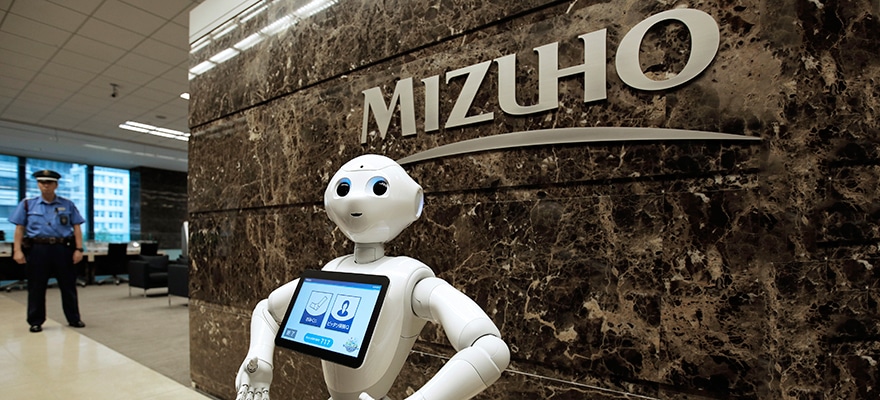

In an example of the Japanese conglomerate’s commitment to the technology derived from bitcoin, last week Mizuho Bank, Ltd. and Fujitsu Laboratories Ltd. revealed that they successfully conducted an operational trial using blockchain for cross-border securities transactions. The firms said the technology makes it practically impossible to tamper with transaction histories as well as shortening the processing time from three days to same-day settlement.