There’s a new crypto exchange in town. But if you feel that the town is getting too crowded, this resident is quite different.

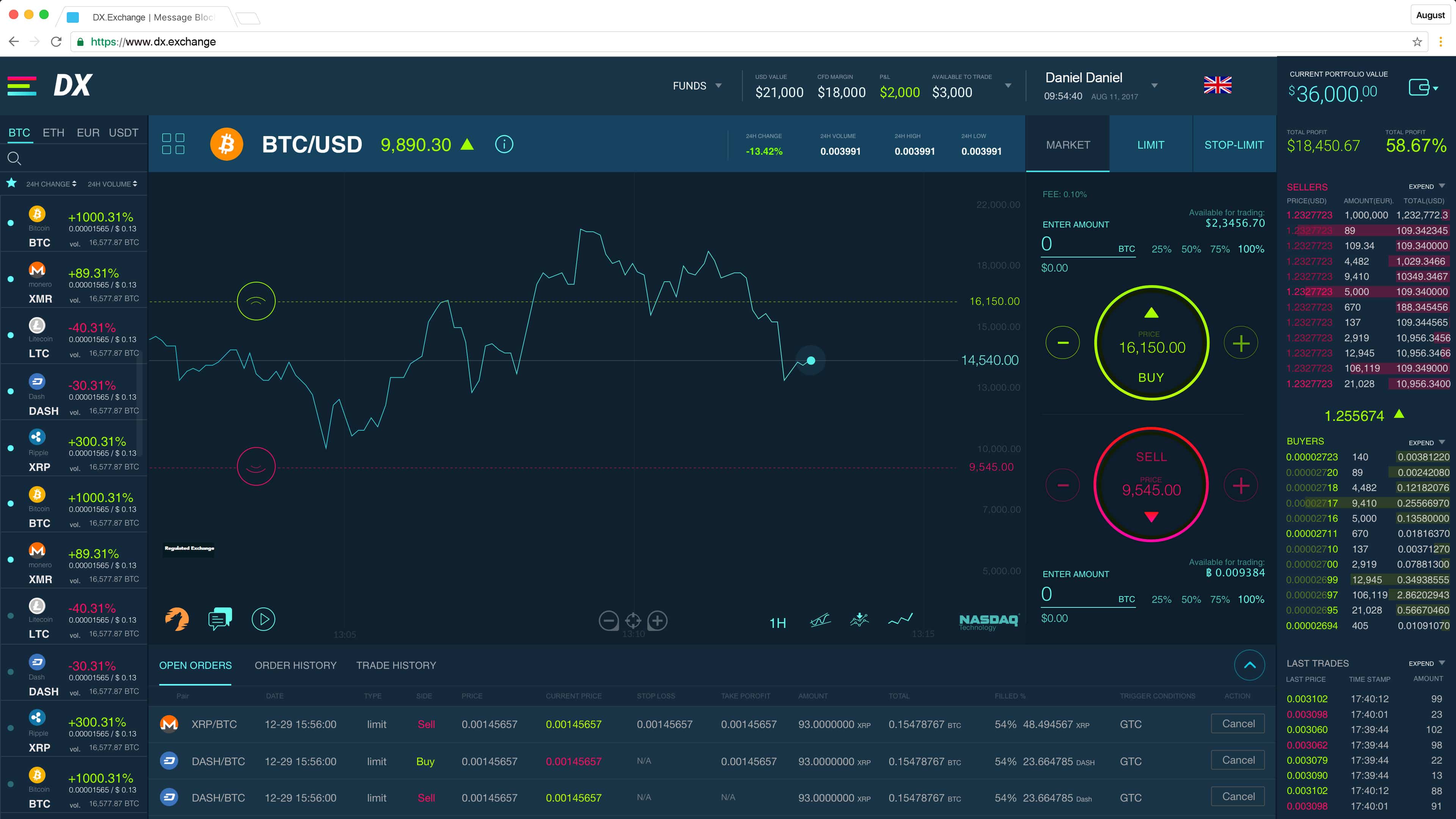

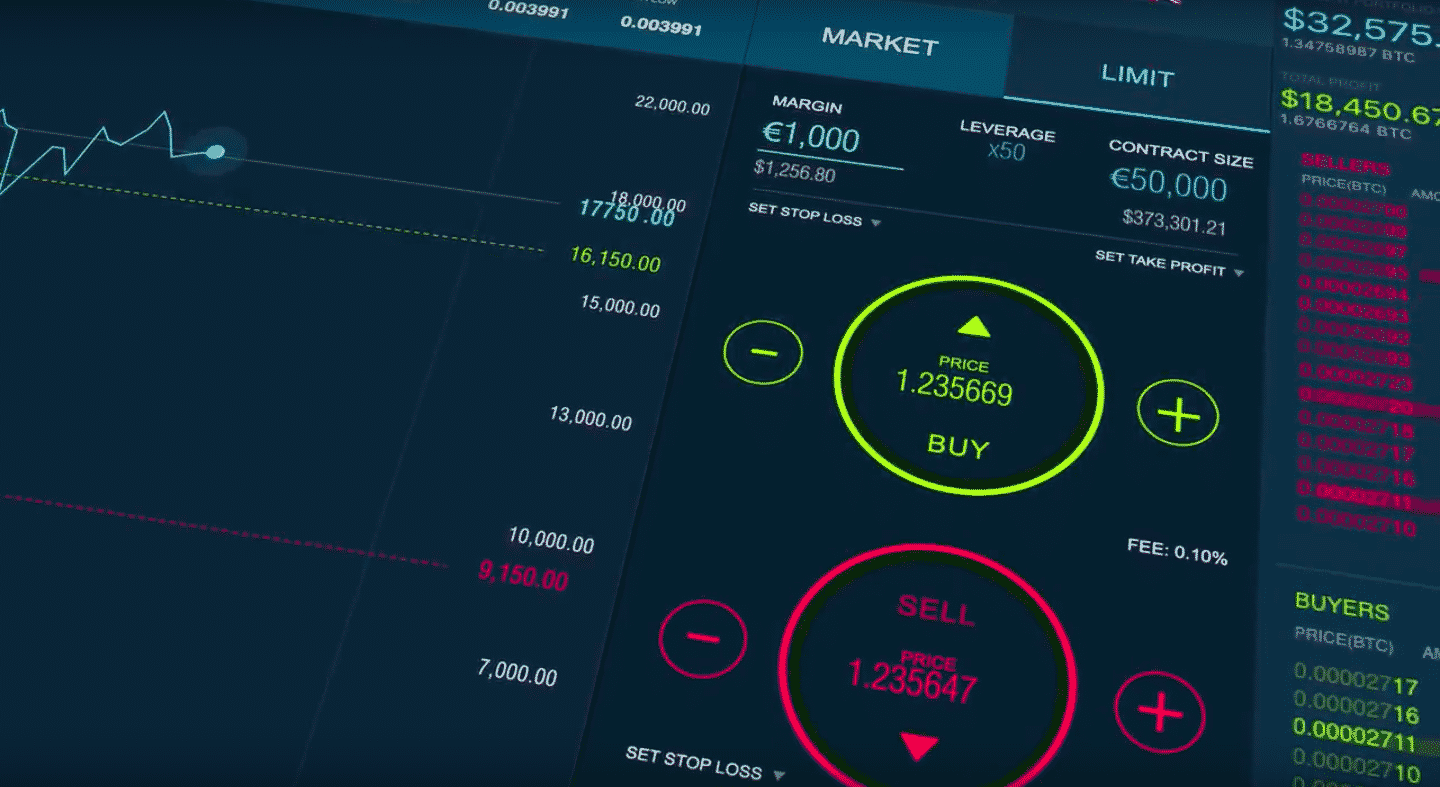

dx.exchange, which is set to launch next month, is the first crypto exchange powered by NASDAQ. “The advantage of this cooperation is threefold: the brand name, the technology and the regulations,” said DX Exchange CEO Daniel Skowronski, commenting on the topic exclusively to Finance Magnates.

While the first advantage is quite self-explanatory, Skowronski further explained that their technology would rely on NASDAQ’s infrastructure, such as its matching engine – used by over 70 exchanges around the world.

Not for US clients, for now

As for the regulations, Skowronski noted that working with NASDAQ mandates that the exchange meets the highest regulatory standards, thus avoiding common errors and bugs, such as double count trading, and in general will prevent fake volumes.

Those above-mentioned standards include a recently acquired Estonian license, as well as a market maker license from the Cypriot regulator, CySEC. This framework will allow DX to offer its clients the entire variety of the crypto trading options and to hold customers funds and deposits.

US customers will be excluded from approaching the platform, at this point. However, the management is currently engaged in a dialogue with the US regulators to obtain a federal license.

Vetting the coins

The exchange will allow customers to purchase crypto with fiat money, to trade on a token-to-token basis, as well as to convert the coins back to fiat and to withdraw it. “We created a one-stop-shop for exchanging fiat and crypto, holding coins and as well as wallet services,” notes Skowronski.

At first, the platform is expected to feature the top six coins, such as Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

At the second phase will feature the top 20-25 coins, as well as some smaller tokens (both utility and security). “We are supporting Blockchain technology. And the way we can help this ecosystem to progress is by vetting the tokens and making sure the good ones are promoted. We are not going to list coins, just because they pay us. Those who are worthy – will be listed.

New coins that want to apply for listing, will go through a three-step process:

- Initial application

- Interview

- Legal opinion by the in-house team and due diligence: inspecting the team and the whitepaper.

Easy KYC, tough security

The platform will not charge fees for trading operations, but the traders will pay a monthly fee of around 10 euros. According to Skowronski, the KYC process will be done by submitting an email and phone number and is expected to be very fast and friendly. “Without undermining the necessary KYC and AML components, required by the regulator,” he notes.

Cybersecurity is another major concern of crypto exchanges, as we seen in numerous cases. This issue will also be addressed with the help of NASDAQ’s infrastructure, and Skowronski promises to hire the best specialists in the field to avoid hacks and other malicious attacks. “People are looking for security and safety. We’re trying to be very clear so that the customers will know what they are getting”.

The platform also offers an internal chat, that will allow users to interact and exchange views, as well as an aggregated newsfeed and information on the coins.

European license, Israeli R&D

The company is led by three veterans of the trading industry. Skowronski served as the CEO and Managing Director at OANDA Europe and Americas. The COO Raz Kaplan was previously the head of Risk Management at SpotBroker. And the CTO Yaron Ben Shoshan was the Director of Strategic Development at Forex Manage.

DX Exchange has hired a large team of 72 employees in Israel to its R&D team, that will lead the set-up of the platform, as well as its future development.