Big trouble may be brewing for OKEx’s futures traders. The Hong Kong-based cryptocurrency exchange processed a USD/BTC futures contract worth approximately $460 million yesterday.

Unfortunately for the trader behind the contract, the price of bitcoin fell such that the exchange attempted to liquidate the position.

The size of the contract appears to have made this impossible and, having only partially liquidated the trade, the exchange is now facing the prospect of a $420 million unfilled position.

The lower $BTCUSD goes, the more OKEX will have to clawback from traders this friday (to settle the huge liquidation at $8050)

this is PRE their expected announcement however. Any new information they give will be updated here. — loomd'rat (@loomdart) August 1, 2018

If the price of bitcoin remains at its current level of 1 bitcoin to $7570, something that is unlikely to happen, OKEx’s systems will suffer a loss of 950 BTC ($7.20 million).

Fortunately for OKEx, the exchange operator does not provide the funds its traders use to Leverage their futures contracts. Unlike FX brokers, who often internalize their trades, the positions that OKEx’s traders take enable them to provide one another with leverage and Liquidity .

For example, if a trader in long bitcoin loses money, the traders that have taken a short position will be the ones making money from the loss. Conversely, if short traders lose money, long traders will make money from their positions.

Clawing back traders money

In this instance, however, the sum involved is so large it seems unlikely OKEx’s short traders will be able to cover their losses. As the firm operates a socialized trading model, it will also be up to its clients to cover for the loss.

Why, you ask, will they have to pay for someone else’s mistake? OKEx operates a ‘clawback’ model. This means that, when the margin balance of a trader reaches zero, the exchange will make a concurrent limit order at the going exchange rate.

If that order is unfilled at the time of settlement, which is 16:00 Hong Kong time on Fridays for OKEx, profitable traders will have to cover the costs. In this instance, that will be traders with short contracts.

OKEx does have an insurance fund that is supposed to cover losses such as the above. The only problem is that the fund only contains 10 BTC ($75,700) - leaving another 940 BTC for OKEx's traders to make up.

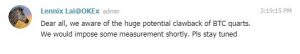

A spokesman for the firm, Lennix Lai, released a statement on Wednesday acknowledging that the firm expects serious clawback measures.

A statement issued by an OKEx spokesperson this Wednesday.

As a result of this, OKEx’s traders look set to foot a bill of approximately 940 BTC ($7,115,800). Given the temperamental nature of the cryptocurrency market, this could change for the better or worse.

At any rate, things are not looking bright for those with short USD/BTC contracts at OKEx. Fingers crossed fellas.