VanEck SolidX bitcoin exchange-traded fund (ETF) proposal, which was foiled several times as the SEC has been kicking the can down the road due to fears of market manipulation, is trying to get around the regulatory rejection.

The two companies today revealed they are employing Rule 144A, which provides a safe harbor from the SEC’s registration requirements. Specifically, this rule was introduced in 2012 to exempt the privately placed securities from registration restrictions, but the shares, in this case, can be sold only to ‘qualified institutional buyers’ and with shorter holding periods—six months or a year, rather than the customary two-year period.

Crypto enthusiasts who have been eagerly awaiting the clearance of the first crypto ETF, however, may have to go on waiting. Some crypto watchers have meanwhile warned the SEC could continue to fight the derivative product indefinitely.

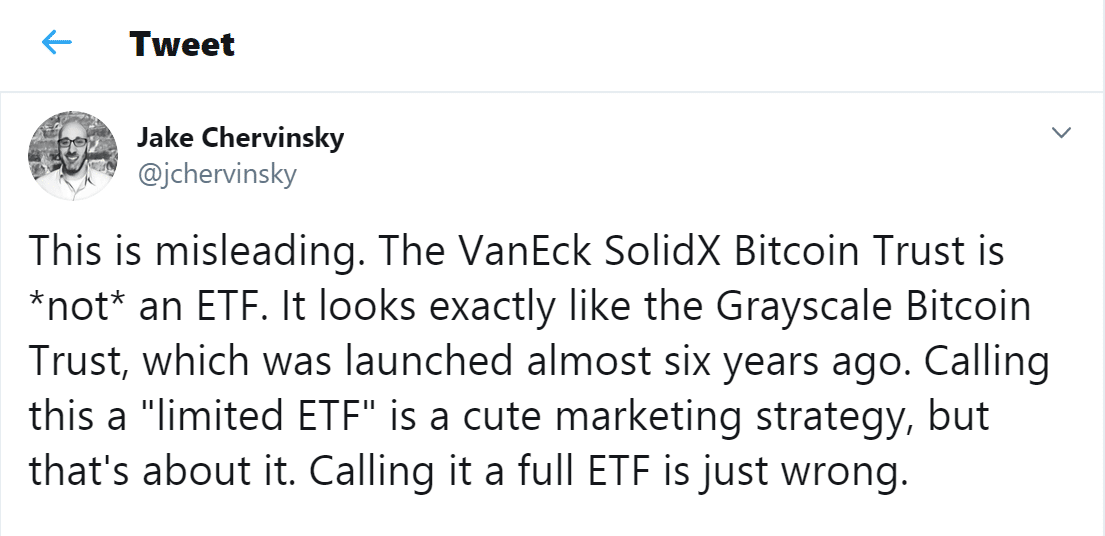

From a different perspective, Jake Chervinsky, general counsel at CompoundFinance who often goes over a plethora of crypto regulatory issues, said the news describing VanEck SolidX product as a bitcoin exchange-traded fund is misleading.

If eventually went live, the bitcoin ETF shares won’t be offered to retail investors but would help qualified institutional players to buy into Cryptocurrencies without having to deal with clunky exchanges that often struggle with lack of public trust.

“We’re introducing a solution for institutions that fits within their operational processes and the current regulatory framework. Utilizing OTC prices to value bitcoin enhances price transparency and the institutional quality of the offering,” said Jan van Eck, Chief Executive Officer of VanEck.

In the statement, the proposal principles revealed that SolidX is the sponsor of the Trust while VanEck provides marketing services and BNY Mellon will act as “the daily fund accountant, administrator and transfer agent, which includes facilitating the investor creation and redemption activity.”

ICE-backed startup Bakkt, which already won approval from US regulators to offer physically-settled Bitcoin futures contracts, also has partnered with BNY Mellon to offer geographically-distributed storage of private keys secured by the bank.

“As the first bitcoin product in the U.S. with standard ETF creation and redemption and established clearing and settlement processes,institutional investors can finally gain exposure to bitcoin within a familiar context,” added Daniel H. Gallancy, CEO of SolidX.

SEC repeatedly denies the long-awaited bitcoin ETF

In a bid to launch an ETF that is backed by actual bitcoins rather than futures, which would have been the first financial product of its kind, the application was initially filed by Cboe in collaboration with money management firm VanEck and Blockchain company SolidX in June 2018.

Earlier in January, Cboe BZX Exchange shelved its proposal for a coveted bitcoin ETF license after the SEC delayed its approval/disapproval decision for the third time. However, the exchanges operator resubmitted its joint proposal with VanEck and SolidX in February, saying the decision to pull their application was only to prevent an automatic rejection due to US government shutdown, which could have complicated the entire situation.

SolidX was the second company to file for a bitcoin exchange-traded product with the U.S. regulators. Some had argued that the proposal from New York-based VanEck, the ninth biggest ETF provider, was more likely to gain approval thanks to plans for a high minimum share price that would discourage retail investors.

The SEC repeatedly delayed deciding on the application, first extending the time it had to act on the proposal in August, then instituting formal proceedings to determine approval in December, and again extending its deadline to 2019.

Despite investor interest, it seems unlikely that the SEC would be comfortable using bitcoin as an underlying asset in a regulated investment vehicle any time soon.