FTX, the beleaguered cryptocurrency exchange currently navigating bankruptcy proceedings, has petitioned the Delaware bankruptcy court to authorize the sale of crucial trust assets worth approximately $744 million. These assets, originating from crypto asset manager Grayscale and custody service provider Bitwise, have been targeted for sale to facilitate the preparation for forthcoming distributions to creditors.

Overview of Trust Assets: Bitwise and Grayscale Holdings

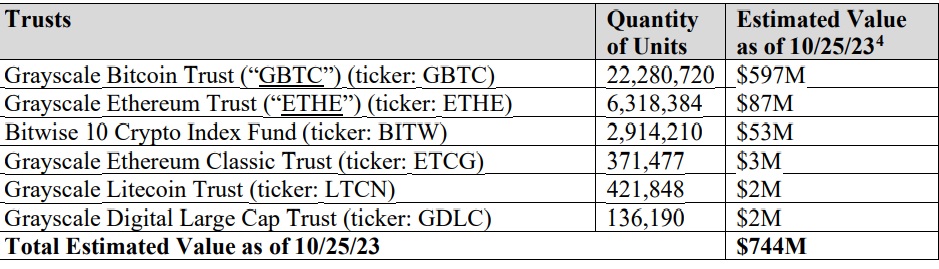

The trust assets in question encompass holdings within one Bitwise trust, evaluated at $53 million, and five Grayscale trusts valued at $691 million. These trusts serve as pivotal onboarding mechanisms for numerous investors, offering exposure to the cryptocurrency market without necessitating direct ownership of digital assets.

In the court filing dated November 3, FTX debtors articulated their perspective, emphasizing that proactively mitigating the risk of price volatility will safeguard the value of these trust assets, ultimately maximizing returns to creditors and ensuring an equitable distribution of funds as part of the debtors' plan for reorganization.

This latest development transpires following the court's prior authorization for the liquidation of nearly $3.4 billion in cryptocurrency assets. These liquidations were mandated to transpire in batches of $50 million and $100 million to prevent any potential market disruptions.

FTX's plea for the sale of trust assets also encompasses a request for approval by an investment adviser, and the proposal of a pricing committee comprising stakeholders to oversee the sales process.

Asset Liquidations and the Complex Landscape of Exchanges

Finance Magnates reported last week that Sam Bankman-Fried had been found guilty on all seven counts of fraud, conspiracy, and money laundering by a New York jury following a five-week trial. The charges included two counts of wire fraud, two counts of conspiracy to commit wire fraud, one count of conspiracy to commit money laundering, one count of conspiracy to commit commodities fraud, and one count of conspiracy to commit securities fraud.

These convictions could potentially lead to a maximum prison sentence of 115 years. Bankman-Fried was once a prominent figure in the cryptocurrency industry but faced allegations of orchestrating an $8 billion embezzlement scheme. His sentencing is tentatively scheduled for March 28, 2024, and an appeal is expected.

The ongoing legal battles and asset liquidations underscore the complex and dynamic landscape of cryptocurrency exchanges, as FTX navigates bankruptcy proceedings amid the legal woes of its former CEO.