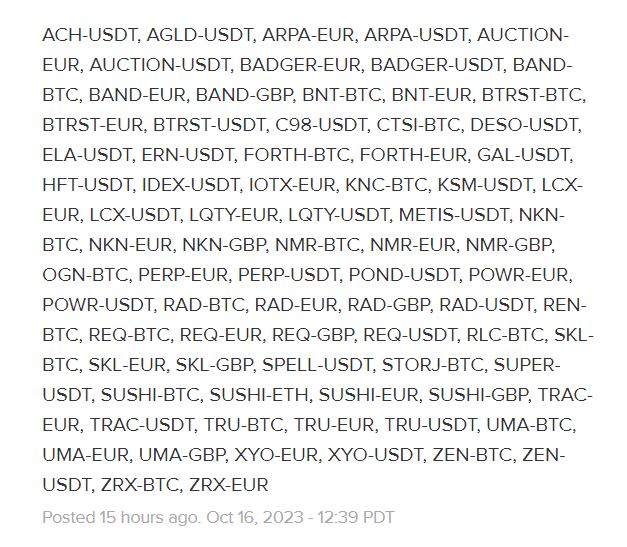

In its latest drive to improve liquidity, California-based crypto exchange Coinbase (Nasdaq: COIN) removed 80 non-USD trading pairs yesterday (Monday). The removed trading pairs were trading against Tether, Bitcoin, Ethereum, and fiats like the euro and the British pound.

A Major Delisting Drive

The crypto pairs were delisted from three Coinbase platforms: Coinbase Exchange, Advanced Trade, and Coinbase Prime.

"Coinbase Exchange regularly monitors the markets on our exchange," the exchange wrote in the announcement on Coinbase Status. "In an effort to improve overall market health and consolidate liquidity, we will be removing a number of non-USD trading pairs for certain supported assets."

Despite being paired against some fiats, most of these pairs are low-volume altcoins. The crypto exchange highlighted that these trading pairs made up an immaterial amount when compared to the overall trading volume of the exchange.

The delisting did not come as a surprise, as Coinbase initially notified users about the move on October 3. The exchange will continue to allow users of the Advanced Trade platform to trade these assets in more liquid USD order books by using your USDC balances.

Usual Practices by Crypto Exchanges

The delisting of illiquid tokens has become a routine for many crypto exchanges. Last month, Coinbase removed 41 non-USD trading pairs from its platforms, citing similar circumstances. Binance, the largest global crypto exchange in terms of trading volume, also dropped dozens of crypto pairs from its listing.

Although Coinbase is headquartered in San Francisco and is the largest crypto exchange in the United States, it is extensively expanding internationally. Recently, the exchange received a license for Singapore, which will allow it to further expand its presence in Southeast Asia. It also received a license from Bermuda's financial regulator to allow eligible non-US retail customers to participate in perpetual futures trading.

Meanwhile, the exchange is fighting a legal battle in the US against the country's securities market watchdog, facing the allegation of running an illegal exchange platform, among others.