Blockstream, an emerging crypto startup focusing on the development of ‘sidechains’, has unveiled the first solution for them: Liquid.

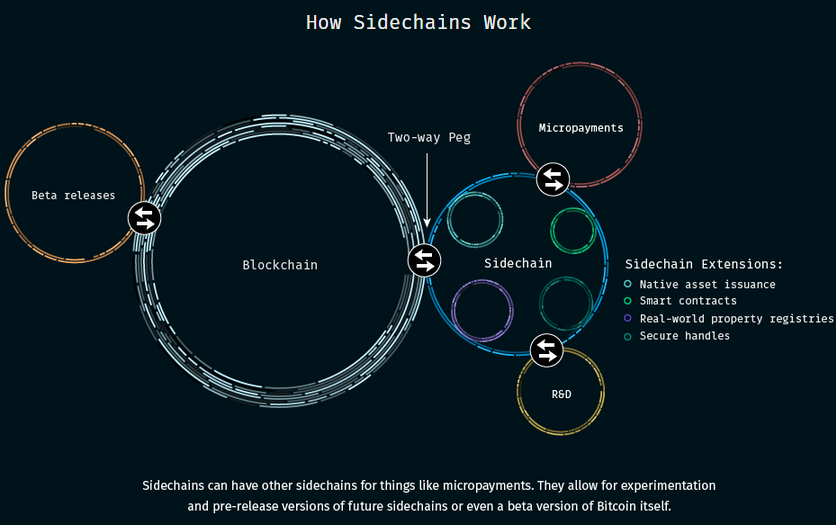

The idea of sidechains is to create an entire ecosystem of alternative, interoperable blockchains supporting the decentralized transfer of digital property. In other words, “Sidechains enable innovators to safely develop new applications without jeopardizing Bitcoin’s core code and putting billions of dollars worth of digital currency at risk.”

Blockstream received $21 million in venture funding last November, one of the largest rounds in the industry at the time, and released the alpha version of open source code behind its first major project, Sidechain Elements, in June.

Source: blockstream.com

space

Blockstream has not gone the way of other crypto startups and bank experiments that have cast aside Bitcoin's core currency but have kept the Blockchain shell. Instead, it has been steadfast with its faith in Bitcoin itself; its sidechains come to append the main Bitcoin blockchain, aiming to compensate in areas where it is lacking.

Liquid is reportedly being adopted by a number of bitcoin exchanges, brokerages and remittance services. Analogous to the T+3 settlement times in securities trading, these Bitcoin services have large amounts of capital locked up while waiting for the Bitcoin network to perform its own settlement i.e. the confirmation of transactions, which can take several minutes to several hours.

Blockstream referred to the Bitcoin-specific version of this phenomenon as "Interchange Settlement Lag (ISL) – a host of Liquidity inefficiencies including latency and confirmation times that hinder the overall prospects of the Bitcoin ecosystem."

Liquid would reduce ISL by facilitating rapid transfers between linked accounts "in a separate, high-volume and low-fee cryptographic system that preserves many of the security benefits of the Bitcoin network."

Thus, it is hoped that the solution will minimize counterparty risk while increasing the liquidity pool of available bitcoins, allowing traders to quickly capitalize upon opportunities and for a generally more efficient usage of capital resources.

Zane Tackett, Director of Product Development at Bitfinex, suggested that Liquid would help improve liquidity and reduce spreads on the exchange.

Blockstream listed Bitfinex, BTCC, Kraken, Unocoin, and Xapo as initial launch partners. It also said that "discussions are underway with another dozen major institutional traders and licensed exchanges."