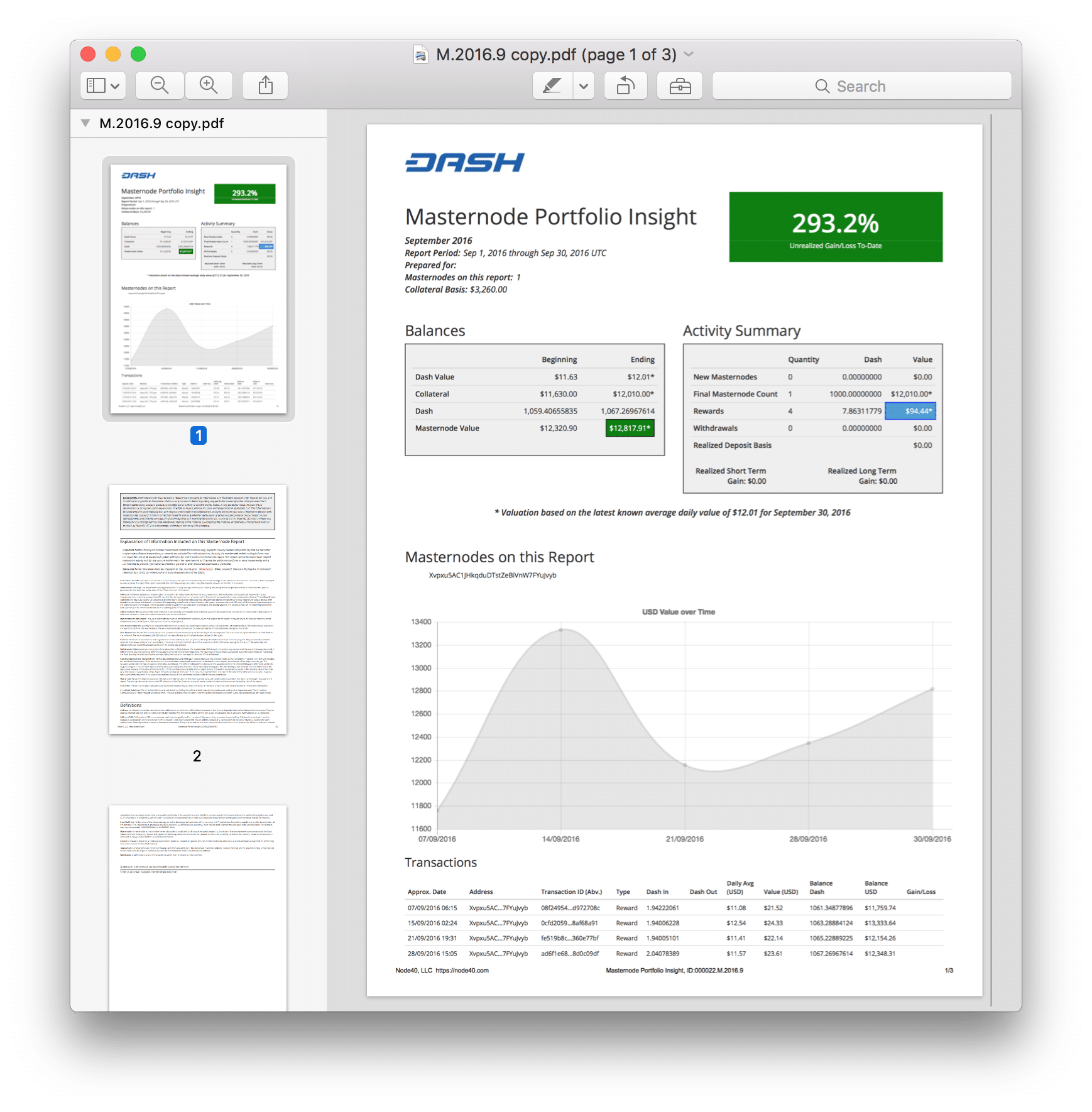

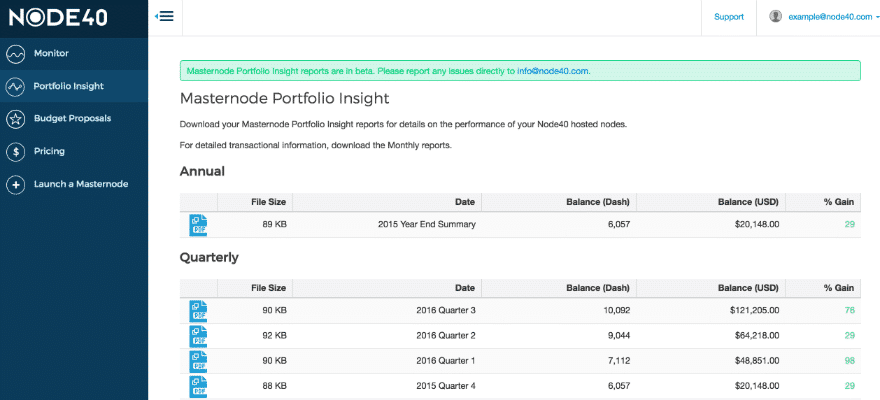

Node40, a Blockchain governance company and one of the biggest server Hosting providers for the Dash network, has released a new service, Masternode Portfolio Insight. The feature is designed to showcase asset performance for every Node40 customer and illustrates how each Node performs fully tracked against the United States dollar on a monthly, quarterly and annual basis with upcoming support for real-time custom ranges.

The developers say this reporting tool will even show Masternode owners exactly how their cryptocurrency gains stack up against other traditional forms of investment such as property, savings account gains, or stock market returns.

Co-founder and CEO of Node40 Perry Woodin explains: “Node40’s Masternode Portfolio Insight reports help users better visualize their investment performance in ways traditional investors are used to. Every transaction associated with a customer’s Masternode is calculated against the daily Dash USD average. This allows our customers to do an apples-to-apples comparison against other more traditional assets. We are firm believers in the importance of blockchain governance, allowing users to one-click vote on submitted network proposals, and we are known for being the only node hosting service that guarantees payment.”

Woodin added: “As a US Corporation, we are required to file taxes. Since most of our customers pay with digital currency, we needed a way to calculate the USD cost of all incoming transactions and then determine if there was a gain or loss when we converted to USD. We built a tool that calculated the USD value of every transaction along with gain/loss for outgoing transactions and provided the data to our accountants. If transactional data with calculated gains/losses and unrealized gains/losses for an entire portfolio was useful to us, then it would also be useful to our customers.”