Startup distributed derivatives platform Velocity has announced a smart contract on price feeds. Using Blockchain technology and Ethereum smart contracts, it is meant to make derivatives more transparent, accessible, and secure for the crypto assets community.

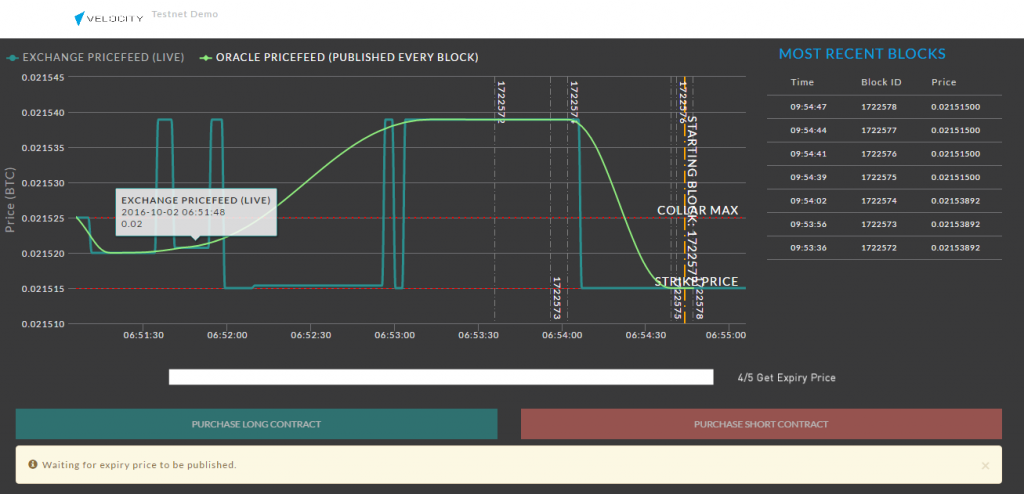

The decentralized options platform allows users to enter into a collar option using a smart contract on the Ethereum blockchain, meaning it doesn’t rely on central servers or middlemen settlement processes to manage funds. Each party purchases a contract by sending a small amount of ETH to the contract’s Ethereum address. Once accepted by the network, the contract will fetch a starting price from the oracle’s price feed, and run for a period of five blocks. The chart displays time, price, and block number for the most recent Ethereum blocks.

The Velocity team has also developed a Twitter bot that shows when users are speculating if prices will go up or down, providing spectators and market-makers in the digital asset industry the potential for blockchain derivatives for cryptocurrency. Users with the Metamask browser wallet are able to send test Ethereum to the Velocity demo smart contract, introducing spectators to the idea of hedging risk using an open-derivatives platform.

“The OTC derivatives market is worth $16 trillion in the U.S. alone, making derivatives integral to today’s financial landscape, in everything from insurance to portfolio management,” said Vignesh Sundaresan, Chief Architect at Velocity. “Velocity provides advanced yet approachable blockchain technology to support cryptocurrency’s trend towards margin trading, and to further adoption of smart contracts on the blockchain.”

In addition to introducing the Velocity platform, the company is planning a crowdsale slated for Q4 2016.

Demo Screenshot